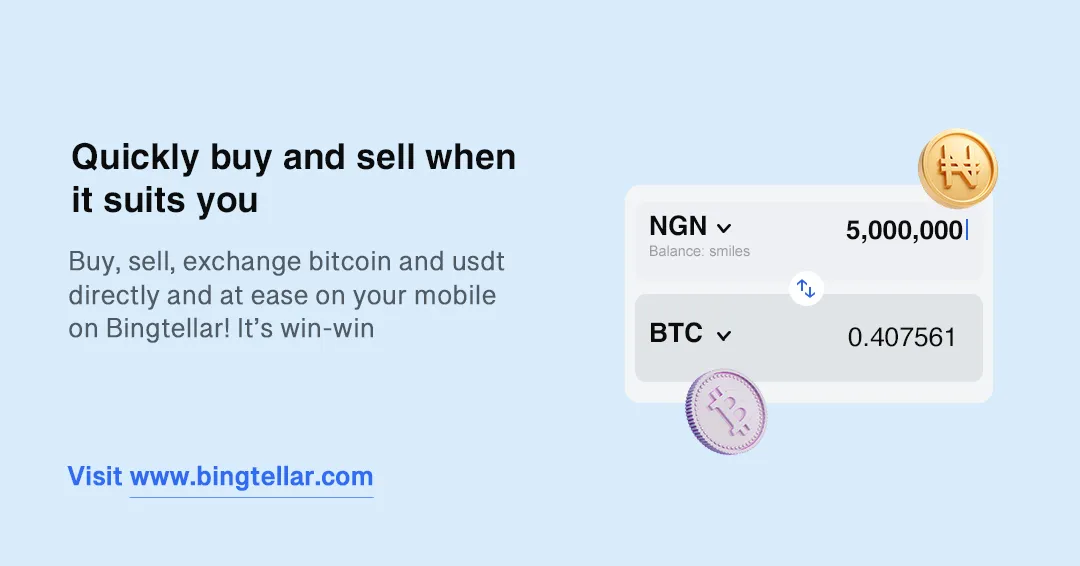

How Nigerian blockchain company Bingtellar is establishing cross-border payment infrastructure in Africa.

Bingtellar, a Nigerian blockchain startup, says it is developing modern cross-border payments infrastructure and solutions for Africa to streamline global transactions for consumers and enterprises.

Bingtellar, founded in 2022 by Joshua Tebepina, CEO, and Arepade Peremi, CTO, facilitates fast and affordable cross-border transactions into or across Africa for diaspora, freelancers, remote teams, foreign contractors, and enterprises.

“Unlike the traditional 7-14 business days, our system ensures fast, frictionless, and cost-effective money transfers. Imagine it as the “Wise for Africa,” leveraging the efficiency of stablecoins to drastically cut expenses and transaction times,” Tebepina told Disrupt Africa.

Bingtellar’s approach is based on the integration of stablecoins and DeFi into local payment networks such as mobile money wallets and bank accounts, which are backed by efficient on/off ramps and institutional market makers.

“This integration empowers African users and businesses worldwide, allowing them to access the global economy, make everyday payments and send money from regions like Africa, Europe, Latam, and Asia using fiat or digital assets such as USDC, USDT, and cUSD, while recipients receive value or cash instantly in their local naira, cedis, or shilling bank accounts or mobile money wallets,” Tebepina said, adding that this results in a seamless and secure experience for transactions.

“This strategic approach tackles challenges related to interoperability, fragmentation, currency restrictions while enhancing accessibility and global connectivity,” he told reporters.

Bingtellar was founded on the personal experiences of its co-founders, who encountered firsthand the inefficiencies of the existing banking system for cross-border transactions in Africa.

“These issues, which included high prices, delays, and currency restrictions, notably in freelance payments, inspired us to offer a stablecoin-based solution to HR teams. “The success of this solution resulted in the organic growth of a strong product and infrastructure within our networks,” Tebepina stated.

While companies such as PayPal, Western Union, and Wise have attempted to address these global difficulties, Tebepina claims they have “drawbacks” and are not designed to properly serve African users.

Bingtellar, on the other hand, does exactly that, and to fuel its growth, the firm has attracted funding from early-stage investors and accelerators such as AWS Startups, Celo Camp, and Nodo, among others. Tebepina stated that the uptake of its remedy had exceeded his expectations.

“Since our launch, we’ve witnessed a substantial increase in user adoption, with a growing number of African diaspora, remote teams and businesses embracing our platform for cross-border transactions,” stated the CEO.

“We have also achieved significant milestones in terms of product development and user engagement, securing strategic partnerships and successful launches in five African countries – Nigeria, Ghana, Kenya, Rwanda, and Uganda.”

As it grows and expands its customer base, the business is “actively exploring” further funding alternatives to extend its operations, accelerate growth, and improve the platform’s capabilities.

“Our pre-seed round is open and we are keen to engage and collaborate with angels investors and VCs who share our enthusiasm for the future of modern finance and payments in Africa,” Tebepina said in a press release.

“Looking ahead, we have ambitious plans to expand into other African markets, particularly the Francophone corridors, and strengthen our presence across the continent. Hopefully, by Q3 2024, we will be operational in four or five of those markets.

Bingtellar makes money largely from FX interchange and arbitrage, transaction fees, and value-added services offered on its platform.

“As for our financial performance, while we’re in the early stages of monetisation, we’ve experienced steady growth in transaction volumes, facilitated over US$1.5 million already, while experiencing month-on-month revenue growth of 35 per cent, indicating a positive trajectory,” Tebepina said in a statement.

“Our priority is to establish a strong user base and provide a seamless and economical cross-border payment experience. We predict that as our market presence and user engagement grow, so will our revenue. The goal is to strike a balance between sustainable growth and offering meaningful services to our users, resulting in a win-win situation for both Bingtellar and the individuals and businesses who utilize our platform.”