Scaling Distributed Systems: Navigating the Complexities of Global Fintech Infrastructure

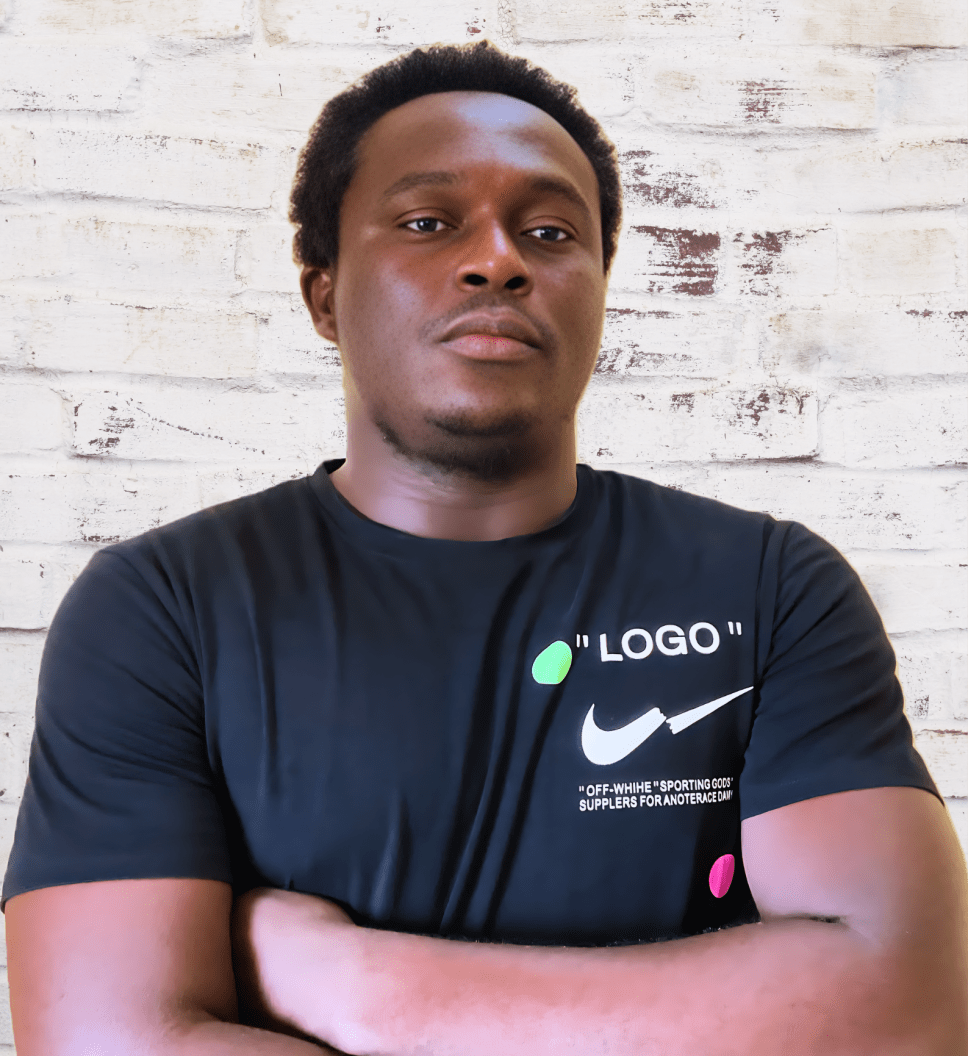

In today’s rapidly changing financial world, businesses are continually innovating to satisfy dynamic client expectations while adhering to severe regulatory standards. As these businesses spread their services across multiple locations, expanding distributed systems becomes increasingly difficult. To shed light on the complexities of this topic, Olamiposi Ogunyemi, a Senior Software Engineer with almost a decade of experience in global financial infrastructure, shares insights into the architectural, operational, and strategic variables critical to success.

At the core of any successful fintech platform lies a robust distributed system. These systems, which span multiple servers and data centers, are designed to handle massive amounts of data and transactions across geographically dispersed regions. For fintech companies, the need to maintain high availability, low latency, and strong security across all regions is critical. This entails a well-architected distributed system capable of scaling efficiently while remaining consistent and reliable.

According to Ogunyemi, the foundation of any distributed system rests on principles such as fault tolerance, replication, and data partitioning.

Data partitioning, for instance, involves dividing data into bits and manageable pieces that can be distributed across multiple servers.

This not only enhances scalability but also promotes horizontal scaling, enabling the system to handle increased loads as the business expands.

Replication ensures that copies of data are stored in different locations, providing redundancy and fault tolerance. In cases where a server fails, the system can seamlessly shift to another server containing a replica of the data, minimizing downtime and ensuring consistent performance.

Scaling a finance platform globally presents issues beyond the technical features of distributed systems. One of the key challenge is ensuring compliance with multiple regulatory authorities in different regions.

Ogunyemi highlighted that fintech organisations must take note of navigating a complex web of regulations, ranging from data protection laws such as GDPR in Europe to anti-money laundering regulations in the United States.

Each region may have its own guidelines on how financial data is stored, processed, and shared, and failure to comply can result in legal action or damage to the company’s reputation.

To address these regulatory challenges, Ogunyemi advocates for a modular approach to system design.

By decoupling various system components, fintech companies can develop region-specific modules that comply with local regulations while integrating into a global infrastructure. This approach allows for greater scalability and flexibility, enabling new regions to be added without requiring major overhauls to the existing system.

Another significant challenge in global scaling is maintaining high availability and low latency. Customers expect real-time access to financial data, regardless of their location.

Achieving this requires a distributed system capable of routing requests to the nearest data center, minimizing latency and ensuring a seamless user experience. Ogunyemi emphasizes the importance of edge computing and content delivery networks (CDNs) in achieving this.

By caching data at the edge of the network, closer to the user, CDNs reduce the time it takes to deliver content. Similarly, edge computing enables data processing closer to its source, further minimizing latency.

In distributed systems, data consistency is often a challenge, particularly when dealing with transactions that span multiple regions. Fintech platforms must ensure that data remains consistent across all nodes, even in the event of network partitions or server failures.

However, the algorithms used to maintain strong consistency can introduce latency, especially in global systems with nodes distributed across different regions. Ogunyemi suggests a hybrid approach that combines strong consistency for critical operations with eventual consistency for less critical data, striking a balance between performance and reliability.

As fintech companies scale their distributed systems, the complexity of managing these systems also increases. Ogunyemi underscores the critical role of automation and DevOps practices in managing this complexity. Automation tools like Kubernetes and Terraform enable companies to manage their infrastructure as code, facilitating repeatable deployments across multiple environments. This reduces the risk of human error and improves system scalability as demand grows.

Another key strategic consideration is the need for continuous innovation. As the fintech landscape evolves, companies must be prepared to adapt their systems to new technologies and business models.

Ogunyemi emphasizes the importance of fostering a culture of innovation within the engineering team, encouraging experimentation with new tools and techniques. Staying updated with the latest trends and advancements in technology is essential for companies to remain agile and responsive to market shifts.

Building and scaling distributed systems in the fintech industry demands significant resources and presents numerous challenges that requires deep expertise and well-considered strategy. Olamiposi Ogunyemi’s insights as a provides a comprehensive roadmap for addressing the technical and regulatory complexities involved. From From ensuring regulatory compliance through modular designs to leveraging edge computing and automation tools, fintech organizations can scale their platforms to deliver secure, reliable financial services to a global audience.By embracing a holistic approach that balances scalability, performance, and innovation, fintech companies can position themselves for long-term success in an increasingly competitive market.