NALA, Remittances Firm Lands in Kenya, Opens Local Office

A cooperation between Lender Equity Bank Kenya and NALA Payments Limited has been declared.

NALA is a platform for processing remittance payments that is authorized in the US and the UK to facilitate remittances from the diaspora into Kenya.

According to a statement from Equity, the partnership would enable Kenyans living in the UK and the US to transfer money directly from their banks to Equity Bank Kenya accounts as well as other mobile wallets via the NALA app.

With NALA as its technology partner, Equity Bank Kenya will provide integrated financial services to its consumers. The lender hopes to improve its position in remittances by giving its clients access to speedier services and taking advantage of the rising popularity of digital channels.

Additionally, it enables NALA to support its customers in the United States and the United Kingdom who wish to save money and make investments in the financial system of Kenya.

Equity increased the amount of remittances from abroad. Leveraging the rising popularity of digital means for sending money home from abroad, it increased by 39% in 2021 compared to the equivalent period in 2020.

In the 12 months ending in December, Equity claims to have processed KES 383.5 billion in remittances, an increase from Sh279.4 billion in 2021.

Another new office for NALA is opening in Nairobi, which will house a third of the organization’s workers.

Although NALA employs a distributed workforce across the globe, operational elements including partnerships and customer support will be based at the Nairobi headquarters, led by NALA COO Nicolai Eddy.

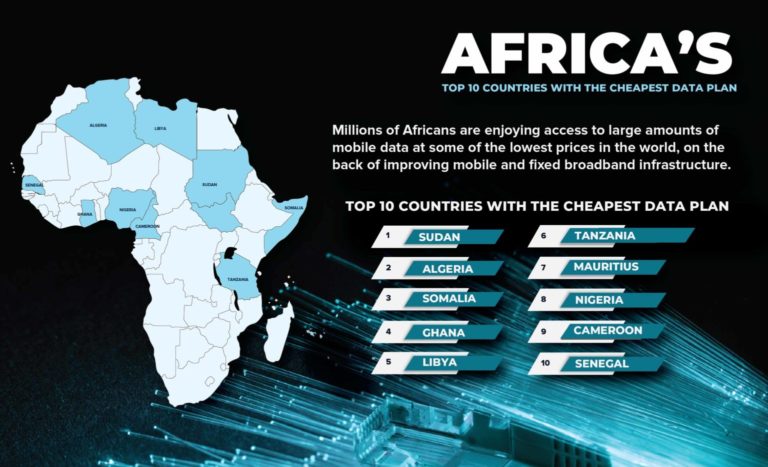

Africa remains the most expensive country to transmit money despite the variety of choices available for doing so from overseas.

The average transfer fee to Africa is estimated by the World Bank to be 9%.

Furthermore, a lot of the currently available solutions have unstated charges that make it difficult to determine the actual cost of sending money.

The two parties signed a comparable agreement in Tanzania in 2021.

NALA CEO Benjamin Fernandes said, “Partnering with Equity Bank is a vital step for us. NALA’s objective is to promote economic possibilities globally. By combining NALA’s technology with Equity Bank’s reach, we can strengthen the financial system for Kenyans all over the world. In Africa, just 1% of payments are built, but technology allows us to improve in integrating the necessary financial instruments.

In a statement made on behalf of Equity Bank Kenya’s Managing Director Gerald Warui, Equity Head of Private Banking Robert Kiboti noted that this relationship solidifies the bank’s position as the top institution helping Kenyans living abroad send money to their loved ones and invest.

He continued by saying that the bank is excited to collaborate with NALA to close the access gap.

He claimed that this connection will aid in extending the geographic scope of the remittances market. Equity will keep establishing connections with organizations that share its values, like NALA, to make sure that all of its members have access to the best and most affordable remittance services. We have a global footprint thanks to the use of fintech skills, and as a result, we have grown to be a significant processor of remittance payments across currencies, he added.