How fintech innovators and regulators can create a synergy

Conciliating innovation and regulation is perhaps the single most significant source of concern for tech titan leaders and startup founders worldwide. This is more common in Africa, where regulatory cultures frequently stifle innovation.

For example, in Nigeria’s fintech space, innovation has accelerated in recent years, with at least three unicorn startups launched during this time period. Much of this expansion has occurred without the direct involvement of the government.

However, there have been attempts, some of which have been successful, to create regulations to guide these fintech behemoths. However, balancing the rigidity of traditional financial regulation with the flexibility required for tech-driven solutions is frequently difficult.

Entrepreneurial innovation is frequently one step ahead of regulations. When policies are left to catch up, they can end up stifling rather than enabling innovation and causing friction between startups and government officials.

Despite their fractious relationship, regulators and innovators have similar goals, so there is a natural common ground between them. According to participants at TechCabal’s recent event, “The Fintech Series: Regulation and Innovation – Finding Common Ground,” this is the case.

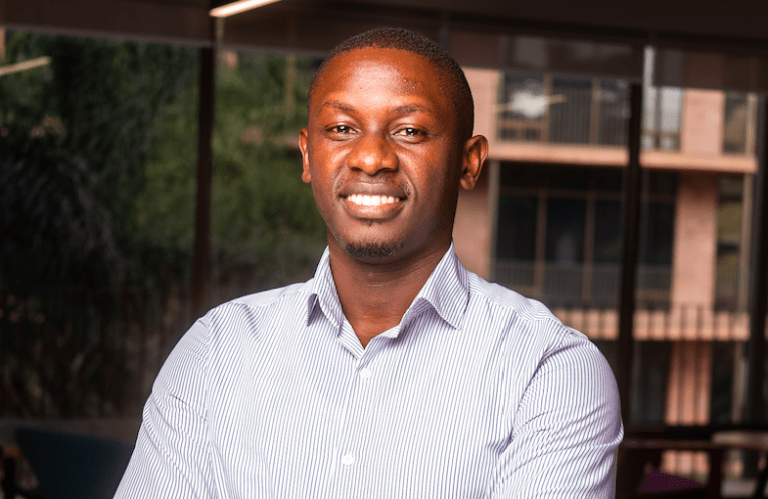

“There appears to be a conflict between their goals, but in reality, both parties have a shared vision,” said Razaq Ahmed, co-founder and CEO of Cowrywise, a Nigeria-based app that helps people save money.

“Innovation is a contributor to economic growth and development because we operate in a private-sector-led economy.” Regulators must create an enabling environment for innovation to flourish.”

Ahmed believes there is a “man-made trust gap” between the ways regulators and innovators think. As a result, both parties must work together to build trust.

“Building this trust is not solely the responsibility of regulators, but also of innovators,” he said. “When discussions of regulations are tabled, the best intentions must be assumed.”

Emomotimi Agama, Head of Registration, Exchanges, Market Infrastructure, and Innovation at the Nigerian Securities and Exchange Commission (SEC), emphasizes the importance of timely information exchange between both parties in order to build trust, while emphasizing the importance of a regulator to the ecosystem.

“Fintech startups that have worked with the SEC are better off today,” Agama says. “As regulators, we ensure that entrepreneurs do not overstep their bounds.” Because innovators frequently fail to consider the risks to themselves, the investor, or other stakeholders. A regulator is unavoidable for long-term sustainability and some level of protection.”

According to Dr. Ola Orekunrin Brown, founder of the Flying Doctors Healthcare Investment Company, this protection ensures industry stability and gives venture capital firms some level of confidence to back innovators (FDHIC).

“As investors, we’re always looking for regulation to protect our investments,” Brown explained. “We also encourage participation, which I believe is a two-way street.” It is critical that we [investors and portfolio companies] learn to engage as well.”

According to Topsy Kola-Oyeniyi, Partner and co-leader of Mckinsey and Company’s Payments Practice, there have been instances where regulatory measures have intentionally or unintentionally allowed innovation to thrive in Nigeria.

“Initiatives such as the bank verification number (BVN) have enabled the growth of fintech apps.” Then there’s SANEF [Shared Agent Network Expansion Facility], without which the current agency banking boom would not have been possible,” she added.

Africa’s rapidly growing fintech industry is poised to play an even larger role in the financial services sector, with several opportunities yet to be explored and more room for expansion. This potential necessitates future collaboration between fintechs and regulators.

“There have been quite a few misunderstandings because neither side tried to see issues from the other’s perspective. This isn’t good for anyone, especially the consumers,” said Oswald Guobadia, IT veteran and senior special assistant to the Nigerian president on digital transformation.

“We need to see the digital ecosystem not as a fighting ground but as a playing field,” Guobadia added. “Nigeria boasts two homegrown fintech unicorns. If this can be achieved despite the current regulatory landscape, how much more if both parties come together?”