Trends in Financial Inclusion Products: Opportunities for Fintech in Africa’s Unbanked, Underserved Segements | By Nelly Nneli

In the world’s population today, Africa holds the ranking of the second largest and second most populous continent, with nearly 1.4 billion people living in it and accounts for a good 18% of the world’s human population. Where others would fix their eyes on the outrageous figures, the fintech industry could focus on the horn of opportunities that lie within that number.

The African financial sector has grown from what it used to be in previous years, and as a result, it is undergoing a major overhaul, which is driven by the growing demand for financial inclusion products. Although such reformation of the continent’s financial segment is a win, there is still so much to be achieved if vast opportunities are harnessed in unbanked and underbanked domains. How, you may ask?

Digital financial services are one of the biggest groundbreakers that the financial industry and the world, at large, have ever witnessed. It’s a significant trend in the financial inclusion space that can completely transform the unbanked and underbanked areas of Africa. Platforms like mobile money, digital wallets, microfinance, agent banking, etc. have indeed made financial transactions more accessible, convenient and affordable. Still, they can be better employed because, to date, some African sectors are yet to experience the benefits of these privileges.

One of the major reasons for this downside in the African financial sector is Identity Documentation. The lack of this is alarming in some rural African areas, and it continues to pose as one of the barriers holding back the implementation of some financial inclusion products. A good instance of this can be found in Sub-Saharan Africa, where over 80 million adults with no account still receive government payments in cash. This means that there is also an opportunity for fintech to invest in trusted identification systems, which will aid in increasing the usage of financial inclusion product trends.

Fortunately, the emergence of the COVID-19 pandemic that broke out in 2020 didn’t come with only disadvantages. During this time, the banking sector experienced an acceleration in the adoption of financial inclusion products in Africa, and this, in turn, paved the way for an increase in financial participation and economic growth. To reduce the spread of the virus, the World government, including the African government, implemented rules such as lockdowns, social distancing measures, travel restrictions, etc., which skyrocketed the utilisation of these products as people sought alternative ways to access financial services while minimising physical contact.

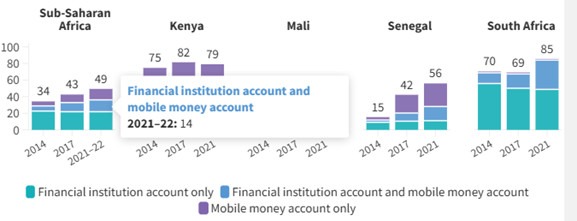

This incident was a breakthrough for financial technology in Africa as they found a way to navigate into new marketplaces. In a survey carried out illustrating the outstanding development in the usage of financial inclusion products between the years 2014, 2017 and 2021, respectively, African fintech recorded a 50% increase in account openings of adults, which showcases the advancement of the usage of financial inclusion products like mobile banking before and after the COVID- 19 outbreak.

D1. Graphical representation of the increase of financial inclusion products in Sub-Saharan countries

Despite this advance, there are still many layers to the digital banking trend that the African fintech unbanked and underbanked communities have yet to tap into. However, this can be done by winning the trust of the unbanked and underbanked populations. Therefore, the African fintech industry can only enjoy the opportunities of financial inclusion trends in these areas if they prioritise building trust between the banking sector and the population of the unbanked and underbanked segments.

What do Fintech Industries need to do?

- Agent Banking: Leverage Agent banking by partnering with local agents who understand the people, their language, and their culture better. This will make the locals comfortable enough to listen to the financial services the industry can provide them.

- Make Financial Products User-Centric: When designing products that could meet the unique needs of the underbanked and unbanked sectors, you must consider their preferences and implement them into your designs so that their usage goes smoothly.

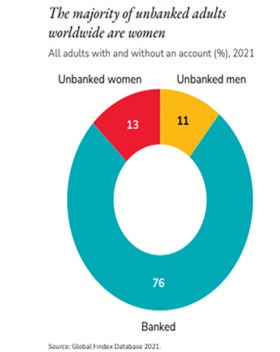

- Provide Financial Education and Campaigns: Invest in free and easy courses in finance, street enlightenment and literacy programs that can empower users with the knowledge they need to be informed about financial institutions. Additionally, create campaigns for women in finance. According to the Global Findex Report, a majority of the world’s unbanked and underbanked are women, and this is because of gender inequality. This means that if the African fintech industry looks to get a significant increase in the usage of financial inclusion products, it must advocate for the female population.

D2. Diagram illustration of the world’s banked, unbanked and underbanked sectors

- Expand Mobile Money Banking: Though the banking sector thrives on success to grow and expand, all efforts shouldn’t only be focused on the banked areas to increase sales and income. Rather, the fintech industry could consider expanding these services to get to the unbanked and underbanked sectors. Germany Kent once said, “If you never try, you will never know.” This solution might be the opportunity that leads to a positive change in the industry.

- Digital Loaning and Savings: A considerable number of the underbanked and unbanked communities are vulnerable adults who are unemployed or underemployed. The introduction of digital loaning is an option to help such individuals establish a standing in the environment. Once that is achieved, digital saving can be the platform that secures their stability.

- Bugs, Glitches and Cyber Security: Seldom times, part of the unbanked and underbanked spaces records a numerical increase because of individuals who have tried the banked sector and experienced hazardous outcomes due to app/website bugs, glitches and lack of proper cyber security systems. This means that the African fintech industry must consider investing in ensuring that they create standard apps and websites that are devoid of bugs/glitches and provide a safe space for their customers against cybercrimes.

Overall, the African banking area can benefit greatly if only it can further exploit the trends of financial inclusion products in unbanked and underbanked segments.

By leveraging digital financial services, fintech innovations, and user-friendly designs, African fintech companies are bound to not only witness changes in these areas but also record a notable decrease in them.

Contributor:

Nelly Nneli is a digital sales leader with a focus on making financial inclusion innovations accessible and actionable. With expertise in payment technologies and a passion for fostering inclusive finance, Nelly regularly shares her insights on the intersection of technology and financial services, offering clear, practical strategies for driving digital innovation and expanding access to financial solutions.