African tech startup funding moves beyond the $2bn mark

Over the course of a record-breaking 2021, investment into the African tech startup ecosystem nearly tripled, with total funding passing the US$2 billion mark for the first time.

This is according to the seventh edition of the annual African Tech Startups Funding Report, which was released by startup news and research portal Disrupt Africa as part of an open-sourcing initiative in collaboration with Novastar Ventures, MFS Africa, Quona Capital, 4Di Capital, MEST Africa, and Future Africa.

The report tells the story of an extraordinary 2021 in which more startups raised significantly more funding than ever before. In total, 564 startups raised a total of $2,038,627,500 in 2021.

This represented tremendous progress. The number of funded startups increased by 42.1 percent to 397 in 2020, and the funding total nearly tripled – up 190.6 percent – from the previous year’s total of US$701,460,565 banked.

Since 2015, the number of African startups that have received investment has increased by 351.2%. Though growth slowed slightly in 2020, owing in part to the COVID-19 pandemic, investors more than doubled in 2021, with the number of different investors increasing by more than 100% to 771 from 370 the previous year.

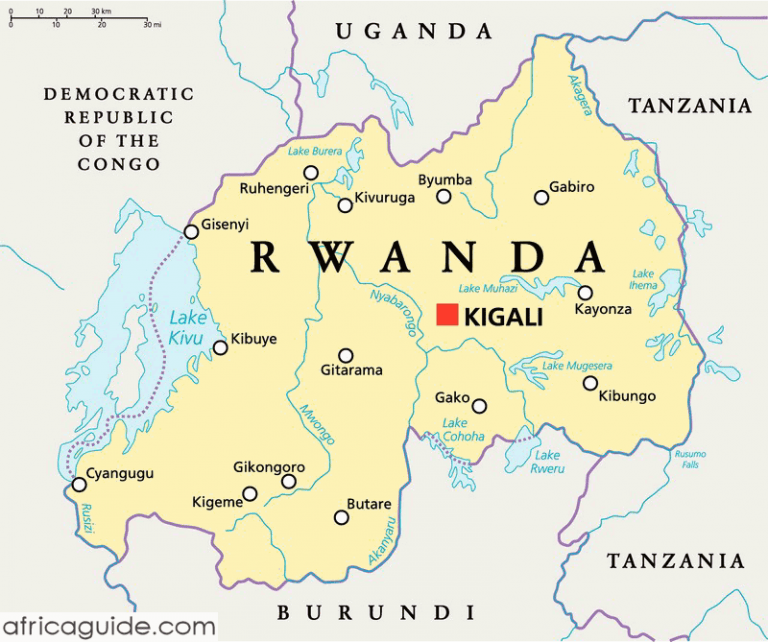

Nigeria, Egypt, South Africa, and Kenya remain Africa’s “big four” in terms of funding, securing a larger share of total funding than in 2020, but Nigeria soared past all other countries to take first place, with 161 startups raising a massive combined total of nearly US$800 million.

Though Nigeria and the other “big four” countries continue to be the clear leaders, there is still plenty of activity elsewhere on the continent, with startups supported in 24 African countries.

The fintech sector was the most appealing to investors once again in 2020, with more startups securing funding than any other sector and a total that dwarfed all others.

Fintech accounted for more than half of total investment, breaking the US$1 billion funding barrier, which the African tech space as a whole only managed for the first time in 2021.

Other sectors, including e-commerce and retail-tech, e-health, logistics, ed-tech, energy, agri-tech, and transportation, also had strong years.

The report can be downloaded for free here. Aside from providing a complete list of funded startups, who invested in them, and, where possible, the amount raised from the previous year, the annual reports also provide in-depth analyses of investment trends within key startup geographies and verticals, as well as data on African startup acquisitions.

“For quite some time now, momentum has been building in the African tech space, and 2021 will be remembered as a watershed year.” Breaking the US$1 billion barrier, as well as the US$2 billion barrier, creating more unicorns, and nearly doubling the number of active investors – it was a very good year. However, it is only the beginning, and there is plenty of room for expansion,” said Disrupt Africa co-founder Gabriella Mulligan.

Previously available for purchase, the African Tech Startups Funding Report was purchased each year by leading African and global tech companies, Big Four consulting firms, banking and fintech leaders, venture capital firms, supranational investors, and international trade bodies. Now, however, Disrupt Africa releases the publication for free, making it accessible to those for whom the information is most valuable – African entrepreneurs.

This year it is doing this with the help of partners Novastar Ventures, MFS Africa, Quona Capital, 4Di Capital, MEST Africa and Future Africa, with whose support Disrupt Africa will be distributing the African Tech Startups Funding Report 2021 to as many ecosystem stakeholders as possible.

“For far too long, access to critical industry data like this has been out of reach for active or aspiring entrepreneurs, as it is typically priced out of reach,” Disrupt Africa co-founder Tom Jackson said. “It is the Disrupt Africa ethos to make as much information as possible freely available, and we can’t thank our partners enough for their assistance with the open-sourcing of this publication.”

“We have been investing in African startups since 2014 and have been encouraged by the tremendous growth of the venture ecosystem since then.” Nonetheless, capital remains scarce as startups progress from proof-of-concept to scale. The annual funding report from Disrupt Africa is a valuable resource for founders as they climb and navigate a capital ladder that still has missing rungs.

We are excited to collaborate with the Disrupt Africa team to make their research available to all entrepreneurs.

The report’s data and insights are a valuable resource, not only for charting the development of Africa’s venture ecosystem, but also for supporting it,” said Steve Beck, managing director at Novastar Ventures.

Dare Okoudjou, founder and CEO of MFS Africa, stated that the African tech ecosystem had experienced unprecedented growth, breaking records year after year.

“It’s the clearest indicator that we’re approaching an exciting tipping point in our industry.” We raised US$100 million in Series funding in the fourth quarter of 2021 to accelerate our growth as we make borders less important. As a result, we recognize the critical importance of adequate funding to construct the fundamental infrastructure required to facilitate interoperability across payment schemes, borders, and currencies. Accurate and informative reports about the ecosystem raise the profile of our sector outside of Africa, which helps to channel much-needed investments into impactful startups. “We are overjoyed to be able to support Disrupt Africa on this critical project,” he said.

“Quona Capital is proud to support Disrupt Africa’s important work,” said Johan Bosini, partner at Quona Capital. “We are seeing tremendous traction on many fronts of the African venture ecosystem, with major milestones being achieved in large investment rounds and total quantum being invested in technology businesses across the major hubs in South Africa, Nigeria, Kenya, and Egypt.” We all benefit and learn from this industry data, and we are thrilled to be a part of this important initiative.”

“Once again, we are delighted to lend our support to this critical initiative.” Publications like this one provide all members of the African ecosystem with a snapshot of how and where the industry is moving, which is critical to all of our businesses and teams. “We can’t thank Tom, Gabriella, and the team enough for all of their hard work in putting together the report,” said Anton van Vlaanderen, partner at 4Di Capital.

MEST Africa’s managing director, Ashwin Ravichandran, expressed excitement about collaborating with Disrupt Africa on this initiative because of the “massive opportunities” it brings to the continent, allowing innovators to do more.