The Effect of Robotic Process Automation on Accounting Services

Technology is swiftly transforming society and accounting services are not exempted from these developments. Emerging technologies are becoming more capable of replicating human behaviour, doing repeated tasks more accurately and quickly than people. According to Liao in 2018, there are numerous stated benefits of RPA which includes significantly reducing processing time and improved accuracy, particularly for rule-based, repetitious, monotonous operations.

In this article, my aim is to describe Robotic Process Automation and the effects it has on accounting services

Automation is the process of making machines execute work normally performed by humans. Thus, automated processes will lead the way to increased success for companies in the near future.

Artificial Intelligence (AI), Robotic Process Automation (RPA), Virtual Assistance, Machine Learning (ML), Industrial Robots, and other technologies are currently used for process automation with each one having a diverse reason for usage. But, amongst all these technologies, Robotic Process Automation serves as the foundation for all other current automated technologies.

RPA is a presentation layer automation programme that duplicates the actions of a rule-based, non-subjective procedure without damaging the current IT infrastructure, allowing it to perform prescribed activities reliably and simply scale up or down to suit business demands.

It can execute data input, purchase order placement, online access credential creation, and business activities that need access to numerous existing systems.

According to David Maynard, Robotic Process Automation (RPA) is transforming accounting and finance processes at a rate unmatched by any other modern technology. Robotic Process Automation usage in business has grown considerably in recent years. According to a report from Information Services Group, 72% of companies were going to employ RPA by 2019. Deloitte conducted a survey and discovered that its clients consider RPA implementation to be a top priority within their organisations.

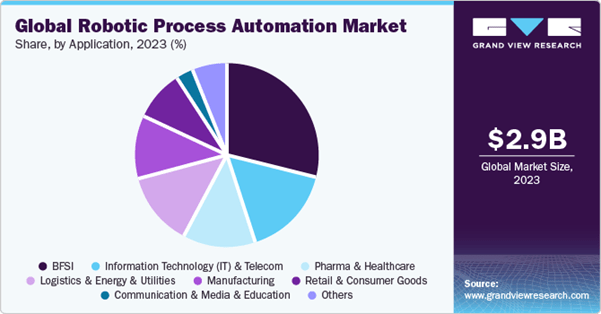

Based on research conducted by Grand View Research in 2023, the BFSI section of the robotic process automation market generated the greatest revenue share in 2022, accounting for over 29% of the total market.

The application of robotic process automation market trends in the financial industry enables banks and other financial institutions to automate business activities such as providing loans, account opening, and deposits, amid others.

Furthermore, the use of RPA increases efficiency and work speed. It also opens the door to merging RPA with AI, which is critical for the BFSI sector to implement new policies and services.

Source: https://www.grandviewresearch.com/industry-analysis/robotic-process-automation-rpa-market

The number of firms in the robotic process automation market that offer RPA solutions tailored to the banking and financial services sector has additionally contributed to the segment development from 2023 to 2030. For example, UiPath provides an RPA solution for the BFSI sector with an 80% faster reconciliation time and double the transaction processing capacity. The existence of such players in the robotic process automation market has contributed to the BFSI segment’s growth between 2023 and 2030.

Author:

Ogunleye Oluwatobiloba Timothy