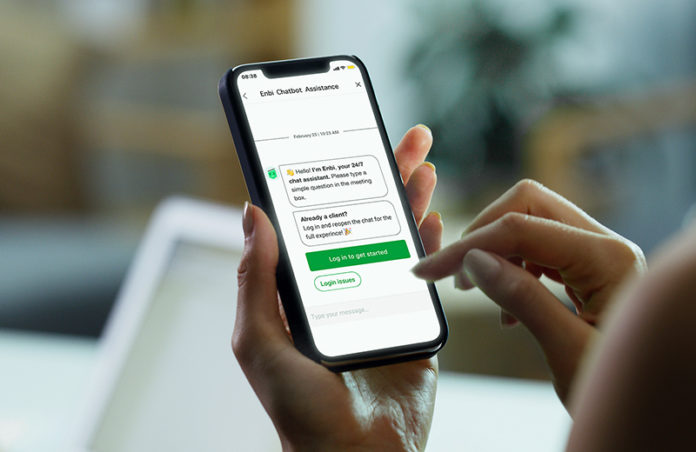

Nedbank Launches “Enbi” – A New Intelligent Chatbot Assistant

Written by Luis Monzon

Nedbank South Africa has announced the launch of a series of enhancements to its digital services, including the introduction of a conversational AI-powered chatbot.

“In line with its commitment to offer cutting-edge digital banking that adds real value to clients, Nedbank works tirelessly to add new features and services across its range of digital banking platforms,” the firm says in a statement.

These recent value-adding enhancements include the introduction of cardless withdrawals, simplified cellphone banking registration to access extensive mobile transaction options, and Enbi, an innovative digital conversational chatbot assistant.

“Our digital journey is, and always has been, undertaken with the targeted destination to offer clients an easy to use, highly engaging and helpful digital banking experience, one that ensures seamless, cost-effective and convenient banking across all our digital channels,” he says.

Enbi – Nedbank’s New Intelligent Chatbot

The implementation of the new intelligent and intuitive chatbot assistant, Enbi, on Nedbank’s Money app and Online Banking platforms offers users an easy to use way of getting day-to-day tasks done in a timeous manner, as well as allowing customers a more natural way of engaging with Nedbank.

“Enbi is set to raise the bar when it comes to the value that digital assistants can bring to customers when managing their finances,” Govender says.

Enbi’s intuitive interface and natural language make it easier for Nedbank’s users to find out more about the bank’s services and products. Enbi navigates users to key features in the Money app and Online Banking and has useful buttons and quick replies so users can quickly and easily achieve their tasks, like how to reverse a debit order or find the nearest branch.

“One of the challenges with banking apps is that it can take time to find the various features that the customer is able to use. Enbi helps by understanding what the customer is looking to achieve and either giving them the information or guiding the customer to the right function,” says Govender.

“Nedbank’s customers have enthusiastically adopted the Live Agent Chat functionality that was implemented two years ago, and this latest feature builds on that to further enhance the ability of customers to engage with us.”

Nedbank Taps ChatBot Specialist Kasisto for Enbi

Enbi was developed for Nedbank by Kasisto, a leading global provider of Conversational AI technology and digital assistants for the financial services industry.

According to Zor Gorelov, CEO and co-founder of Kasisto, “Enbi is powered by KAI Kasisto’s industry-leading digital experience platform that comes with the financial skills and knowledge to deliver a truly human-like conversational experience. Enbi will be a leader in its capabilities through its ability to empower Nedbank’s customers with efficient, intuitive and friendly banking experiences.”

Other Enhancements Coming to Nedbank Digital

Nedbank’s steady advance on its digital journey isn’t limited to an industry-leading digital assistant.

The bank will also unveil a number of other enhancements to its digital banking offering, including enhanced cellphone banking and an innovative cardless withdrawal solution on the Nedbank Money app, Nedbank Online Banking, Cellphone Banking and MobiMoney platforms.

The cardless withdrawal facility makes it quick and easy for Nedbank clients to send money to recipients, even if they are not Nedbank clients.

Recipients can withdraw the cash from any Nedbank ATM or at selected retail stores, using a secure voucher number and one-time password. The bank has already partnered with Shoprite, Checkers, Usave and OK stores, and will continue to grow its footprint across the country.

According to Govender, these enhancements align with Nedbank’s ongoing commitment to ensuring that clients who prefer to use convenient and cost-effective cellphone banking can now also enjoy other benefits that this popular platform offers.

“Until now, clients had to use their Nedbank profile and PIN credentials to register, which meant that they first had to visit a branch to create a profile and then had to remember a 10-digit profile number and PIN…we recognised the need to bring in more convenience and a simpler experience for customers,” says Govender.

Going forward, Nedbank clients can register for cellphone banking using their Nedbank card details or following the traditional profile and PIN process.

Either way, clients need to register only once and then receive a five-digit cellphone banking PIN, which is all they need to access this mobile banking platform.