Moove opens office in Kenya, adds bikes and trucks to vehicle financing

Moove, an African mobility fintech, has opened its first office in East Africa and its sixth on the continent in Nairobi, Kenya, as part of its efforts to expand operations across the continent.

This move came after a collaboration with Uber that allowed ride-hailing and delivery drivers to acquire motorbikes for Uber Connect, UberEats deliveries, and UberBoda journeys in order to expand their vehicle and product offerings to clients.

Following its recent collaboration with pan-African e-logistics platform Lori Systems, the company has also partnered with Kenyan fulfilment and last-mile logistics startup Sendy.

According to the company, its entry into the East African market brings it closer to its goal of democratizing car ownership in Africa by providing revenue-based vehicle financing.

With lending rates in Kenya nearly doubling those in South Africa, credit finance affordability has remained a challenge for businesses, particularly those without a credit history.

Moove intends to capitalize on this market opportunity by allowing drivers to access brand new vehicles through its alternative credit-scoring system, resulting in more decent job opportunities in the mobility industry.

Affordably priced asset-backed vehicle financing

Ladi Delano and Jide Odunsi co-founded Moove in 2019 to provide asset-backed vehicle finance through the integration of its alternative credit-scoring system into ride-hailing and e-logistics platforms.

Customers can obtain loans by purchasing new automobiles and financing up to 95 percent of the purchase price within five days of signing up, according to the company.

Customers can repay their loans over a period of 12, 36, 48, or 60 months by paying a portion of their weekly income through the Moove app, which tracks all transactions and provides access to other financial products on the platform.

So far, Moove-financed vehicles have completed over 1.6 million rides and driven over 20 million kilometers across its markets.

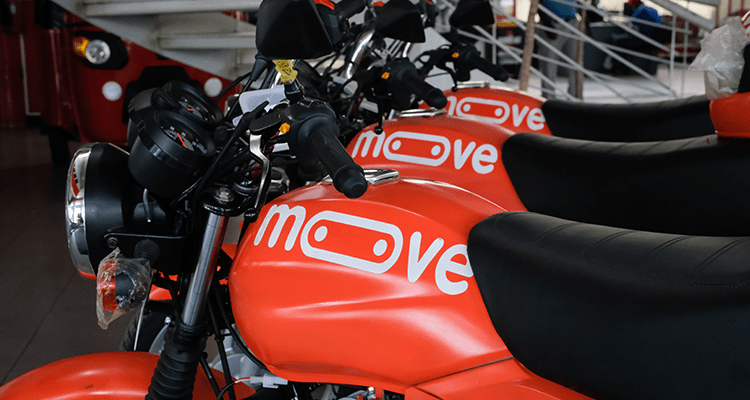

The company, which recently launched its first two-wheeler bike product, Moove Xpress, in Lagos, empowers drivers by providing vehicle financing solutions that allow them to increase their earnings and productivity.

Speaking about the move to Kenya, Ladi Delano, Co-Founder and CEO of Moove, agrees that the country already has a thriving mobility and entrepreneurial economy, making it easier for the company to tap into and roll out our financing solutions.

“As one of the biggest economies in Africa, our move into Kenya serves as a gateway to other East African markets. We are excited to continue our expansion, having achieved over 50%+ MoM growth since launch. ”

– Ladi Delano, Co-Founder and CEO of Moove

The company believes that, among other things, the new expansion to Nairobi will allow it to create jobs for the citizens.

“By guiding customers down the noble path of vehicle ownership, we create job and income opportunities for these mobility entrepreneurs.”

According to the company, the Sub-Saharan African two-wheeler hailing business is hampered by a lack of new vehicles as well as a lack of regulation for both drivers and passengers.

Moove is expanding its presence in East Africa in order to increase asset ownership of brand new motorcycles while maintaining industry regulatory compliance, ultimately generating money through ride-hailing and delivery applications.

Tayo Oyegunle, Chief Operations Officer, says of the Kenya launch, “The team and I are proud to be bringing financial inclusion to mobility entrepreneurs in Nairobi, Kenya.”

“We’re offering flexible employment through revenue-based financing, thus empowering drivers and driving growth in Africa’s mobility industry. This is underlined by our commitment to ensure that 50% of our customers are female. The Uber, Sendy, and Lori System partnerships will also allow us to enter the market with a substantial range of products and services for mobility entrepreneurs to take advantage of by moving people, goods, and services.”,

Moove raised $23 million in August with the goal of simplifying vehicle ownership across Africa. Following the funding, the company has expanded into two additional African countries: South Africa and Kenya. It will be fascinating to see where the journey takes us next.