Report: Africa’s average mobile fraud rate reached 16.4% in 2021

Payment structure narratives are changing as a result of technological advancements. Naturally, this convenience increases the risk of payment fraud. Each new payment method carries its own set of risks.

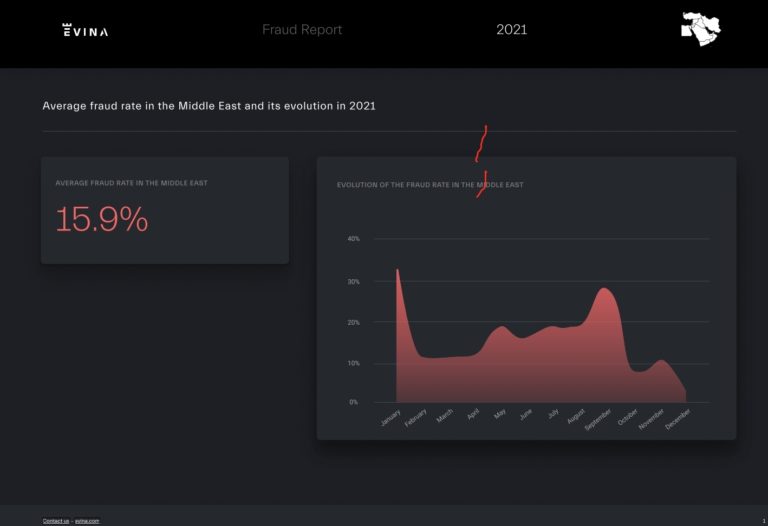

Evina, a mobile anti-fraud specialist, examined the prevalence and evolution of this threat in 2021, with a focus on the African continent and the Middle East, in its most recent carrier calling fraud report.

According to the details from the 2021 reports, mobile fraud is common in these regions during the first few months of the year. This is most likely due to the holiday season, as the preceding months saw a nearly half-decrease.

Although these figures consistently show a double-digit fraud rate, they reached a new high in September 2021, with an estimated 28% fraud rate recorded before plummeting until the end of the year.

On a 12-month basis, Africa leads

Similarly, the fraud rate in Africa in January 2021 was around 28%, which was slightly lower than the figures for the Middle East at the start of the year, but the Middle East region performed comparably well over the course of a year.

According to the reported figures, Africa had an average fraud rate of 16.4 percent, which was 0.5% higher than the Middle East’s twelve-month average of 15.9 percent.

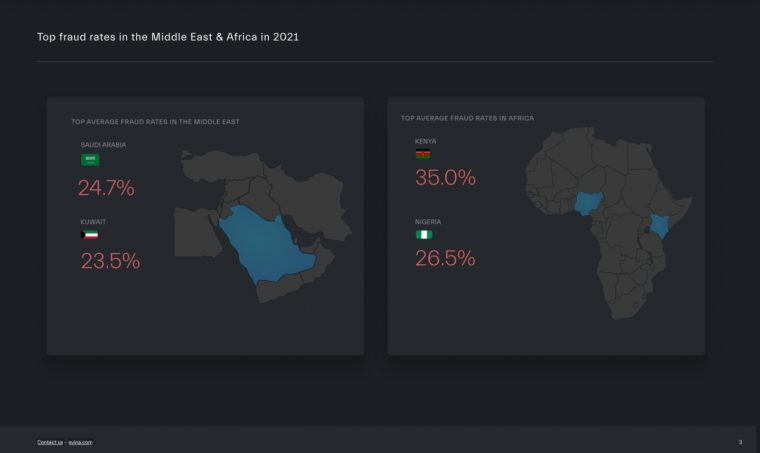

Saudi Arabia and Kuwait had the highest rates of fraud in the Middle East, with figures of 24.7 percent and 23.5 percent, respectively.

On the other hand, due to unscrupulous activities emanating from two Sub-Saharan African countries, Kenya and Nigeria, Africa saw a significant increase in mobile payment fraud figures.

Although Nigeria witnessed a fraud rate figure of 26.5 per cent in 2021, it still faired slightly when compared to Kenya, which had a 35 per cent rate, making it the country with the most prevalent mobile fraud cases in Africa.

In Nigeria for 2021, bypass fraud accounted for 82.1 percent of all mobile fraud cases, with remotely controlled fraud, spoofing, and others accounting for 14.2, 3.6, and 0.1 percent, respectively.

The majority of mobile fraud cases in Kenya (70.7%) are caused by bypass fraud, with the remaining 29.3 percent caused by spoofing, malicious apps, clickjacking, remotely controlled fraud, and others.

The reports maintained that the topmost malicious app on the African continent was the PDF reader, which is intended to work in the background and subscribe users to services without authorization.

The Middle East, on the other hand, is also confronted with malicious apps, but these range from messaging to photo editing apps, to mention a few.