SA’s Centbee graduates from regulatory sandbox, adds new countries to remittance service

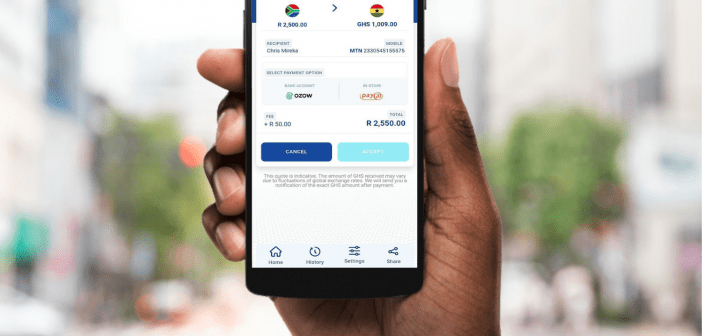

South African fintech startup Centbee has successfully completed testing of its remittance service Minit Money within the framework of the South African Intergovernmental Fintech Working Group’s Regulatory Sandbox.

Launched in 2016 by co-CEOs Lorien Gamaroff and Angus Brown, Centbee launched its bitcoin cash wallet to market late in 2018, allowing users to send bitcoin cash directly to their phone contacts.

The startup has secured funding worth over US$1 million, most recently last year, and saw its low-cost remittance service Minit Money selected for the first Intergovernmental Fintech Working Group (IFWG) cohort to test the regulatory treatment of crypto assets for low-value cross-border remittances between South Africa and Ghana.

The IFWG is a collective of South Africa’s financial sector regulators including National Treasury, the Financial Intelligence Centre, the Financial Sector Conduct Authority, the National Credit Regulator, the South African Reserve Bank, the South African Revenue Service and the Competition Commission.

Minit Money has since expanded operations to include money sending from South Africa to Nigeria, Senegal, Benin, Ivory Coast and Uganda, and plans to add Mali, Tanzania, Kenya, Mozambique and Zimbabwe in the coming months.

“We’re proud to have graduated from the IFWG’s inaugural regulatory sandbox and are aggressively scaling-up our winning remittance solution. We expect to see incredible growth in the remittance app market in the coming years and are confident in our ability to bring fast, low-cost transactions to everyone,” said Centbee co-founder Angus Brown.