Visa accelerates financial inclusion for African SMEs by making a significant investment in Nigeria’s Moniepoint

Visa, a world leader in digital payments, has invested in Nigeria’s Moniepoint, a platform for commercial payments and banking services.

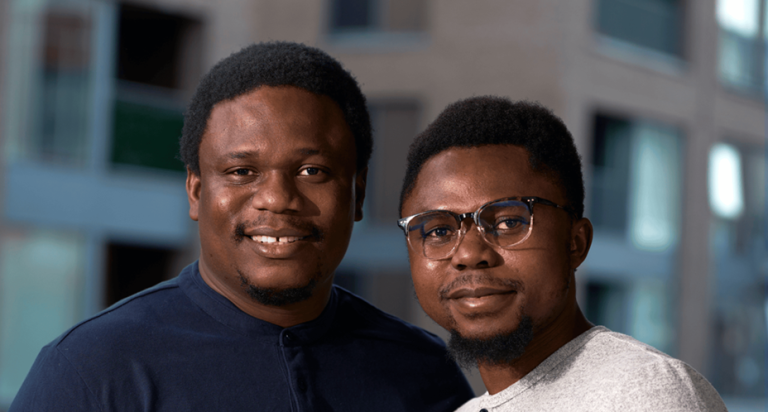

Tosin Eniolorunda and Felix Ike founded Moniepoint, formerly known as TeamApt, in 2015. It is a comprehensive financial ecosystem that provides 10 million consumers and organizations with easy access to banking, credit, payments, and company management tools.

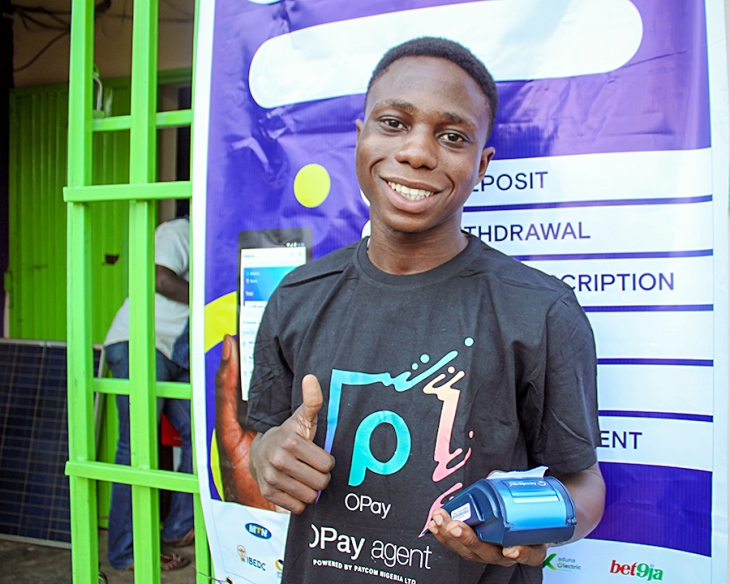

It powers the majority of point-of-sale (POS) transactions in Nigeria and is the biggest merchant acquirer in the nation. operates profitably while processing US$17 billion for its clients each month through its subsidiaries.

Moniepoint, the newest “unicorn” in African tech with a valuation of over $1 billion, raised US$110 million in Series C equity fundraising late last year. Visa has now contributed strategic funding to the company.

Since its launch in 2023, Visa, a global leader in payments, has promoted 64 entrepreneurs in three cohorts through its Africa Fintech Accelerator. Visa recently provided strategic capital to four firms that participated in the first program in 2023, and the corporation has now made a strategic investment in Moniepoint.

“Visa’s backing is a strong endorsement of our vision to digitise and support African businesses at scale. Together, we aim to deepen financial inclusion, enabling SMEs to access the tools and resources they need to thrive in an increasingly digital economy. Given that about 83 per cent of employment across Africa is in the informal economy, we are very keen to widen access and participation in the formal financial system and drive economic growth across Africa,” said Eniolorunda.

“Visa’s expertise in global payments and Moniepoint’s proven ability to serve African businesses make this partnership an exciting opportunity in shaping the continent’s economic future even as we pave the way for a more inclusive and dynamic financial ecosystem. We are delighted in joining forces with Visa to enhance the digital payment infrastructure, expanding financial services, and fostering innovation in Africa.”

“Moniepoint has created an impressive platform that directly addresses the needs of Africa’s SMEs, a crucial segment in enabling economic development,” said Andrew Torre, regional president of Central and Eastern Europe, Middle East, and Africa at Visa.

“Moniepoint is contributing to the transformation of business operations in Nigeria and abroad by increasing the efficiency and accessibility of digital payments and financial services. We can’t wait to help them with their next stage of development and innovation,” he said.

“Our long-standing dedication to developing digital economies in Africa is demonstrated by Visa’s investment in Moniepoint. Through cutting-edge software and payment solutions that streamline operations and enable SMEs to grow and create new revenue streams, we will help even the tiniest enterprises succeed.