Kenya’s high court issues landmark ruling against Uber

In 2016, 34 plaintiffs filed a suit against Uber Kenya Limited. Their claim? Uber’s group of companies had violated an online contract signed by drivers in Kenya.

According to court documents, the contract stipulated that the plaintiffs would transport Uber’s Kenya customer base at a minimum of $0.54 per kilometre, with a minimum fare of $2.71. Under this agreement, Uber Kenya Limited retained a 25% cut of overall profits from each ride.

In July 2016, Uber reduced the minimum rate per kilometre to $0.32 and the minimum fare to $1.81 per trip. This, claimed the drivers-turned-plaintiffs, was a breach of contract that left them unable to earn profits as Uber drivers and maintain vehicles purchased to adhere to Uber standards.

Uber Kenya Limited had a different story. They claimed that the group of 34 drivers had not entered into contracts with them but had done so with Uber BV, a private LLC registered in Amsterdam. Because of this, Uber Kenya Limited said they were not liable for the breach of contractual obligations.

After years-long litigation in the High Court of Kenya, during which the drivers fought to prove that Uber Kenya Limited and Uber BV are one and the same, the High Court of Kenya has finally issued its ruling on the issue this week highlighting growing contradictions between faraway multinational tech companies and the growth of Kenya’s tech industry.

The Corporate Veil

Uber BV is an Amsterdam-based company that owns the rights to the Uber app. Uber Kenya Limited acts as a subsidiary that contracts Uber drivers in Kenya. While Uber BV claimed it was a separate entity from Uber Kenya Limited, the High Court of Kenya concluded that there was an intricate link between both companies.

Evidence presented to the court revealed that the group of Ubers shared the same email address and hired the same council to litigate disputes in court.

This, stated Milimani court justice, Francis Tuiyott, lifted the “corporate veil” off of the conglomerate, making Uber Kenya Limited and Uber BV liable to the plaintiffs.

Uber and Its Drivers

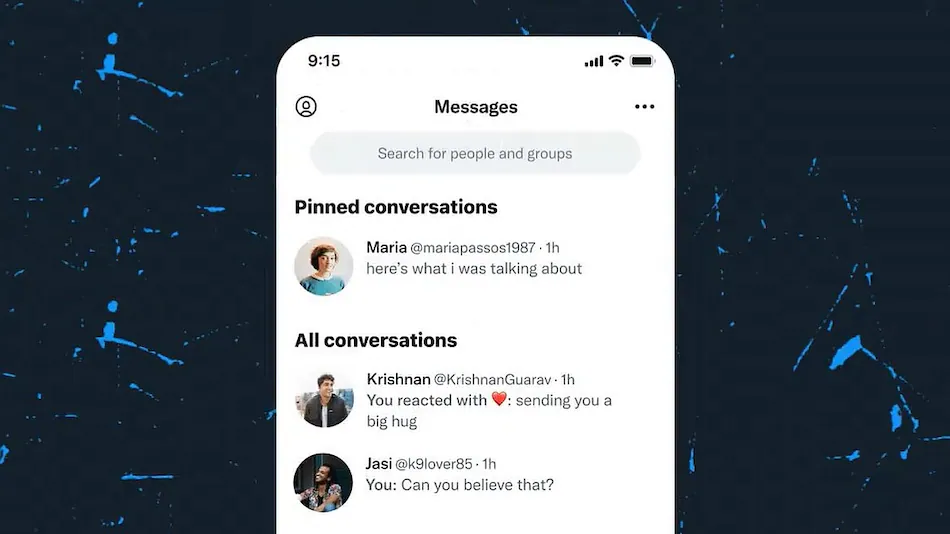

Uber, as a company, maintains the claim that it does not employ drivers but acts as an intermediary between the drivers and clients. This murky relationship has landed the company in court cases across the world.

In April, a group of South African lawyers partnered with a UK law firm to file a class action suit against Uber that would force the company to recognise drivers as employees with benefits rather than independent contractors.

Uber has also been in and out of UK courts over how it classifies its drivers. In February, the company finally agreed to treat drivers as workers after losing in front of the Supreme Court. More recently, The Court of Amsterdam struck down Uber’s intermediary status ruling that drivers are, in fact, employed by the company.

In Kenya, the line between Uber as an intermediary and employer becomes even blurrier.

Uber employed over 12,000 drivers in Kenya as of November 2020. While some of Uber’s fleet owns their vehicles, many do not.

Drivers who cannot afford their own cars are employed by private sub-contracted companies that run their own group of cars. Others act as private chauffeurs whose employers allow them to drive their vehicles as Ubers between pickups.

This sub-contracted third-party relationship means that returns to Uber drivers in Kenya are even lower than the cut they receive from Uber itself.

Fuel to the Fire

Adding to reduced incomes are Kenya’s ongoing petrol price hikes that have placed fuel prices in Kenya at a historic high.

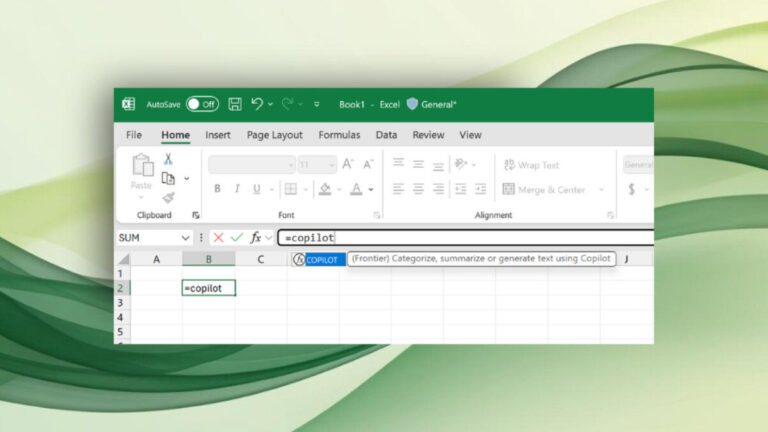

David Muteru, Chairman of the Digital Taxis Association of Kenya, claims that after the fuel price hike, Uber failed to cushion the financial blow for drivers

“They did not raise fares. Instead, they introduced new cheaper products,” said Muteru in an interview with TechCabal.

As of the time of writing, Muteru claims he has been deactivated from the Uber app as a result of his activism.

Uber has consistently lowered its prices to suit the needs of the Kenyan market. For over two months, the rideshare app has been offering weekly 25% discounts to loyal customers, competing against Bolt who is also making inroads in the Kenyan market. The reduction in fare is then shirked to the driver.

Bottoms Up

Uber cannot be blamed for this alone. Its strategies in rapidly expanding African cities are permitted by policymakers who see Uber’s entry as a red stamp of approval for on-track development. The ability for a city to Uber everywhere also delays the need to address and urgent need for reliable public transportation.

Kenya’s Uber drivers recognise the company’s important presence in the nation’s transport infrastructure. David Muteru and his colleagues do not want an all-out ban of Uber in Kenya but better regulation that yields a more transparent relationship between the company and its contracted drivers.

“it’s opaque,” said Muteru of the current situation. “Uber should start by recognition of driver representation from registered bodies…the end goal is compensation for losses incurred”.

But, will it be worth it in the long run? While powerhouses like Uber can keep up in a foot race, local tech companies with little capital in their early stages cannot. If this trend continues, large multinationals may price out drivers, as well as local tech companies hoping to cash in on Kenya’s digital revolution.