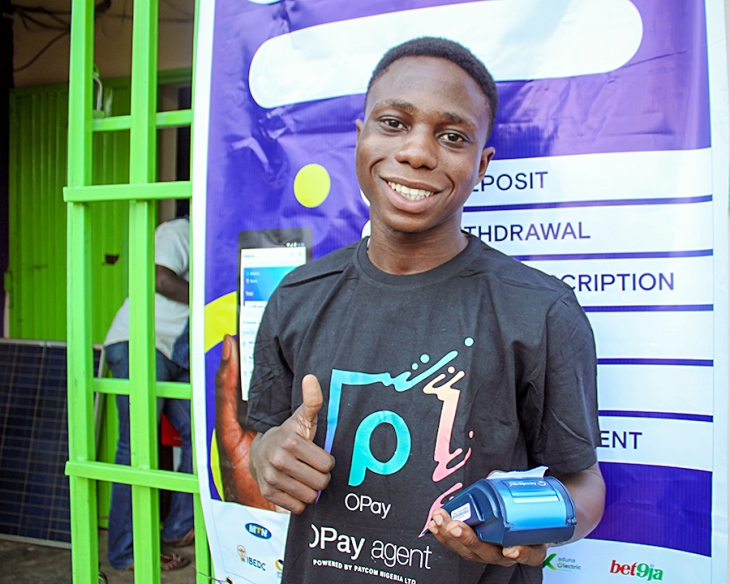

Fintech is a path to democratised financial services

Fintech has played a significant role in democratising access to financial services across Africa in the past decade. Improved access includes the usability and quality of these services, with most fintech solutions targeting the underserved population, including the youth, women, low-income earners, rural communities, and SMMEs. These groups have faced many barriers to accessing banking,…