MaxAB Secures $40M to Accelerate Growth, Regional Expansion

MaxAB, a B2B e-commerce and distribution platform for food and grocery products that serves a network of conventional merchants in Egypt and Morocco, has announced the closing of a $40 million pre-series B equity transaction to support its growth throughout the MENAP area.

The round included a number of new investors, including British International Investment (BII; formerly known as CDC), the UK government’s development finance institution, Silver Lake, the world leader in technology investing, through its Long Term Capital strategy, and DisruptAD, ADQ’s venture platform. Existing investors Beco Capital, 4DX Ventures, Flourish Ventures, and Africa Platform Capital are also participating in the round.

By linking suppliers with underserved traditional retailers and providing a variety of embedded financial solutions, MaxAB is revolutionizing the food and grocery supply chain and promoting the economic growth of the nation. MaxAB’s e-commerce company has successfully served about 150,000 different traditional shops since its start in 2018, delivering 2.5 million orders while maintaining an industry-leading delivery success rate. The goal of MaxAB’s fintech solutions rollout across its merchant base in 2021 was to digitize the flow of cash and turn MaxAB into a one-stop shop for conventional shops.

With presence in all major Egyptian towns and Casablanca, Morocco, MaxAB has established itself as the market leader in its sector. MaxAB has additional ambitions to expand its geographic reach, with the goal of covering all of Morocco by the end of 2023 and entering the Kingdom of Saudi Arabia.

Additionally, MaxAB will use the additional funding to strengthen its technology and product teams, finance additional e-commerce company expansion, and ramp up its fintech division by providing more embedded finance solutions.

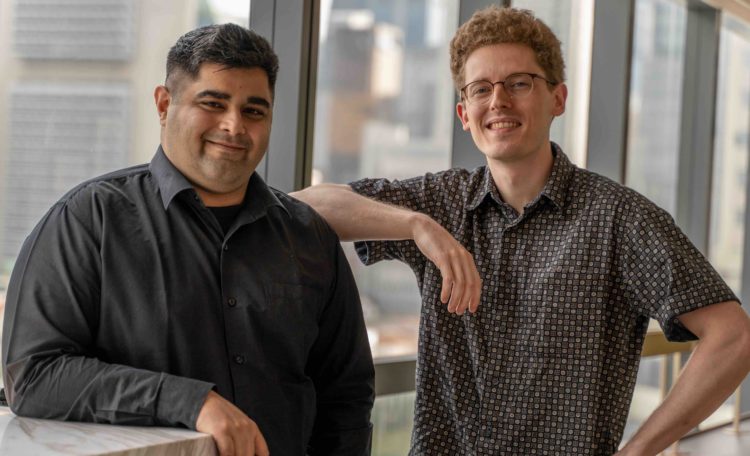

In barely four years of operation, Belal El-Megharbel, CEO and Co-Founder of MaxAB, claimed, “We have been able to re-engineer the informal food and grocery sector in Egypt and Morocco. We are overjoyed to have received the endorsement and funding of renowned investors, adding to the welcome and support we already receive from the merchants and suppliers we work with. We are eager to embark on the next phase of the MaxAB journey, which involves further consolidation of the informal grocery sector, heavy focus on and investments in Fintech, and replicating our success in new markets to grow beyond borders, based on the caliber of investors who are partnering with us.

Amer Al Ameri, Head of Venture Capital and Technology Investments at ADQ, added: “MaxAB is developing technology-driven products and services that address problems relating to more seamless, effective, and dependable food supply chains for the MENAP region. They have shattered the mold and created a cascade of opportunities by digitizing the supply chain for the largely traditional, multi-layered, and fragmented food and grocery industries. One of these chances is the introduction of the fintech vertical. We are excited to travel this path with MaxAB and look forward to offering strategic advice for further development and influence.

Small traditional stores are the backbone of the grocery industry in Egypt, and same dynamic is present in many other MENAP nations. MaxAB has created a tested playbook of experiences, technology, data, and relationships that can be used for launch into new geographies and is hoping to repeat the same success around the region after experiencing remarkable success in Egypt and Morocco. MaxAB says that more than 750,000 small businesses in Egypt and Morocco alone need its assistance, and Saudi Arabia is particularly appealing because of the government’s push to digitise the unorganized sector and the FMCG industry’s openness to test out new business models.

Silver Lake is making the investment in connection with its Long Term Capital strategy, which was established in 2020.