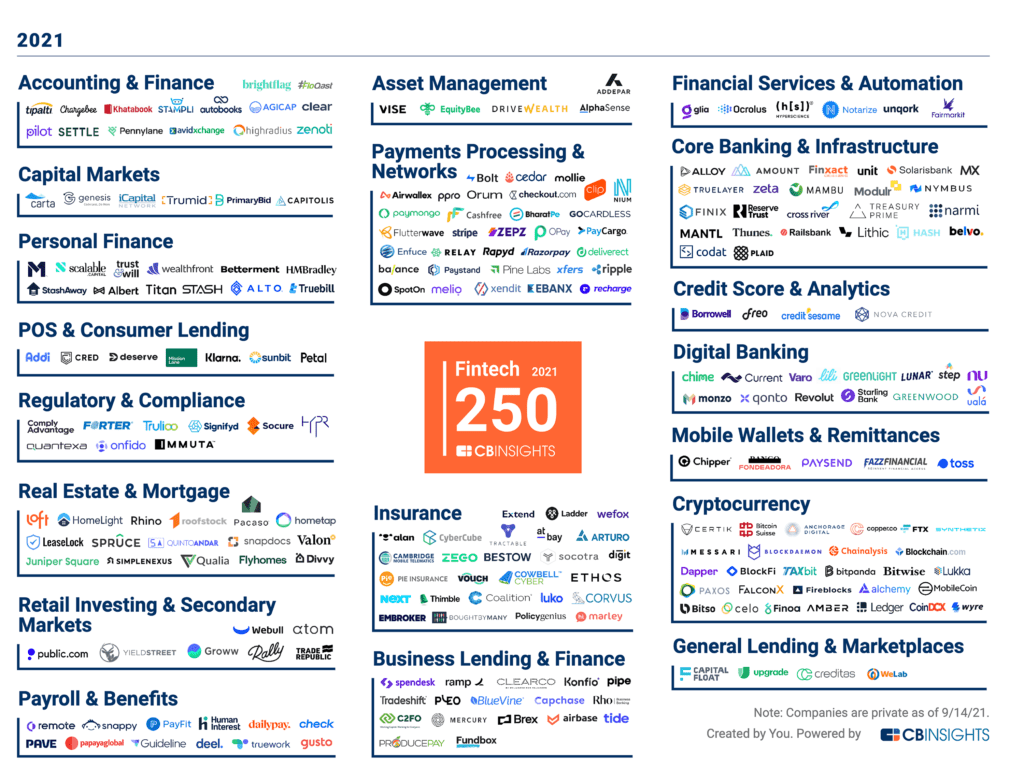

Flutterwave, Opay named among CB Insights’ Fintech 250 companies

Made up of 250 top private companies leveraging technology to solve challenges in the financial services industry, CB Insights has unveiled the fourth annual Fintech 250.

The Fintech 250 includes the most promising fintech companies from around the world, operating in capital markets, insurance, digital banking and wealth management.

Companies in this year’s cohort have raised approximately $73.8 billion in aggregate funding across almost 1,200 deals since 2016 and include startups at different investment stages of development, from early-stage companies to well-funded unicorns.

Selected by CB Insights’ Intelligence Unit from a pool of over 17,000 companies, including applicants and nominees, these companies were chosen based on factors including data submitted by the companies, company business models and momentum in the market, and Mosaic scores, CB Insights’ proprietary algorithm that measures the overall health and growth potential of private companies.

Included among the top 250 fintech companies making a global impact were Flutterwave and Opay, two companies making waves across the African continent and beyond.

Flutterwave was listed among the Internet Software and Services sector, under the Payment Processing and Networks category. The report showed Flutterwave’s total disclosed funding to be $224.29 million, backed by investors including Tiger Global Management, Y Combinator, Insight Partners, DST Global and Greycroft.

With a remarkable revenue growth of 226% CAGR, Flutterwave attained unicorn status earlier this year with its $170 million Series C round, boosting the company’s valuation over a billion.

Through several partnerships with companies including Paypal, Airtel Money, MTN, Currencycloud, Discover, among others, Flutterwave is steadily climbing a global reach, making impacts in every nook and crannies of the world.

Of course, Flutterwave’s innovative team, headed by Olugbenga ‘GB’ Agboola, founder and CEO, Flutterwave, cannot be ignored in the growth of the company. It is thrilling to have such creative minds rising from the African continent.

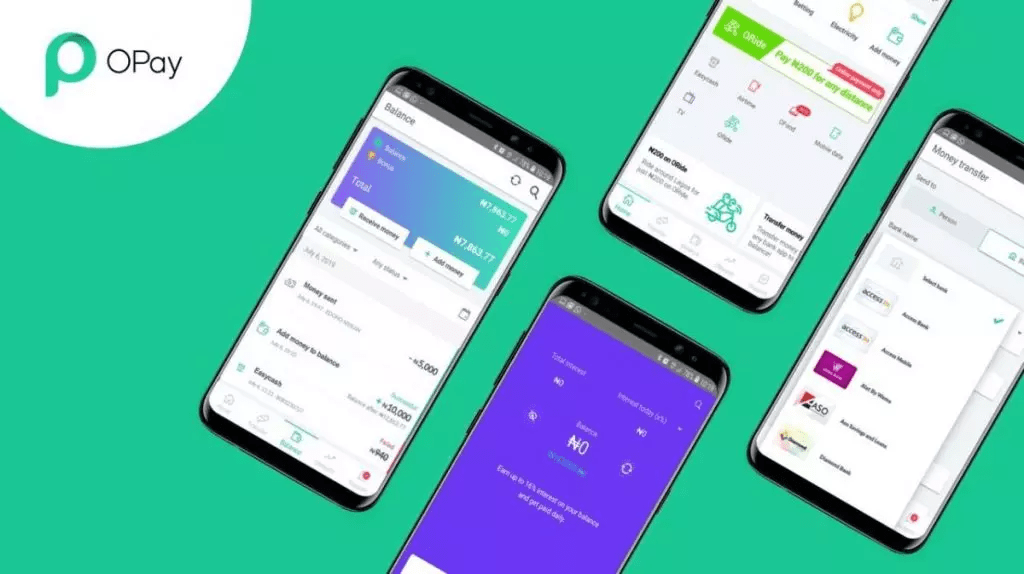

Among the companies in the Mobile Software and Services sector was Opay, also under the Payment Processing and Networks category. With total disclosed funding of $570 million, investors backing Opay according to the report include Sequoia Capital China, SoftBank Group, IDG Capital, Source Code Capital and SoftBank Ventures Asia.

Just within three years of establishment, Opay has done remarkably well.

By the end of 2020, the company had an annual revenue run rate of about $70 million and attained unicorn status recently, when it raised $400 million in a funding round led by SoftBank Vision Fund. The investment boosted the company’s valuation to $2 billion, and its total investments to $570 million since launch.

Founded by Yahui Zhou, who is also the chief executive officer of the company, the company’s team deserves the accolades for relentlessly working together to ensure the excellence of the company.

CB Insights builds software that enables the world’s best companies to discover, understand, and make technology decisions with confidence. The company combines data, expert insights, and work management tools to help clients manage their end-to-end technology-making process.