How Nigeria’s Dukka supports emerging market commerce

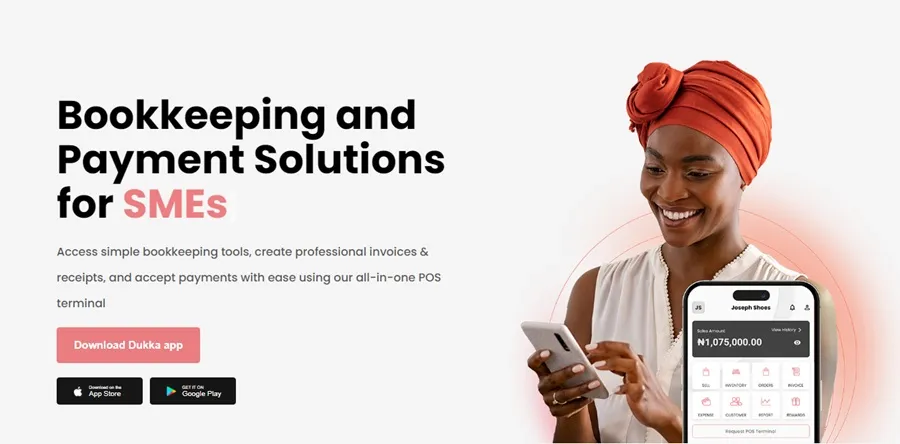

Nigerian startup Dukka has created a digital environment that supports emerging market commerce by assisting businesses in automating daily operations, accepting payments, and gathering performance data.

Dukka, founded in 2020 with a demo app produced during the early phases of the COVID-19 epidemic, offers simple technologies to assist individuals and small businesses better manage their money.

From automating simple daily operations such as capturing sales, managing inventory, generating e-invoices and e-receipts, to accepting any form of digital payment of customers’ choice, to gaining deep insights into how their business is performing, all from a simple app installed on smartphones or through the use of Dukka Terminals.

“Dukka’s technology turns anyone into a merchant, whether you’re a solopreneur or a mid-sized business with staff and multiple locations,” Dukka CEO Keturah Ovio told Disrupt Africa.

“Our ecosystem enables anyone to pay and get paid, manage inventory, analyze sales and expenses at one or more locations, gain micro insights into business performance, and sell online. Consumers can securely discover, shop, and spend with vetted merchants.

Ovio stated that before founding Dukka, she learned about the untapped and neglected market opportunity in Africa’s small business sector. Micro, small, and medium-sized companies (MSMEs) account for 90% of all firms and employ the most people.

“Yet they struggle or stagnate within the first two years of operation, for a number of reasons – poor infrastructure, access to finance, low technology adoption, multiple taxation, poor business management skills, no clear insights on costs and revenue centres… the list goes on and on,” she went on to say.

“They have a tremendous opportunity to grow and scale at a minimum of four times their current growth rate, but they are unable to do so. This is because they have not been given the necessary tools and resources.

Dukka provides these tools, as do a number of other companies, but Ovio believes the breadth of Dukka’s offering distinguishes it.

“Dukka provides an embedded platform solution that caters to all a business needs to thrive – point of sales and payments for streamlined operations, business performance insights for better decision making, and access to capital and online discoverability for growth opportunities,” she went on to say.

The firm was initially self-funded but has since secured financing from a number of angels and VCs totaling just shy of US$1.5 million. Ovio stated that it is in the midst of closing a round, but that Dukka can already cover its operating costs through cash flows.

“It’s been a heck of a ride in such a short time,” she told me. “We’ve had over 100,000 users aboard our platform, with over 90,000 using our product in Nigeria. We beta-launched our payments infrastructure solution to a few hundred customers in the second half of 2023, and they were important in helping us establish and polish our pricing model and monetisation approach.

That model combines transaction fees, SaaS fees, services, and terminal device sales. Dukka has also secured distribution through partnerships, with 1.25 million clients profiled and ready to be onboarded into its ecosystem. It intends to grow into two new markets before the end of 2024.