Nigerian fintech, Afriex, secures $10 million in Series A funding

Afriex, a Nigerian payment platform that allows users to send and receive money for free to and from Africa, has raised $10 million in a Series A funding round.

Nairametrcs reported on Tuesday that the money will be used to “expand its blockchain money transfer platform.” The company is now valued at $60 million.

Sequoia Capital China and Dragonfly Capital led the round, with participation from Goldentree, Stellar Foundation, Exceptional Capital, and others. The new funding comes just over a year after the company raised $1.2 million in seed funding to expand its payments and remittances platform across Africa.

The Summer 2020 batch YC-backed startup offers a product that uses blockchain to enable users to send funds by converting them into stablecoins, which are cryptocurrencies backed by the dollar in their most granular form.

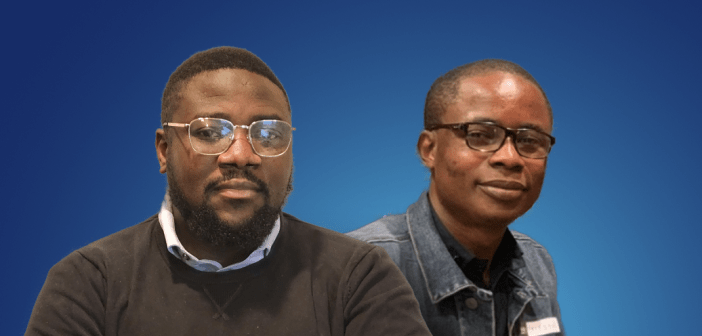

Tope Alabi, who co-founded the company with John Obirije in 2019, stated that their long-term goal is to build a service similar to Visa.

Because we are building this network of connected financial institutions, we have built on-ramps for local Nigerian banks and on-ramps for local currency exchanges.

Tope Alabi

“We’re putting together a web3 mesh of financial institutions that could become the next Visa.”

Haseeb Qureshi, managing partner of Dragonfly Capital, one of the investing companies that participated in the round, stated that the investment is the right path for the VC as it seeks to build a “really strong ground game” in emerging markets such as Africa.

“One of Afriex’s key strengths is its ability to span the entire corridor between the United States and Africa, where many others have tried and failed,” he said. “The reality is that in order to succeed in emerging markets, you must have a really strong ground game.”

Afriex has grown in popularity over the years, processing up to $5 million in transactions per month, thanks in part to its emphasis on free and faster transactions.

This increases its popularity among young Africans, presenting the case that it is a better option than other global businesses offering similar products, such as Wise, which charges a 6.45 percent fee for transactions that take longer to complete.