Earnipay is offering employees flexible access to their salaries

Wages for formal-sector employees in Nigeria are paid monthly; however, wages for informal-sector employees are paid daily. When salaried employees are unable to make ends meet between paydays, they now have three options: borrow, take out a loan, or request a salary advance.

However, most loans have exorbitant interest rates, and salary advance schemes can put an employee further in debt.

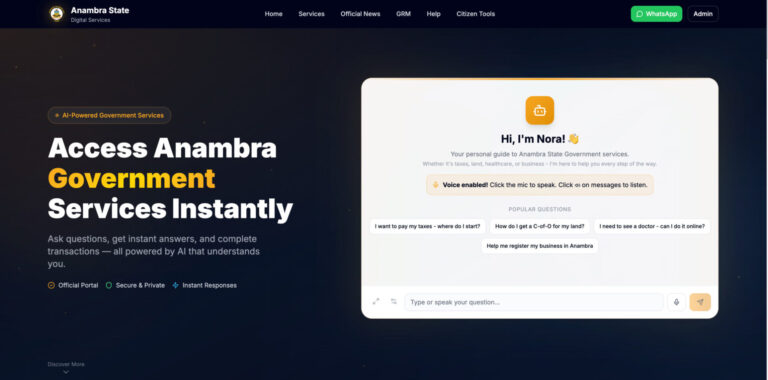

Nonso Onwuzulike founded Earnipay, a fintech solution that provides employees with flexible access to their accrued salaries on any day of the month.

The payday cycle has been revised

In 2019, Onwuzulike established a recycling company in Accra, Ghana, with the goal of reducing plastic waste and facilitating plastic recycling in the capital city. He hired waste collectors and put them on a monthly payment schedule while running the business. However, these employees, all of whom came from the informal sector, were dissatisfied.

They were used to being paid after completing a task or at the end of the workday. They were cash-strapped and unable to match their daily expenses to their income due to the monthly payment cycle. As a result, once salaries were paid at the end of the month, many of the employees left the company in search of other opportunities.

To combat the high attrition rate among waste collection workers, the company switched from a monthly payment schedule to a flexible one that allowed workers to be paid more frequently—weekly or bi-weekly. The change increased their productivity, and fewer employees left.

Onwuzulike had a lightbulb moment. He then polled 100 formal employees in his network to find out how frequently they ran out of cash before payday and what their employers did to help them out.

Onwuzulike’s initial goal for Earnipay was to create a salary advance solution, similar to those already in place in Nigeria, some of which were powered by traditional banks. However, plans were altered when the results of a 100-person survey revealed that 90% of salaried employees would prefer to have flexible access to their accrued salaries.

“People don’t need payday loans or salary advances to fund their lives; they just want to be paid more frequently,” Onwuzulike told TechCabal during a phone interview.

Earnipay is still in beta, with Onwuzulike as CEO, Busayo Oyetunji as COO, and Joshua Ajayi as CTO. According to Onwuzulike, the three of them consider themselves co-creators of the product.

“It functions similarly to an ATM.”

