Workpay, YC-backed HR-payroll Startup Secures $2.7M to Expand in Africa

Due to the rising demand for payroll and other HR solutions, the global HR payroll market is anticipated to develop at a compound annual growth rate (CAGR) of 9.2% and reach a value of $14.31 billion by the end of this decade.

As more firms move their activities online, it is anticipated that a rising number of small and medium-sized businesses in emerging economies will spur the adoption of HR payroll software solutions. Startups in the HR payroll space like Workpay are attempting to take advantage of this market opportunity.

After $2.7 million in pre-Series A fundraising from Launch Africa, Saviu Ventures, Acadian Ventures, Proparco, Fondation Botnar, Kara Ventures, Axian, P1 Ventures, and Norrsken, the Kenyan HR payroll business will soon expand its services to 40 nations in Africa, nearly doubling its present coverage. The firm (W20) with YC backing had previously raised $2.1 million in initial funding in 2020.

Paul Kimani, co-founder and CEO of Workpay, told TechCrunch that in an effort to anticipate customer needs, the company is getting ready to introduce a payroll engine that can service clients in more areas. He continued by saying that the startup would also make an API available, allowing, for example, accounting firms to offer payroll services.

Kimani, who co-founded Workpay with Jackson Kungu (COO), believes that Africa presents a significant chance for market leadership since it has the technical and non-technical infrastructure needed to grow.

In order to deliver money to as many African nations as we can, we have integrated with almost everyone who processes payments on the technical side. Non-tech implies that we have a presence in these nations and are able to remain compliant thanks to partners, which is crucial, he said.

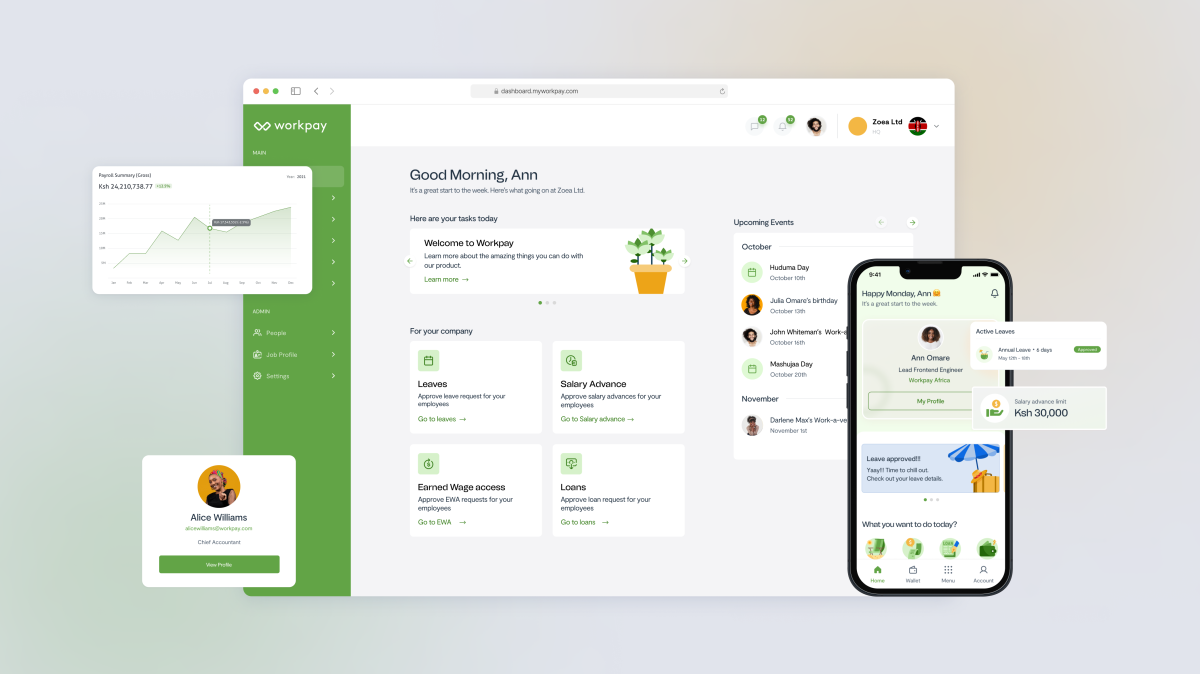

Workpay, a firm founded in 2019, provides tools that let its clients file taxes, administer employee benefits, and pay salaries to employees in local currencies throughout Africa (and, through partnerships with other companies, also outside the continent). Using its tools, employers are able to also track and manage employees’ time and attendance, and leave days.

“Being a full-stack HR Payroll company, we assist employees in managing and paying their staff members. And our software helps firms stay compliant while processing payrolls, added Kimani.

Employees are not required to open accounts with particular banks simply because the company has accounts there, he added. “As an employer, you are able to pay employees wherever they are, in their preferred accounts, and submit taxes too,” he said.

Employees can receive and examine their pay stubs, submit expense reports, and request leave days using an employee-side app.

On top of its HR and payroll platform, Workpay is also introducing financial services including links to investment accounts, medical and asset insurance, and earned-wage access for staff members who need to pay bills or for emergencies.

According to Kimani, “We are developing a marketplace and bringing in additional businesses that can assist employers and people on our platform.”

Kimani claims that Workpay has seen significant income and clientele development, with a surge recorded following the COVID slowdown of 2020.

“Since 2021, we have been tripling both our annual revenue and the number of our clients, who are currently getting close to 700. Also, we handle a total salary value for our customers of roughly $200 million each year, he added.