SA fintech Stitch announces new payment LinkPay

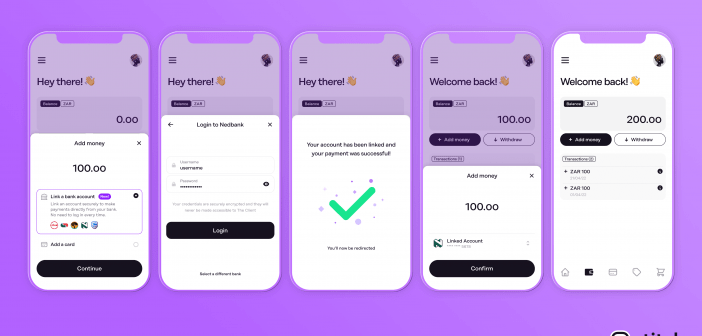

Stitch, a South African fintech firm, has introduced LinkPay, a service that allows customers in South Africa and Nigeria to link their financial accounts and pay securely via rapid bank transfer in seconds.

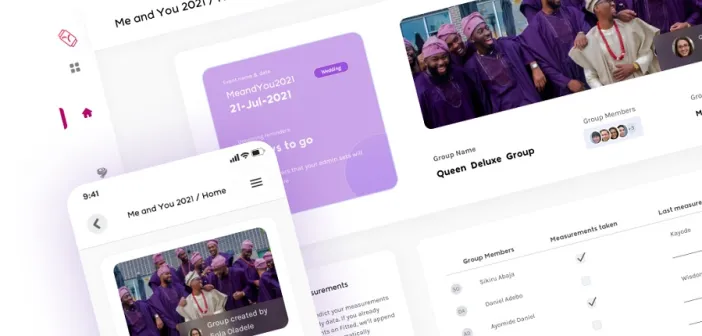

The Stitch API enables developers to quickly connect apps to financial accounts, allowing users to exchange transaction histories and balances, confirm their identities, and make payments.

Companies can use this tools to develop new and improved services in areas like personal finance, lending, insurance, payments, and asset management. Fintechs can also use Stitch to collaborate with traditional financial institutions in a more secure and regulated manner.

Stitch received a US$21 million Series A financing earlier this year, in part to fund the introduction of additional products, and has now developed LinkPay, a linked-account payments tool that allows for flexible recurring payments.

LinkPay enables companies in South Africa and Nigeria to accept safe, one-click payments directly from a user’s bank account, emulating the convenience of a tokenised card but without the hefty costs and chargebacks. Stitch payouts and financial data products can be used with LinkPay to create a comprehensive linked-account journey that includes confirmed payments, refunds, and withdrawals.

“With LinkPay, Stitch can help businesses provide a more frictionless and secure payments experience for their consumers, making it easier than ever for them to pay – while also saving money.” LinkPay delivers a genuinely unique closed-loop linked-account experience for returning users when combined with Stitch financial data and payouts solutions – from rapid, frictionless onboarding to one-click payments and payouts. As a result, businesses will see improved conversion rates, lower costs, and a more convenient experience for their customers,” said Junaid Dadan, Stitch’s chief product officer.