Zenda secures $9.4m in seed funding, set for pan African expansion

Zenda, a business based in the United Arab Emirates, has received $9.4 million in seed funding to help improve school tuition payment and management.

By changing the way parents and guardians pay school fees, as well as how educational institutions conduct fee collection, the company wants to have an impact on the educational sector.

Zenda also plans to make Africa its next growth frontier after expanding in Egypt – its third country after India – in the coming months as part of a growth strategy fueled by a $9.4 million seed round.

STV, COTU Ventures, Global Founders Capital, and VentureSouq are among the investors who took part in the round, according to the release.

About Zenda

Zenda (also known as nexopay) is a fintech that allows families to pay bills using PNPL (Pay-Now, Pay-Later).

Families can use the Pay Now option to make school bill payments more convenient and accessible from the comfort of their own homes. Families can use the Pay Later option to divide their school costs into their monthly budgets.

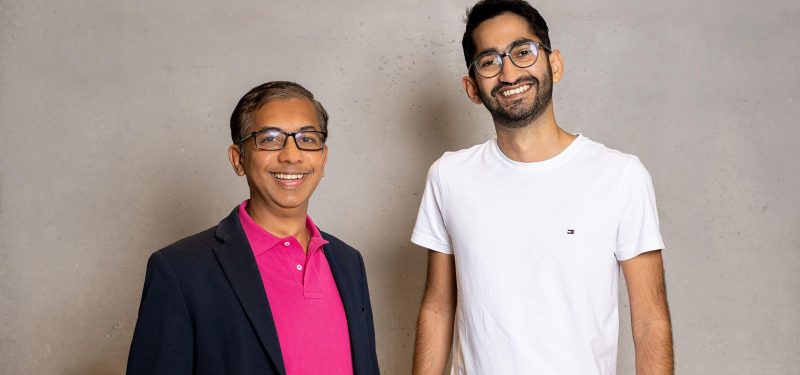

The startup firm, founded in June 2021 by Raman Thiagarajan and Haseeb Ahmed, both former McKinsey & Company employees, is the duo’s second venture.

Zenda is based on their first social Edtech company, nexopay, which provides a management and data analytics solution for schools, instructors, and regulators, according to Thiagarajan.

He argues that their first business gave them a thorough insight of the education market, allowing them to create a fintech solution that addresses the challenges that parents and schools experience when it comes to fee payment and management.

Investors in Zenda are counting on a massive addressable market. Given Zenda’s short history, the $100 million in yearly equivalent fees that the company has funded thus far appears impressive. However, in a market worth more than $140 billion each year in its target areas, that is a small number; the potential, Forbes claims, is enormous if Zenda can keep up.

How it works

Zenda’s app allows parents to pay fees directly to schools while also allowing schools to accept and process payments online, allowing for more efficient collections. Parents no longer need to show bank deposit slips as proof of payment because all transactions on Zenda happen in real time.

Parents can also earn a tuition cost credit with a flexible repayment schedule through the company’s embedded financing option.

Our mission is to help families thrive. We aim to make it easier for families to manage their money, and to enable their financial wellness. We see a need for family-centric products that are simple and collaborative.

Raman Thiagarajan, CEO and Co-Founder

Africa in question

School-related costs have long been a source of concern in African countries with large populations of low-income families.

Many young Africans do not receive the education that they need. One out of every five children aged 6 to 11 in Sub-Saharan Africa is out of school. Between the ages of 12 and 14, the share jumps to nearly a third. School fees are a major contributor to educational marginalization.

However, abolishing school fees entirely may not be the greatest solution because schools may become overcrowded. There are also additional charges for books, uniforms, and other items.

With Zenda’s expansion into Africa, parents’ attitudes on this reoccurring issue will shift. Parents might choose to pay in installments. Furthermore, traditional payment methods may cause transactions to be lost in transit, causing complications for both parents and educational institutions.

This will be aided by the $9.4 million in new cash. The corporation considers sales and marketing to be a top focus, with the acquisition of new schools being critical to revenue development. However, both entrepreneurs see a possibility to expand into related industries, therefore product development will be crucial.