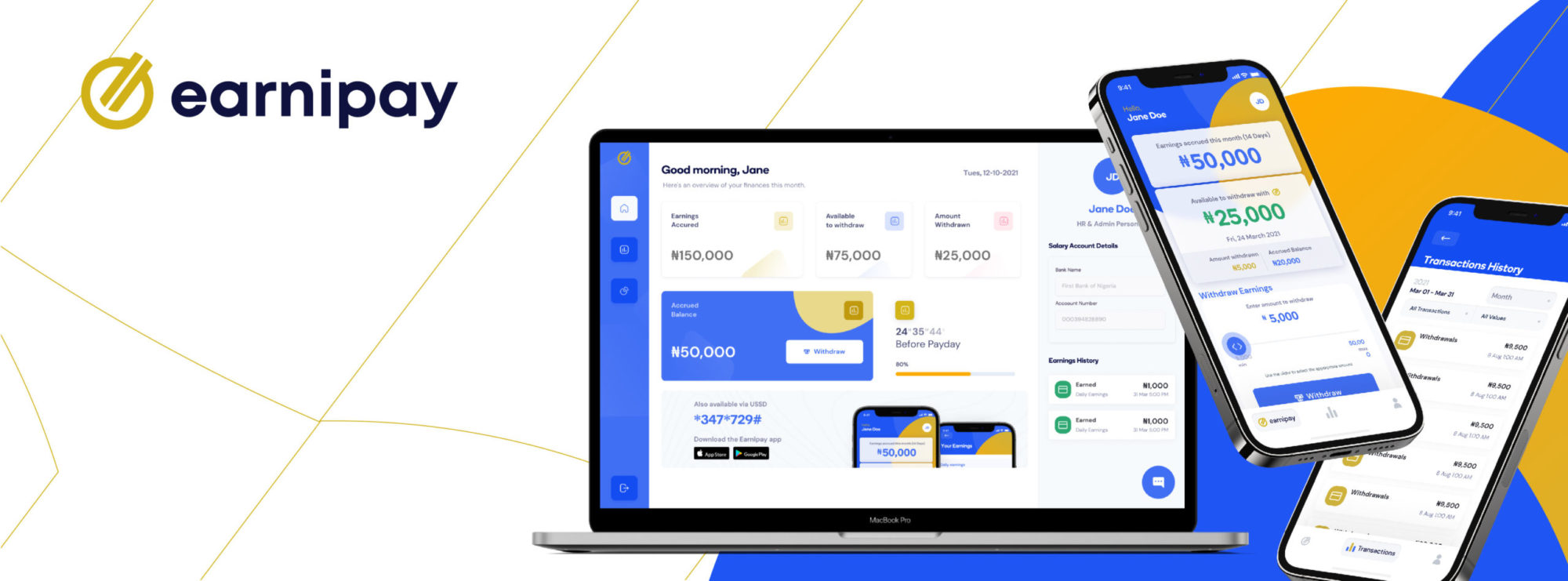

Earnipay is not available to individuals, so employers must sign up and onboard their employees. Employees can withdraw up to 50% of their daily accrued salary as of the time of access, at any time of the month, using the Earnipay app. Earnipay pays for the withdrawal.

For example, dipping into one’s salary on the ninth day of the month entitles them to half of what they’ve earned for working nine days. At the end of the month, their employer deducts the amount withdrawn from their salary, uses it to reimburse Earnipay for initially funding the withdrawal, and then pays the employee the balance as their monthly salary.

Withdrawals are subject to tiers of transaction fees. Withdrawing 5,000-10,000 incurs a 500 fee, while withdrawing 10,000-150,000 incurs a 1,000 fee.

“It works exactly like an ATM,” Oyetunji explained.

Bridging the formal and informal labor markets

In urban Africa, the informal sector employs approximately 80.8 percent of the workforce. In Nigeria, where Earnipay is based, the sector employs more than 70% of the workforce.

Earnipay was piloted three months ago, and Onwuzulike anticipated that the solution would be useful only for low-income staff and informal employees. However, the income profile of the app’s users varies, according to Onwuzulike. “One of our customers earns a million naira per month,” he explained.

So far, 17 businesses have registered as active users on the app, and their employees have used Earnipay over 400 times.

There are undeniable benefits to shorter payment cycles. An employee, for example, can view their daily salary breakdown on the app, and unlike a loan or salary advance, which are borrowed funds, an Earnipay withdrawal is earned wages.

Nonetheless, some of the risks associated with loaning and salary advances may apply here as well. For example, an earner who is unable to manage their personal finances may end up dipping into their salary before payday for the most frivolous reasons, and even after receiving their salary balance at the end of the month, may struggle to control their spending.

In response to these concerns, Oyetunji stated, “The main problem here is that we are not financially educated.” If you’re not financially disciplined, Earnipay may not make a difference in your spending habits whether you get your money at the end of the month or access it [daily] as you work.”

Scaling up

Last year, at the height of the COVID-19 pandemic, Africa’s formal and informal economies suffered. In Malawi, 6% of formal workers were unemployed, while in Nigeria, the figure rose to 45 percent. Now, as Africa adjusts to the global reset imposed by the pandemic, financial well-being in all employment sectors is more important than ever. “We’re in the grip of a financial health pandemic,” Oyetunji declared. “People’s quality of life suffers as a result of their inability to meet their basic needs.” “How can we have on-demand expenses but not on-demand access to our earnings?”

The Earnipay team began developing the product in July, received an undisclosed amount of pre-seed funding in August, and launched their Minimum Viable Product (MVP) in September.

Onwuzulike commented on Earnipay’s plans for 2022, saying, “Our goal is to partner with employers to improve employee financial well-being.” We provide income earners with tools to help them make better financial decisions and improve their quality of life. We provide financial education to advise employees on best practices for managing their finances, as well as other products to assist them on a daily basis, in addition to flexible salary access.”