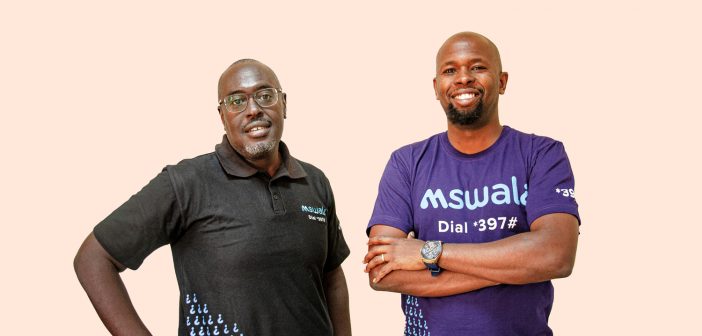

Nigerian Fintech startup, Canza Finance completes $3.27M seed round

Canza Finance, an emerging markets neobank that is building the world’s largest non-institutional-based financial system, announced the completion of its $3.27M seed round.

The fundraising round was led by Fenbushi Capital, with participation from Dominance Ventures, Bixin Ventures, Consensys, Protocol Labs, Emergo Ventures, MEXC Global, NGC Ventures, XanPool, Hashkey, the founders of Celo, and others. This funding enables Canza to continue headcount growth and expand its service offering in Nigeria and other growth regions including South America and Asia.

“Today, we stand at a critical juncture in the journey to democratizing finance, with Nigeria emerging at the vanguard of crypto adoption globally,” said Oyedeji Oluwoye, CoFounder and CTO of Canza Finance. Sub-Saharan Africa’s underdeveloped financial infrastructure has made the region a perfect vector for decentralized finance, despite high inflation, financial instability, and barriers to access to traditional financial services — according to a 2021 report by KPMG, more than one in every three Nigerian adults is excluded from traditional finance. Our vision is to become leaders in decentralized finance and to lead this movement that will provide financial freedom to millions of people. The tremendous interest and support of our investors and strategic partners will allow us to grow the world-class Canza team, improve our security, and, most importantly, establish a clear leadership position in our target markets.”

Canza, which was founded in 2020, relies on a strong network of experienced local money market participants to provide financial and transaction-based services to users in Sub-Saharan African countries. Canza’s seamless crypto on/off-ramp services enable a wide range of DeFi services such as staking, peer-to-peer (P2P), and cross-border settlements, with the goal of contributing to the creation of an innovative and fully decentralized financial system.

Canza is a member of Celo’s Alliance for Prosperity, an ecosystem of 140+ mission-aligned organizations, including nonprofits, merchants, and payment processors, that use the Celo blockchain to foster social impact. Canza now has over 7,000 Celo wallets created through the USSD DApp, with weekly transactions averaging more than $200,000.

“The rate of cryptocurrency adoption in high-growth markets—particularly Africa—not only signals growing excitement for this new digital economy, but also the advancement of real-world use cases,” said Bo Shen, Managing Partner at Fenbushi Capital. “This traction, combined with Sub-Saharan Africa’s market, social, and community conditions, uniquely positions Sub-Saharan Africa as an environment where a project like Canza will thrive.”

Canza was previously funded by Flori Ventures in its pre-funding round and through its participation in the Filecoin Launchpad Accelerator, Powered by Tachyon. This accelerator provides startups with funding, advice, and support as they develop more open, interoperable, and programmable tools, infrastructure, and applications for the distributed web. Canza’s growth from a hackathon project to a mature high-growth company was aided by this program.

“Canza is a shining example of the power of the Filecoin Launchpad Accelerator to transform promising early-stage projects into high-growth businesses on the verge of making a huge impact in developing markets and the Web3 ecosystem,” said Colin Evran, Ecosystem Lead at Protocol Labs. Given Canza’s early success, we are excited to assist in expanding access to Web3 technologies such as decentralized identity tools and KYC options to the Sub-Saharan Africa region. We’re excited to work with the next generation of African innovators to make their Web 3.0 dreams a reality.”