Solv, B2B Supply Chain Financing Platform Starts Operations With Over $8.3m Credit for Lending by Financial Institutions

In Kenya, SC Ventures, the innovation, fintech investment, and ventures arm of Standard Chartered, has begun operating Solv, a business-to-business (B2B) digital platform.

This platform will combine several services to alter the profitability, growth, and operational efficiency for Micro, Small, and Medium-Sized Enterprises through an open and inclusive trade ecosystem along the MSME value chain (MSMEs).

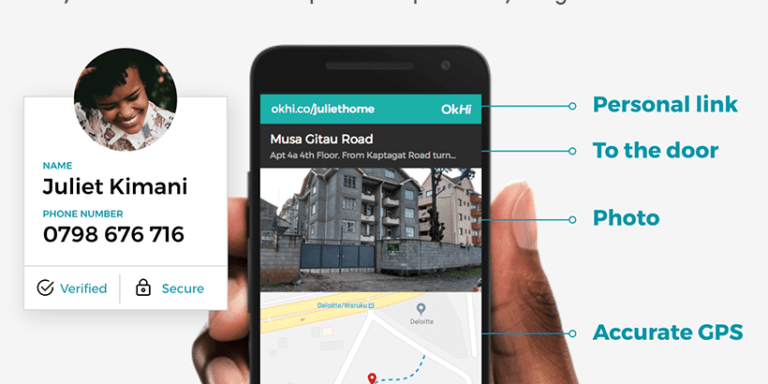

The platform, which is accessible via a web-based application and mobile phone, enables all firms to engage with various stakeholders in a secure setting and have access to competitive loans, bigger markets, and more straightforward business support options.

Solv is making its debut in Africa after a successful deployment to India’s 65 million MSMEs through an e-commerce platform since last year.

By facilitating interactions and discussions between verified MSMEs and financial institutions for inexpensive finance under advantageous terms and price, Solv Kenya’s primary focus is on supply chain financing.

The platform promises to give over 100,000 Kenyan MSMEs access to funding by issuing over Kes 10 billion in working capital credit each year. Through the suggestions of their suppliers and using its pre-approved credit line of Sh1 billion, Solv Kenya has given Sh150 million in loans to the micro, small, and medium-sized firms (MSMEs) registered on the platform throughout the course of its three-month pilot.

“We are very excited to go to market in a much bigger way now following a successful pilot of our initial product, Supply Chain Financing, which has seen over 3,800 MSMEs and more than 10 multinational companies participate and engage on the platform in ways that have altered the course of MSME business in Kenya,” said Sheila Kimani, CEO of Solv Kenya. By the end of this year, we hope to have 10,000 firms on board.

With numerous corporations, including BAT, Diageo, Procter & Gamble, Lafarge, Nestle, and Nokia, the platform has agreements in place. With additional partners from various industries on the horizon, the financiers currently include Faulu Bank, Gulf African Bank, Standard Chartered Bank Kenya, Asante MFI, and Zanifu MFI.

In essence, Supply Chain Financing is the first of several products that will be made available on the market in order to support MSMEs in Kenya and to give them access to more financial and commercial options.

MSMEs continue to be the most underserved industry category globally, despite their vital significance and large contribution to any economy, according to Jiten Arora, Member, SC Ventures. In order to address the major difficulties faced by Indian MSMEs, we established Solv in India in 2020. Since then, we have grown to be a reliable growth partner for MSMEs all throughout the nation. Now, we’re prepared to do the same for Kenya in less than two years.

Solv Kenya is the company’s first step toward global expansion after being first introduced in India in December 2020 with aspirations to expand globally. Building on the success of Solv’s great performance in India, the firm raised US$40 million in Series A fundraising in June of this year, led by marquee investor SBI Holdings with participation from SC Ventures. This funding will be used to advance the company’s objectives for worldwide development.

The goal of Solv is to reach 300+ cities worldwide, including those in Southeast Asia, Africa, and India.

More than 85% of Kenya’s workforce is employed by its over 10 million MSMEs, which operate as either official or informal enterprises and generate close to 30% of the nation’s GDP.