The Rise of B2B Retail Digital Platforms in East Africa: Trends and Growth Opportunities | by Nelly Nneli

The fast spread of internet access has influenced how people across the continent work, socialise, learn, shop, and communicate. This is an opportunity for most businesses to meet their customer’s needs at their own convenience. Eastern Africa, a member of Africa’s Sub-Saharan region, has not been left out of the digitalisation process. This transformation is the result of rapid technological advancements, improved mobile connectivity, and the incorporation of digital payment systems. As of 2023, retailers such as grocers and department stores are driving digital payment adoption in East Africa. According to payments provider Pesapal Ltd, buyers in the region prefer to pay online rather than with physical debit or credit cards.

The B2B retail digital platform sector is a section of the digital economy where a company uses digital methods to smoothen transactions, streamline supply delivery, and manage operations between manufacturers/wholesalers/importers and retail shops who sell straight to the final consumers. In East Africa, the B2B e-commerce sector has witnessed a notable shift over the past decade.

Conventionally, East Africa’s retail environment depended heavily on informal trade networks. Small retailers often acquire goods from physical wholesalers, a process that is very time-consuming, costly, and ineffective. However, the advent of digital B2B has changed the usual narrative by introducing streamlined processes that enhance efficiency and reduce operational challenges.

Digital commerce in B2B has been predicted as the next big thing for years; yet, at the start of COVID-19, 60% of B2B companies in the eastern part of Africa had limited e-commerce capabilities. The pandemic accelerated digital shopping and e-commerce. In February 2022, 65% of B2B companies offered e-commerce capabilities. Some countries, notably – Kenya and Rwanda – were able to adapt to the transition into retail digital systems during the pandemic, while others managed to follow suit. Despite the different levels of infrastructure and policy support, all countries showed a significant increment in the adoption of mobile payments, greater inclusion of SMEs, and a shift toward digital transformation in retail operations. This period laid the foundation for sustained growth in the sector.

With Kenya, Tanzania, and Uganda at the forefront, the introduction of mobile technology has increased the rate to about 46% as of 2023. Unimaginable connections have been made between suppliers and buyers and small and medium-sized businesses (SMEs) thanks to mobile technology. This digital connectivity has enabled platforms like Wasoko and MarketForce to flourish. For instance, Wasoko– a startup originally founded in Kenya – provides retailers with a mobile app that streamlines informal retail supply chains, enabling them to order inventory from a diverse range of suppliers with the additional benefit of same-day delivery. Such innovations are redefining the traditional retail model, making it more accessible and inclusive for entrepreneurs across East Africa.

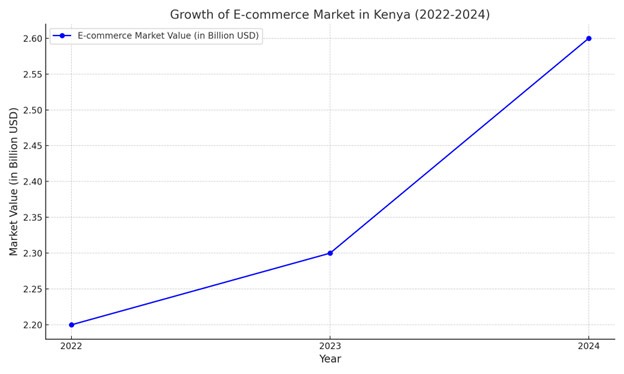

The numbers speak volumes about the sector’s growth. In Kenya alone, the e-commerce market – including B2B – experienced substantial growth in 2022, and projections for 2023 indicate similar momentum, with an annual growth rate of 12.86% expected and the market anticipated to reach $2.6 billion by 2024. The growth can be attributed to the simplicity and efficiency that digital platforms bring. These platforms often integrate fintech solutions, offering digital payments and credit financing, which are critical in a region where access to working capital is a major hurdle.

Figure 1: The e-commerce market’s growth rate in Kenya.

The electronic payment industry is expanding rapidly around the world. Over the last ten years, it has generated the highest growth and returns in the e-commerce sector, as well as the most investment of any other financial services sector. Africa has not been the exception. In 2020, Africa’s e-payments industry, across domestic and cross-border payments, generated approximately $24 billion in revenues, of which about $15 billion was domestic electronic payments. However, challenges remain. While the adoption of digital payment is growing, it still lags in some areas, with cash transactions dominating informal markets. Yet, the trajectory remains positive. The investments of Governments and private sector players in digital infrastructure and the spread of mobile money solutions are slowly overcoming these barriers.

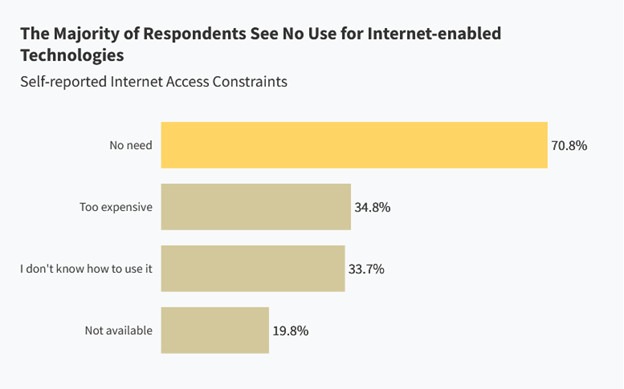

An infrastructure gap in the eastern part of Africa, particularly in rural areas, continues to create a serious challenge for logistics and last-mile delivery. Additionally, many small-scale retailers continue to face challenges related to digital literacy. An International Finance Corporation (IFC) survey conducted in 2023 revealed that approximately 34% of East African SME owners lacked the digital skills necessary to fully use digital platforms. This highlights the important need for capacity-building training.

Source: The World Bank 1

There are many opportunities for development and progress, with the recent projection of over $75 billion by 2025 in East Africa’s retail market and the possibility that B2B platforms will dominate the market. These platforms can have long-term economic effects on the area by focusing on inclusivity, especially for small-scale retailers, and pursuing technological innovation.

As the narrative develops, it becomes clear that East Africa is spearheading the digital revolution in the retail sector. The rise of business-to-business platforms is a story of efficiency, empowerment, and a completely new vision for trade—not just technology.

Contributor:

Nelly Nneli is a digital sales leader with a focus on making financial inclusion innovations accessible and actionable. With expertise in payment technologies and a passion for fostering inclusive finance, Nelly regularly shares her insights on the intersection of technology and financial services, offering clear, practical strategies for driving digital innovation and expanding access to financial solutions.