Some of Africa’s largest banks are using a new blockchain-based payments processor

To solve problems African businesses have when settling payments within the continent, convince banks to transition from centralized systems to those based on a blockchain.

That is the argument by Appzone, a 13 year-old Nigerian fintech company that has launched a payment processing system built on its own private blockchain network.

Appzone’s blockchain-based payment processor, called Zone Switch, has been in use for five months, though on a pilot scale. Elendu Uche, the product’s chief executive, says 10 Nigerian banks have started using the new service to process some of their customers’ transactions within the country, including Guaranty Trust Bank, Zenith Bank, and United Bank for Africa – three of Africa’s largest banks.

At least two similar banks with branches across Africa are in the process of signing up for the switch, Uche tells Quartz.

What’s wrong with instant payments on centralized platforms?

As far as solutions for intra-Africa payments go, Zone Switch is not an entirely novel idea.

Its vision is similar to the Pan-African Payments and Settlement System(PAPSS), the instant payments effort led by the African Export-Import Bank (Afreximbank) and the Africa Continental Free Trade Area (AfCFTA) which went live this month. Both projects aim to make payments in Africa instant and cost-effective with the least friction possible.

But the difference between PAPSS and Zone Switch is that blockchain systems are supposedly more reliable and enable faster settlement.

Appzone’s motivation for the product was based on the growing adoption of cryptocurrency as a faster alternative for peer-to-peer transactions, like individuals sending money to friends or family from one African country to another. Africa has the fastest crypto adoption rate in the world, recording 1,200% growth between July 2020 and June 2021.

But because central bank regulations in countries like Nigeria forbid banks from enabling crypto trades, adapting a blockchain’s qualities for fiat currency transactions became Appzone’s move. Appzone says it is able to offer this middle-road service in regulation-heavy Nigeria by leaning into its payments provider license, and a relationship with an existing payments switch, Uche says.

African payments settlement will be done with a stablecoin

Because there has been no central switch for African banks, payments between say a trader in Ghana and his Zambian supplier are settled with the dollar over a platform like SWIFT, which is why cross-border payments take days to weeks to reflect. PAPSS is designed to change this by settling payments faster and in local African currencies.

But with the blockchain-based Zone Switch, a stablecoin is the currency.

Stablecoins are a fairly new financial concept, one that attracts curious regulatory inquiry just like volatile cryptocurrencies. But beset by inflation, Africans have adopted stablecoins like Tether (USDT), USD Coin (USDC), Binance USD (BUSD) for transactions.

Where stablecoins are based on a government-backed currency like the dollar or rare metals like gold, Zone Switch’s stablecoin is based on what the company says is a basket of African currencies. “We’ve already designed that,” Uche says. The idea of the basket is that it creates a currency that is not swayed by the negative effects of any African currency’s inflation , while avoiding using a foreign currency like the dollar.

It is not clear how this basket works, essentially the secret sauce of Appzone’s Zone Switch.

The payment processor’s current adopters are just Nigerian banks doing intra-country transactions with the naira. As such we will have to wait till the platform starts being used between banks across the continent to know if stablecoins or indeed blockchain-based payment processors are the future of formal inter-bank payments in Africa.

Pitching a blockchain to digital banks

Promoting this idea across Africa may not be an easy task. For one, Appzone admits it is not currently considering the Francophone African market due to the sub region’s peculiar financial system that revolves around the euro-pegged CFA. Even with its controversial colonial connotations, the CFA has not been an easy currency to fight.

Outside of Nigeria, Zone Switch would need traction in approachable west African economies like Ghana, and the Gambia, before hoping to be accepted by Africa’s top banks in southern and north Africa.

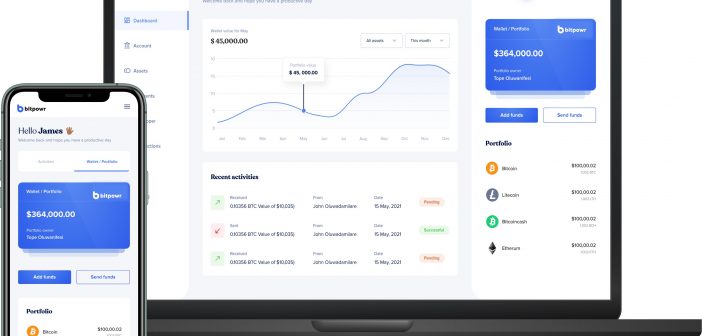

Until then, the Appzone group, which is actually a holding company with five subsidiaries, is targeting Africa’s rising crop of digital banks—from Kuda in Nigeria to Telda in Egypt, etc—as a possibly easier group to convince about the value of processing transactions on a blockchain. Digital banks are structured around being cost-efficient and so should favor the most cost-efficient payments platform, the thinking goes.

To this end, Appzone has revamped its digital core banking business, BankOne, a so-called banking-as-a-service platform premised on the idea that entrepreneurs who want to build new banks do not need to build every piece of infrastructure from scratch. Instead, they can license all they need for banking by simply plugging into a bundle of services