How to Scale Your African Fintech Without Struggling With Liquidity Gaps

The African fintech industry has recorded remarkable growth in recent years, onboarding millions of users, attracting billions in foreign investment, and producing at least five unicorns. These success stories are proof of the sector’s potential.

Yet, behind this impressive rise lies a major operational hurdle that continues to challenge many fintechs across the continent: liquidity management. Despite the growth in digital transactions, many emerging players still struggle to scale efficiently due to liquidity gaps especially in markets characterized by currency volatility, regulatory inconsistencies, and fragmented payment systems.

This article explores practical ways African fintechs can strengthen liquidity management and scale sustainably across the continent.

Understanding the Liquidity Problem

Liquidity management remains one of the most persistent hurdles in the fintech lifecycle. For companies exposed to foreign exchange (FX) volatility, the challenge is even greater, as poor liquidity handling can disrupt financial stability, affect settlements, and slow overall growth.

Fintechs must maintain sufficient liquidity to move money, pay merchants, and settle transactions smoothly. However, keeping liquidity in unstable local currencies is often risky, as currency depreciation can quickly erode value. In short, the ability to manage liquidity effectively determines how well a fintech can operate and expand in Africa’s complex markets.

What Causes Liquidity Gaps?

To solve a problem, it’s important to understand it. Liquidity gaps often result from a combination of operational, regulatory, and market factors, especially for fintechs managing cross-border transactions.

Common causes include:

- Delayed cross-border settlements: Transfers can take days to clear.

- FX shortages: Local banking partners may delay or freeze payouts.

- Policy misalignments: Inconsistent regulations between countries make settlements unpredictable.

While these challenges may seem temporary, their long-term effects are significant, they erode customer trust, slow transaction volumes, and hinder business expansion.

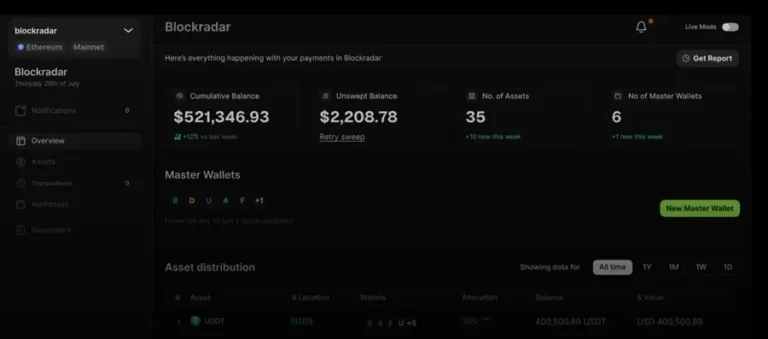

Build a Strong Settlement Infrastructure

Avoiding liquidity gaps starts with a solid settlement infrastructure. Fintechs aiming to scale across Africa must be able to process high-volume payments across local bank networks, digital channels, and even stablecoin corridors. Establishing direct relationships with payment processors and liquidity providers that support instant conversions between fiat and digital currencies is key.

This approach improves cash flow, builds user confidence, and enables fintechs to handle customer withdrawals and merchant settlements efficiently. For example, Ledig Technologies, a liquidity management fintech, provides institutional liquidity services across more than twenty payment rails in emerging markets, helping businesses process transactions faster and maintain steady cash flow.

Diversify Liquidity Sources

Relying on a single liquidity provider is one of the most common mistakes fintechs make. In volatile markets, where rates and regulations can change unexpectedly, over-dependence on one provider can leave a business stranded.

The smarter approach is to diversify liquidity sources. Working with multiple providers creates resilience, ensures smoother settlement cycles, and protects the business from market shocks. It also guarantees continuity even if one partner experiences downtime or regulatory changes.

Proactively Manage FX Exposure

Securing liquidity is only half the job, protecting it from currency volatility is equally vital. A fintech might close the day with a healthy balance, only to discover a 0.5% loss the next morning due to currency depreciation. Though small, these losses can compound over time and significantly impact margins.

To minimize exposure, fintechs should adopt proactive FX management strategies such as:

- Locking in exchange rates for future settlements.

- Using stablecoins to reduce dependence on volatile local currencies.

- Maintaining a stablecoin treasury for hedging against FX scarcity.

Anticipating volatility before it happens helps fintechs protect their capital and maintain predictable financial outcomes.

Leverage Strategic Partnerships

Africa’s financial ecosystem is fragmented, with diverse regulations and payment frameworks across countries. As a result, strategic partnerships are essential for scaling successfully.

Collaborating with other fintechs, local banks, and compliance partners can help navigate complex regulatory environments and improve settlement efficiency. While capital is important, partnerships often make the real difference between struggling to grow and achieving sustainable scale.

Conclusion

Liquidity management is not just a financial requirement, it is a strategic foundation for growth in Africa’s fintech space. Fintechs that understand and prioritize liquidity management are better positioned to scale faster, handle high-volume transactions, and build lasting trust with users and partners.

By strengthening settlement infrastructure, diversifying liquidity providers, managing FX exposure proactively, and forming strong partnerships, African fintechs can overcome liquidity gaps and build the foundation for long-term success across the continent and beyond.