Payment Channel Interoperability – The Future of Diversity and Inclusion | By Banji Kayode

In an increasingly interconnected world, the way we exchange value – whether through cash, cards, or digital wallets – shapes not just economies but societies. It is worth emphasising that with innovation in science and technology, digital markets and e-commerce have witnessed a global shift toward digital payments over time, unlocking transformative possibilities for financial systems.

A revolution in digital payment, rather than conventional cash payment, is redefining how we engage with money, thereby creating an immense potential to advance diversity and inclusion worldwide.

Furthermore, recent data reveals that in 2024, digital payments used for in-person purchases in the United States of America climbed to 28% from 19% in 2019, while online transactions via mobile apps jumped to 60% from 25%.

These statistics inevitably attest to the various payment channels that came into play – mobile apps, bank cards, and digital wallets.

At the centre of this revolution is Payment channel interoperability. This concept promises to bridge the gap between various financial systems while also redefining diversity and inclusion for the twenty-first century.

It should be stressed that this is about more than just making transactions easier; it is also about guaranteeing that everyone, regardless of geography, income, or access to technology, has equal access to the global economy.

Payment channel interoperability can break down financial barriers, paving the way for a more diverse and inclusive global economy. In this article, I will examine how interoperability can shape a future where diversity and inclusion are not just tangible outcomes of an interconnected financial landscape.

Clarification of concepts- payment channel interoperability, diversity and inclusion

Payment Channel Interoperability

There are several definitions for this. However, at its core, payment channel interoperability is the basic ability of multiple digital payment systems, networks, and financial institutions to work together and exchange seamlessly.

That is, it is the ability of different payment channels like cards, digital wallets, and bank transfers to communicate and facilitate transfers of funds between each other.

This allows customers to make payments and transfer funds using their preferred payment method, regardless of the technology or infrastructure used by the payee. For instance, if a customer wants to make a payment using their bank’s mobile app, but the payee only accepts payments through a different processor, interoperability would allow the transaction to be completed smoothly without the need for the customer to sign up for a new payment method or open a new account.

Diversity and inclusion

Diversity and inclusion refer to the presence of differences within a given setting and the practice and policy of ensuring that everyone, regardless of those differences, has equal access to opportunities and resources feels welcomed, respected, supported, and able to participate fully.

In the context of financial technology, diversity and inclusion come into play when financial industries maximise digitisation and the power of connected ecosystems to transcend geographical and economic barriers, thereby making finance more democratised.

With this type of societal change, more people can access more banking services, whether they are in the poorer sections of society or niches with unique needs not sufficiently served by traditional banking.

The Current Landscape of Payment Channels

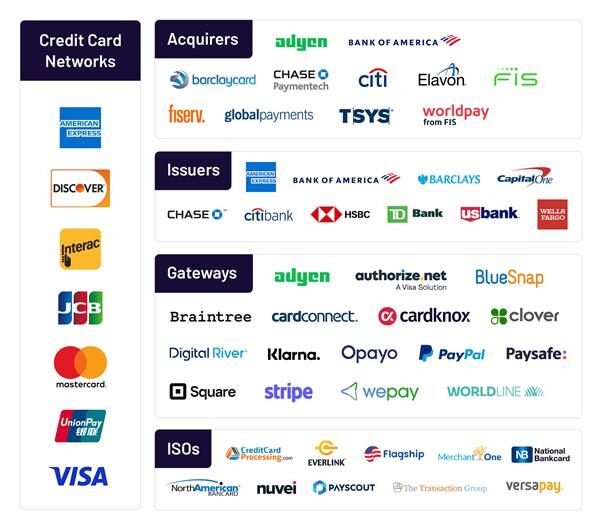

The payments industry is a rapidly changing scene that is constantly in flux due to the introduction of new payment methods, mergers and acquisitions, and technology. Especially as technology advances, we’re seeing payment technology companies play a bigger role in the payments industry—and many of them are even merging with traditional financial institutions to cater to the latest customer and merchant preferences.

Unlike in the past, when payment processing was simply about facilitating the transfer of funds, the newest players in the payment processing world are completely redefining the customer experience and enabling business owners to manage their businesses with incredible ease. The illustration below shows some of the various payment channels in the world.

IMAGE CAPTION: Fig. 1. Highlights the various payment channels in the world.

Fragmentation in Payment Channels

Irrespective of the above, it is important to emphasise that for a long time, payment services have been pretty straightforward, even when the advent of online shopping did not make things more complicated, as e-commerce was seen as a completely separate channel.

However, the proliferation of payment channels and the fragmentation of paying services have made payment service processing increasingly complex.

