Xend Finance, Global Crypto Bank Announces XendBridge, SwitchWallet

Global crypto bank Xend Finance, based in Nigeria, has announced the release of SwitchWallet, a free public wallet infrastructure, and XendBridge, a crypto payment API.

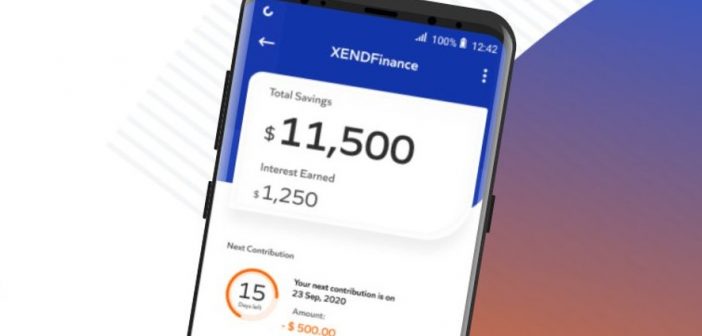

A platform that offers everyone access to the global money market so users may save and invest in safe currencies has been developed by Xend Finance, which in 2019 participated in the Google Launchpad Africa accelerator and the Binance Incubation Programme.

By eliminating traditional middlemen and allowing users to establish their own credit unions and cooperatives, the Xend Finance platform also enables users to earn up to 15% annual percentage income on their deposits.

After receiving US$1.5 million in funding from backers like Binance Labs, Google Developers Launchpad, and AU21 Capital, the firm debuted its platform publicly in late 2020. In February 2021, it raised an additional US$2 million in a follow-up round.

Since then, it has surpassed the 100,000 user milestone, and the introduction of XendBridge and SwitchWallet has expanded the range of goods it offers startups and established companies looking for storage and payment options for cryptocurrencies.

A peer-to-peer system called XendBridge enables companies to safely conduct transactions between fiat cash and cryptocurrencies. On XendBridge, a variety of crypto assets, including BTC, ETH, BNB, MATIC, USDT, USDC, BUSD, and more, can be exchanged in addition to USD and EUR.

SwitchWallet, on the other hand, levies no fees, a first for any wallet services provided in Africa. Any existing web application may quickly be integrated with XendBridge and SwitchWallet to access the Web3 business solutions.

The Central Bank’s prohibitions on cryptocurrencies made it extremely difficult for blockchain firms who wished to support fiat in Africa in the past, according to Ugochukwu Aronu, CEO of Xend Finance.

“We have developed a solution that makes it simple for any startup to conduct remittances from the United States or Europe as well as to on- and off-ramp five important local currencies, including the naira, the dollar, the euro, the ghanaian cedi, and the kenyan shilling. With regard to SwitchWallet, companies have previously used foreign wallet providers that need challenging KYBs and stringent rules. The first free wallet infrastructure for entrepreneurs is now available, and it is designed to scale across Africa and adhere to worldwide KYB standards.