LoftyInc Capital Management, Nigerian VC firm made up to 65 African investments in 2021

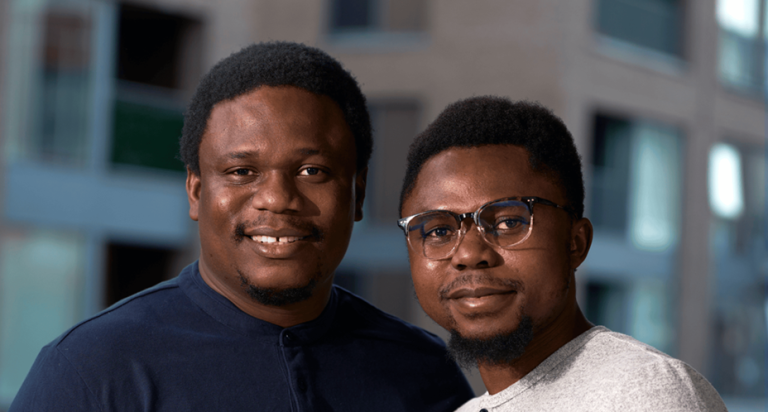

LoftyInc Capital Management is a venture capital business with the goal of “creating an ecosystem of Africans investing in Africans solving African problems.”

LoftyInc Capital Management is a venture capital business with the goal of “creating an ecosystem of Africans investing in Africans solving African problems.”

The business announced the first closing of its US$10 million LoftyInc Afropreneurs Fund 3 (LAF3) in September, as it ramped up its participation in the African startup area. This followed after the first “unicorn exit” in Flutterwave, which provided considerable returns to its investors through the LoftyInc Afropreneurs Fund 2 (LAF2) investment.

LAF3 is a US$10 million technology fund that invests in seed-to-Series A technology-enabled businesses that are laying the groundwork for Africa’s digital infrastructure and are positioned for rapid expansion.

In 2021, the company made 92 investments in total, 65 of which were in African ventures. Metalex, Sudo, ATHLST, AlumUnite, TechAdvance, RxAll, Omnibiz, Star Kitchens, PayPecker, Enlumi, Homefort, FlexFinance, eBanqo, Aladdin Digital Bank, Epump, Bitnob, RoHealth, Sabi, Eden Life, NestCoin, Touch and Pay, Terragon Group, Treepz, Aku Fintech, Ceviant, and Pesabook were among the twenty

Appetito, AlgoPay, Odiggo, Tagaddod, InstaDiet, ILLA, Pylon, ShipBlu, MoneyHash, Gahez Market, Supportfinity, Sylndr, and Nawah Scientific are among the 13 Egyptian firms LoftyInc has invested in.

Ada Marketplace, CashBackApp, Craydel, Dash-Spektra, FlexPay, Raise, and Wowzi were among the seven Kenyan firms that received funding, while LoftyInc also invested in six South African startups (Akiba Digital, Beamm, Epic Contests, Foondamate, Smart Wage, and Welo Health).

InstantRad, Second Stax, Tendo, and Yemaachi Biotechnology were among the Ghanaian firms supported, while eJara and PAPS were from Senegal. LoftyInc also invested in startups from Cameroon (StarNews Mobile), Ivory Coast (Afrikrea), Rwanda (PayDay), Uganda (Rocket Health), Zambia (Zazu), and Sudan (Bloom) in 2021.

The company also invested in 27 non-African companies, including 16 in the United States, 5 in Pakistan, 2 in the United Kingdom, 1 each in Bangladesh, Cambodia, Germany, and the United Arab Emirates (1 each).

“What makes this so motivating is that it represents African fund managers and angel investors investing in African entrepreneurs.” Those who have been successful have already reinvested in other African entrepreneurs, forming a sustainable virtuous circle! And it solved a lot of problems, created a lot of new opportunities, and inspired young people to cease looking for government and international jobs. Instead, they’ve been building African businesses,” said Marsha Wulff, co-founder, and principal of LoftyInc Capital Management.