According to the World Bank, approximately 1.4 billion people globally remain unbanked, lacking access to formal financial services. For these individuals, fragmented payment systems create a barrier, as they are unable to participate in transactions requiring electronic methods.

In Africa, the exclusionary impacts are stark for Africa’s rural population, a place where digital infrastructure remains uneven. For instance, payment platforms like M-Pesa in Kenya, MTN Mobile Money in West Africa, and Orange Money across multiple counties in the region have brought millions into the financial fold. Yet, the fragmentation of these payment channels, marked by a lack of interoperability, has emerged as a medium of exclusion, sidelining many Africans.

In rural regions, poor network coverage and limited electricity access are a testament to this fact.

Addressing this fragmentation requires interoperability among payment platforms, ensuring no one is left behind by a lack of compatibility.

The Promise of Payment Channel Interoperability

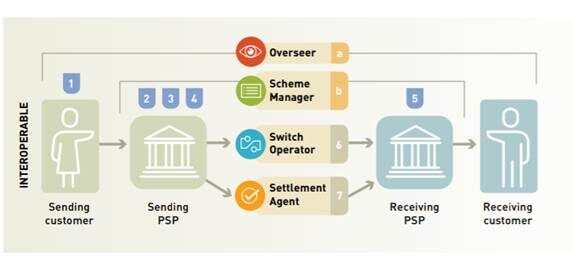

The proliferation of disparate payment channels has led to fragmentation that hinders seamless transactions and thereby excludes millions from full economic participation. What provides the resolution to this challenge? The answer lies in payment system interoperability. Interoperability enables seamless, efficient, and secure exchanges of value, as it allows users to engage in financial activities effortlessly, regardless of the payment method or infrastructure they employ.

Subsequently, it is worth mentioning that the technical promise of interoperability is already evident in pioneering initiatives. For instance, in India’s financial year of 2023, the introduction of the Unified Payments Interface (UPI) by the National Payments Corporation of India (NPCI) in 2016 demonstrated how a single infrastructure can connect banks, mobile apps and merchants, enabling over 400 million users to conduct 10 billion transactions monthly.

IMAGE CAPTION: Fig 2 illustrates the payment process of an interoperable transaction. Alice Negre and Will Cook. Interoperability in Digital Financial Services.

The promise of payment channel interoperability, therefore, is to create a future of seamless and efficient global payments, enabling users to send and receive funds across different payment systems and platforms, thereby fostering financial inclusion and boosting economic activity.

Interoperability as a Catalyst for Diversity and Inclusion

The value proposition of digital services is improved for customers when these services are interoperable – when they work together rather than in silos. Interoperability makes financial services more convenient and easily accessible, thereby driving diversity and inclusion across multiple dimensions.

The following are major features of payment channel interoperability as a future of diversity and inclusion.

- Bridging Geographic and Socioeconomic Divides: here, interoperable payment channels dismantle the barriers of geographic and Socioeconomic divides by ensuring that financial services reach even the most remote or underserved regions. For instance, officially launched in Kenya in 2007, M-Pesa, a mobile money platform, expanded access to unbanked individuals such as rural farmers and petite traders, thereby allowing them to participate in the digital economy.

- Economic Empowerment and Gender Equity: According to the Global Findex Database 2017, reports show that 72% of men had an account compared to 65% of women globally.[1]Women, particularly in developing economies, face systemic barriers to financial participation, including limited ownership of bank accounts and restricted access to credit. However, interoperability payment channels can narrow this gap by integrating women-centric financial tools, such as microfinance platforms, with mainstream payment networks.

Conclusion

As the world moves toward a digital-first future, payment channel interoperability stands as a beacon of equity. It is more than a technical fix- it is a transformative force for diversity and inclusion that addresses the root causes of financial exclusion with scalable, technology-driven solutions.

About the Author

Banji A. Kayode is a seasoned expert in merchant acquiring and financial technology, with a strong background in payment system infrastructure for banks and major operators. With extensive experience in digital payments, he has played a pivotal role in driving financial inclusion and fostering innovation within the fintech ecosystem. A recognised thought leader, Banji provides insightful commentary on digital financial services, emerging payment technologies, and industry trends. Beyond payments, he is a trusted advisor to fintech startups, offering strategic guidance on product development, go-to-market strategies, and regulatory compliance. His deep industry expertise and hands-on approach have helped startups scale and navigate the complexities of the financial landscape.

[1] Asli Demirguc-Kunt et al. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. World Bank Group. https://worldbank.org/globalfindex.

Solutions at our doorstep. Bravo

I agree with the author’s point about payment channel interoperability

the future of diversity and inclusion.

nice article sir

Nice

nice work

Nice one baba

Like this