Oui Capital, Nigerian VC Firm Announces a Second Fund of $30 Million

TeamApt, a fintech business in Nigeria, announced its Series B investment in July 2021. Global Ventures, Oui Capital, Kepple Africa Ventures, Gbenga Oyebode, and a few more angel investors and venture capitalists participated in the round.

The Oui Capital Mentors Fund II, a $30 million fund, is being launched today by Oui Capital, one of the investors in that round.

Vibe Capital, D Global Ventures, One Way Ventures, Ground Squirrel Ventures, Seth Levine, Ryan McIntyre, and Tokunboh Ismael are a few of the local and foreign investors in the fund. The list is completed by TeamApt CEO Tosin Eniolorunda and investor Gbenga Oyebode.

In order to launch a venture capital firm with Francesco Andreoli, Oui Capital’s managing partner Olu Oyinsan left his position as vice president of investments at Ingressive Capital in 2018.

The following year, Oui Capital made its official debut with a $10 million fund that, according to the company, will give the most creative entrepreneurs in Africa access to early funding. The company plans to keep funding pre-seed and seed stage businesses throughout the continent with the new fund.

Since its inception, the company has made investments in 18 startups in South Africa, Kenya, Senegal, Egypt, and Nigeria. These startups include TeamApt, Herconomy, Akiba Digital, Clane, Awabike, AIfluence, Intelligra, and Ndovu in addition to those already mentioned.

VC activity has decreased globally as startup values have decreased and some have shut down. Behemoth buy now, pay later In a previous round valued at $46 billion, Klarna raised $639 million. However, after receiving $800 million in its most recent fundraise, its worth substantially decreased to $7 billion.

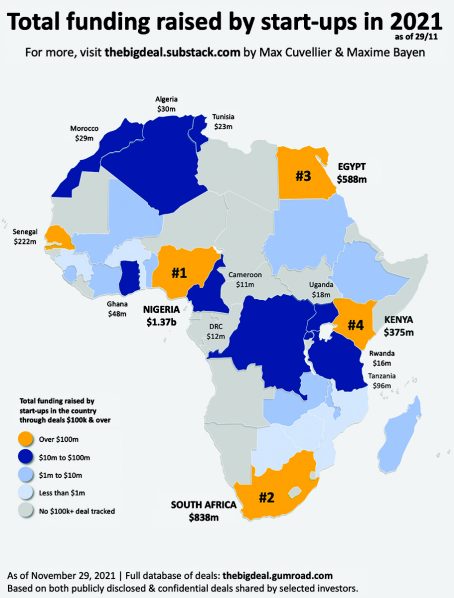

It’s interesting to note that African entrepreneurs continue to raise money at record-breaking rates, defying the general trend.

Africa is the only region that has continued to grow year after year, according to data from The Big Deal.

Startups in the continent raised 2.25 times as much money in Q2 2022 as they did in Q2 2021. However, because most of the wealth is invested outside of the continent, investors are probably more likely to favor conservative pricing. Oui Capital wants to benefit from that.

“We’re thrilled to be coming back to the market at a good time, as valuations have leveled off across the board and founder skill is at an all-time high. In an interview with Techpoint Africa, Oyinsan said, “We think this will make for a strong 2022 vintage and can’t wait to start deploying Fund II.

The company plans to issue checks up to $750,000 from this new fund with the promise of more follow-on investments. With investments planned for Francophone Africa and North Africa, it also intends to increase its reach.

One of the company’s initial investments, MVX, founded and led by Tonye Membere-Otaji, spoke of Oui Capital’s assistance with his venture.

“Oui Capital has played a significant role in our business, starting with giving us our first yes and then co-pitching with us on early calls, introducing us to other VCs and investors, helping with products and hiring, and so on. Oui Capital has given us a lot of help, and in my opinion, they are one of the VCs funding African businesses that is most sincere. We are pleased and proud of their development, and we anticipate continuing to do so,” he said.

The startup ecosystem in Nigeria has expanded significantly. The success of firms like Paystack and Piggyvest means that more local investors are at ease with the idea of investing in startups, in addition to obtaining the most money from venture capitalists on the continent.

In fact, a few entrepreneurs have started investing, either as angel investors or by starting their own funds.

While Odunayo Eweniyi, COO and Co-Founder of Piggyvest, co-founded First Check Africa, Shola Akinlade, CEO and Co-Founder of Paystack, has been an active angel investor for the past two years. The Magic Fund also counts certain Nigerian founders among its partners.

It is hoped that since Oui Capital’s new fund has a few local investors, this will become a common theme among VC firms in the nation.