Clickatell Joins Forces With the Central Bank of Nigeria to Provide Seamless eNaira Services

All Nigerians can now access quick, easy, and affordable eNaira banking services using the USSD channel, which eliminates the need for data and is accessible on all handsets, thanks to a partnership between Clickatell and the Central Bank of Nigeria (CBN). Clickatell is a pioneer in CPaaS and a leader in chat commerce.

In an effort to expand financial inclusion and make basic banking available to all Nigerians, Clickatell and the CBN have partnered to launch a USSD channel for the CBN’s eNaira Central Bank Digital Currency (CBDC).

The eNaira was introduced in October 2021 after Nigerian President Muhammadu Buhari said that the continent’s first digital currency backed by a central bank would increase remittances, promote international trade, and make it easier for his administration to distribute welfare benefits.

President Buhari also stated that he thought the CBDC will boost the nation’s GDP by $29 billion over the following ten years, with financial inclusion at the core of the eNaira ambitions.

“The introduction of the USSD short code makes it possible for Nigerians who are not currently banked—many of whom do not own smartphones—to access cashless banking services, which is a major step toward achieving the goals of delivering genuine financial inclusion. One of the most significant accomplishments of Clickatell’s involvement in Nigeria has been its contribution to making this a reality, according to Uzo Nwani, Clickatell Commercial Director, West Africa.

How It Operates:

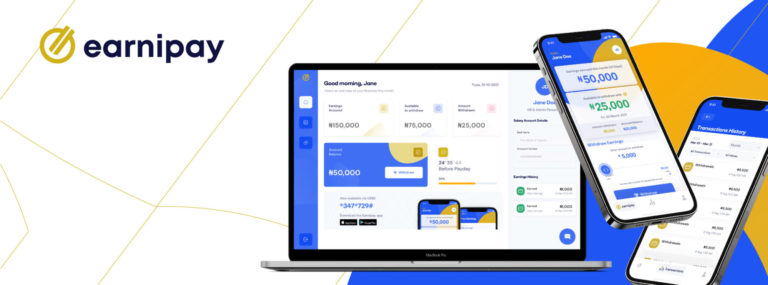

Nigerians can build their eNaira wallet utilizing the new USSD channel and the short number *997#.

Once this is completed, customers may quickly check their balances, transfer money, and securely purchase airtime or data for themselves or their loved ones.

On the channel, users can easily protect their wallets by checking and updating their information, changing and resetting their pin, or even blocking the wallet if necessary.

“The USSD channel is a crucial step in our effort to realize our vision of financial inclusion. The eNaira, in our opinion, represents a step up in the development of money. Therefore, CBN is collaborating with partners who are dedicated to utilizing this new technology for ongoing innovation in order to bring exciting new features, says Dr. Kingsley Obiora, deputy governor of CBN’s economic policy.

99% of GSM handsets support the USSD communication protocol, also known as unstructured supplementary service data.

Nigeria is still not fully banked

It continues to be especially useful in underdeveloped areas where it may be used to deliver services at considerably reduced costs without requiring access to the user’s SIM card.

Despite the explosive expansion of smartphones, most Nigerians still use feature phones, which is a strong argument in favor of the USSD offering. The CBN is relying on the new route to make quick strides toward bringing the majority of Nigeria’s 30% unbanked population into the established banking system.

The CBN has provided an incentive of 200 eNGN airtime for the first 100,000 users to sign up using the eNaira USSD feature as part of its efforts to increase awareness and education about the new digital currency.

Looking forward, Nwani asserts that the Clickatell solution perfectly places the system for future enhancements that will enhance the eNaira offerings.

“Our Chat Flow solution offers a stable framework that fosters quick innovation. Digital currencies offer quantifiable client benefits, such as decreased costs and a simple user interface, and will undoubtedly draw in more users as more innovative features are gradually added. Without a question, the CBN has established the standard for financial inclusion in Africa, and we welcome the opportunity to join them on their journey, according to Nwani.