Nigeria is the First African Country to Have an Open Banking Regulation

The operating parameters for open banking have been accepted by the Central Bank of Nigeria (CBN), launching an open banking system in Nigeria.

Nigeria is the first nation in Africa to establish an Open Banking regulation as a result of this regulation.

On March 7, 2023, Musa Jimoh, Director of the CBN’s Payments System Management Department, issued a circular announcing the instructions.

A banking practice known as “open banking” gives third-party financial service providers API access to consumer banking data. It encourages innovation and the sharing of accounts and data among different organizations, possibly changing the banking sector.

Open banking in Nigeria is expected to usher in a transformational period for financial innovation and inclusion in Nigeria and across Africa. Nigeria now has some type of Open Banking regulation, joining other nations like the US, UK, India, South Korea, etc.

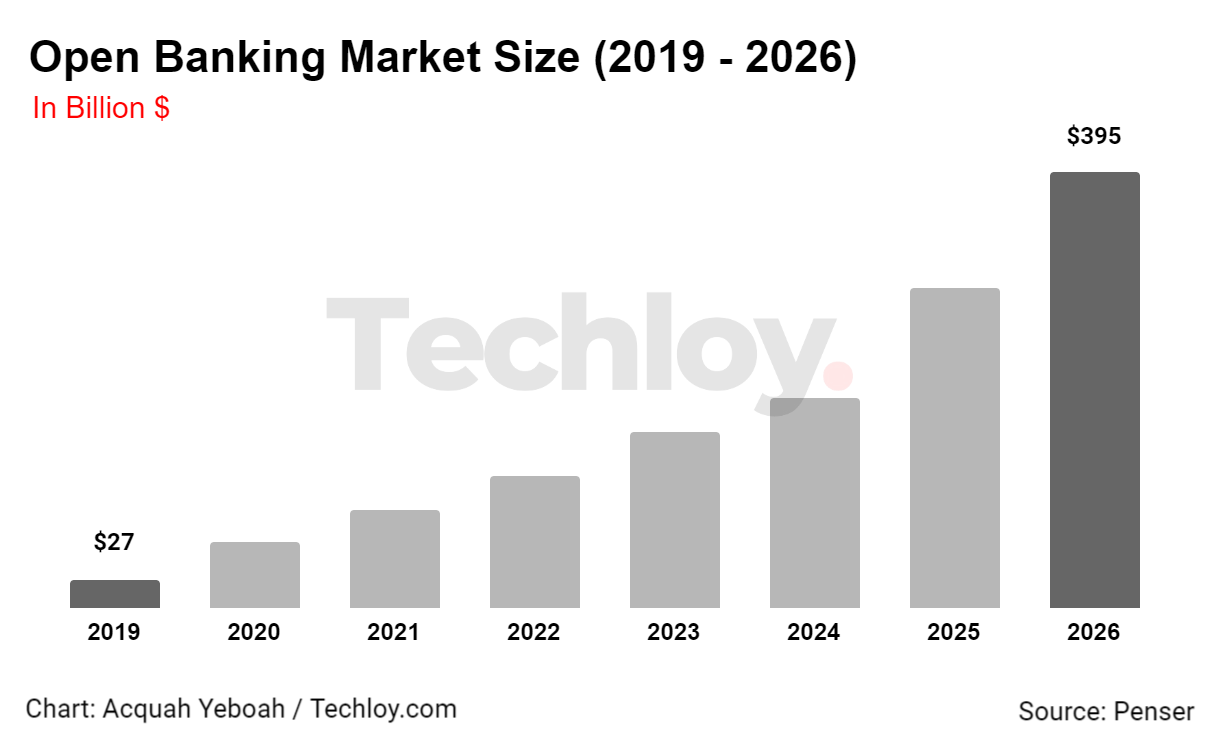

By 2026, Penser estimates that the global market for open banking would be worth $395 billion and have close to 39 million consumers.

The publication of the guidelines marks the end of a protracted road for open banking in Nigeria, which began in 2017 with the formation of the Open Banking Nigeria working group by a group of seasoned business leaders led by Adedeji Olowe.

The CBN released the regulatory framework for open banking in Nigeria in February 2021 as a result of the group’s interactions with banks, fintechs, and foreign stakeholders. This served as the foundation for the industry group to establish the operational rules that are currently the law for bankers and fintechs under the CBN’s supervision.

Fintechs may expect enriched data from open banking, which would also promote financial inclusion and innovation in Nigeria. The Open Banking Nigeria coalition’s members, Mono, Okra, and Stitch, are among the businesses that stand to gain from open banking. Sterling Bank, KPMG, PwC, EY, Paystack, Teamapt, Wallet Africa, and OnePipe are a few of the coalition’s early supporters.