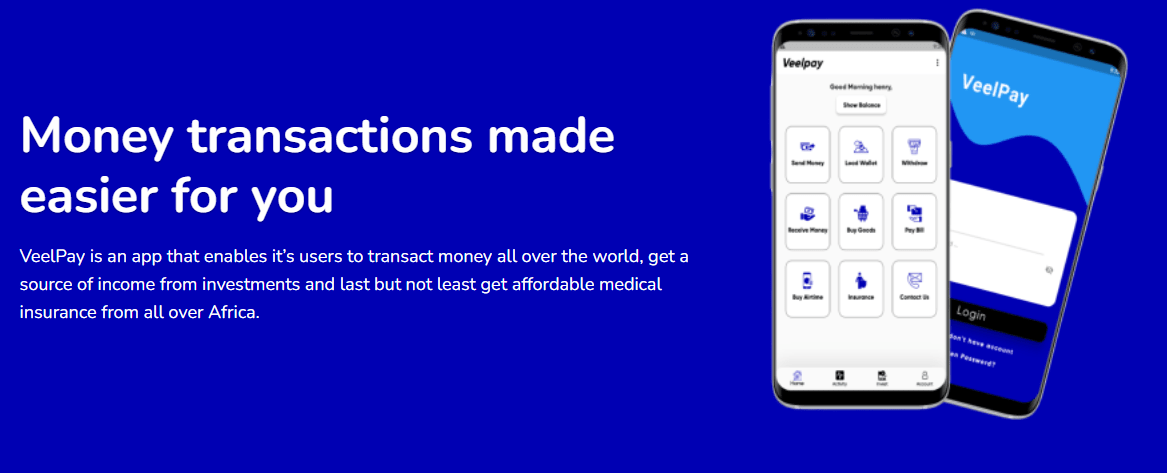

VeelPay aspires to be Africa’s PayPal, offering low-cost international money transfers and payments to nearly everyone.

VeelPay, a new fintech platform, is expected to launch soon to enable rapid money transfers from anywhere to anywhere in the world using cutting-edge encryption technology.

The platform, which has been in stealth mode for some time, aims to allow users to send and receive money, store funds, pay bills via credit card or M-Pesa, and purchase airtime across major African mobile networks. It is also in the process of introducing affordable medical insurance packages across Africa. It will also include an investment platform that will connect investors with companies that are willing to invest.

The burden of high transaction fees

Vivian Kang’ethe, the Kenyan-based co-founder, told TechMoran that the company currently has ten employees and is onboarding users on a daily basis to relieve them of the burden of high transaction fees incurred on money transfer platforms, assist their businesses in accepting digital payments, and provide them with appropriate investment opportunities or enough capital to start their own businesses.

“Yes, despite the fact that the company is new, it is accomplishing what we set out to do.” People are able to interact affordably, make dependable investments, obtain business loans/capital for their initiatives, obtain affordable healthcare, and much more,” Kang’ethe explained. “We have intentions to develop regionally and in terms of goods.” We are now based in Kenya, but we want to grow across Africa and the rest of the world… “VeelPay has gone global!”

VeePay sees mobile money companies, telcos, and banks as its greatest competitors because most of them are racing to offer these services on their platforms. VeePay, on the other hand, wants to be the mother super-app with all financial services in one place.

It also appears that bitcoins will be accepted in the near future. VeePay has not yet raised any outside funding, but it is looking for investors from all over the world.

Cryptocurrency is gaining popularity.

According to Kang’ethe, Bitcoin is becoming more mainstream, and businesses should consider accepting it as a form of payment. Because cryptocurrencies do not require third-party authentication, they provide greater payment security. Customers’ data isn’t housed in a centralized center where data breaches are common, she says, when they pay with cryptocurrency. According to her, bitcoin would stop the scenario in which clients fraudulently reverse transactions, because once a cryptocurrency payment is made, it is permanent.

“Only the party receiving the funds can reimburse transactions,” Kang’ethe added. “Companies that accept cryptocurrencies should anticipate refund requests from customers and maintain track of how much money each customer has paid.” Cryptocurrency payments have the potential to foster a more borderless and globalized economy, as well as combat financial inequality by providing rapid and secure financial services to those who do not have access to a bank.”

Fintechs are a significant instrument for democratizing finance in both developed and developing countries, as well as enhancing customer retention for merchants through speed and ease, while creating personalized experiences for customers through AI and machine learning.

If Veepay takes off, Kang’ethe believes it will have a significant impact on Kenya’s ecosystem. “In Kenya, fintechs have acted as catalysts for traditional banking.” Fintechs in Kenya are harnessing internet, mobile technologies, and data analysis to provide alternatives to traditional banking. As a result, I believe Kenyan Fintech firms are on pace to stay up with modern financial digital trends.”