Ozow, a South African startup, has raised $48 million in a Series B financing funded by Tencent.

Ozow, the South African payment gateway, raised $ 48 million in a Series B funding round to expand the availability of payment solutions.

The financial environment has been led by Chinese internet giant Tencent and includes other investors such as Endeavor Catalyst and Endeavor Harvest Fund.

Tencent, a major investor, donated $ 20 million, accounting for almost half of the total fundraising, along with other other investors.

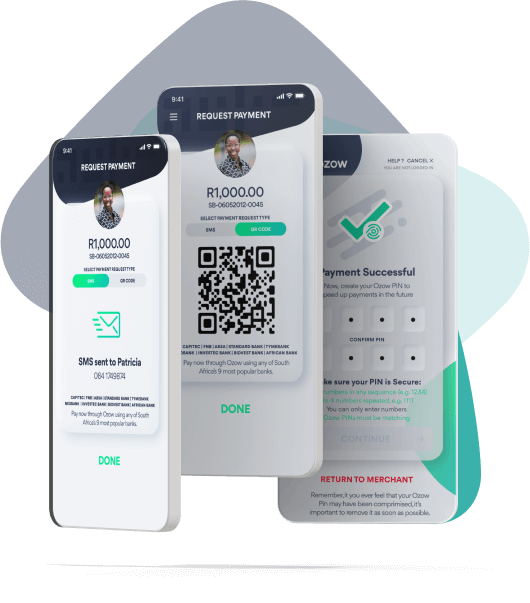

The company offers alternative payment methods such as QR numbers, sales (POS), e-commerce, e-invoicing, and peer-to-peer (P2P) payments throughout South Africa.

The new funding will allow Ozow to increase sales and further strengthen the country’s finances. The company is also considering investment opportunities, such as joint ventures and acquisitions, to help develop new products and expand to other African countries such as Namibia, Ghana, Nigeria and Kenya in the next months.

Originally known as i-pay

Ozow was introduced as i-pay in 2014 by CEO Thomas Pays to support accounting during bank openings. Following the competitive financial environment, the startup will finally be back in business for Ozow in 2019.

As a company, it develops bank payment solutions for more than 47 million banking users and more than 100 locations in South Africa.

The EFT process has been a popular choice for online businesses, but Ozow says it works on the EFT process and “allows consumers to pay seamlessly with three clicks.”

“When you look at e-commerce, point of sale (POS), e-invoicing or peer payments over the past seven years, it’s always been a broken business. For example, if you want a POS machine, you have to go to a company like Yoco. To accept card payments on my e-commerce site, I had to go to PayU. “,” What we have tried to solve is the importance of a platform that can provide solutions for e-commerce, point-of-sale, e-commerce. P2P payments and payments. ” Thomas Pays, CEO of Ozow

The platform currently serves more than 47 million bank account holders. All a customer needs is a bank account and a “smart device” to receive payment.

Ozow currently works for a wide range of consumers, including companies such as MTN, Vodacom, Shoprite Group, Takealot, and Uber.

Part of our network also includes suppliers, payment providers and sales of our products. A percentage of 1.5 to 2.5% is charged.

Ozow raised $ 2.5 million in Series A revenue in 2019 and grew 100% last year in the industry. Reaching over $ 100 million in merchandise each month from thousands of retailers.

On finance, Thomas Pays, CEO of Ozow, said in an interview: “It is an honor to join Tencent, Endeavor Catalyst and Endeavor Harvest Fund. It changes the way the bank operates. »By innovating, simpler and more. It just proves our responsibility. “