How Data-Driven Marketing can Scale Fintech Adoption in Africa

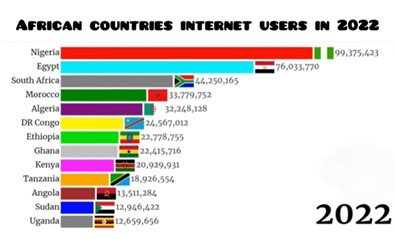

Over the past five years, Africa’s fintech sector has rapidly grown and transformed financial services through mobile payments, digital banking, and other lending platforms. This transformation is due to the high internet penetration of Africa’s young demographics. Customers expect on-the-go financial tools that are as convenient and intuitive as their favourite social media apps. Fintech thrives where mobile penetration is high, and this is the reality across Africa. A clear example is the survey on mobile money transactions in sub-Saharan Africa that surpassed $490 billion in 2020, with over 50 million new accounts registered in a single year.

This shift drives more people away from cash-based transactions toward mobile wallets, USSD payments, and app-based services.

Despite this expansion, Fintech businesses still have to deal with issues like attracting, retaining, and engaging customers. However, data-driven marketing presents a strategic approach to scale up fintech adoption in Africa. Here, I have shared ways to leverage data-driven insights in scaling up fintech adoption, thereby enhancing customers’ loyalty and satisfaction.

The Function of Data-Driven Marketing in Fintech Development

Data–driven marketing involves the use of real data to enhance marketing strategies.[3]By utilising customer data, fintech companies can:

- Personalised Customer Engagement

Understanding your customers deeply is crucial for implementing personalised engagement strategies. The days of relying on standardised messages to offer the same products and advice to a broader audience are over. Through the analysis of transaction history, browser activity, and user preferences, financial businesses can customise alerts, emails, and SMS that encourage users to interact with the platform more. Customers want more personalised and tailored experiences that take into account their particular financial objectives, adjust to their changing demands, and then provide timely and useful guidance.

- Use of Predictive Analytics to Expand the Market Share

While collecting data is just the beginning, advanced analytics is essential for transforming raw data into meaningful insights. Predictive Analytics forecasts customer needs based on historical data. For example, identifying when a customer might need a loan or insurance renewal becomes easy. By tapping into these historical data, fintech institutions can predict future usage behaviours and preferences, allowing for tailored recommendations that enhance customer satisfaction. Predictive analytics are powerful tools for market expansion of the fintech industry in Africa. The sector should focus on three essential elements – data collection, analysis, and action – to ultimately drive higher market rates and retain customers.

- Enhance Customer Acquisition Strategies

Targeted advertisement based on data analytics is one of the best ways to attract a new audience. Instead of relying on broad marketing campaigns, fintech companies can focus on a specific medium that drives results, like social media campaigns. Unlike billboards, television adverts, and radio advertisements, social media interacts with users and targets customers according to their location, spending patterns, and financial needs. In addition to being the perfect marketing tool, it works well for customer service.

Almost all internet users have accounts on one or more social media platforms. For example, for a B2B fintech startup, LinkedIn will play a more vital role in its channel strategy than other social channels would. With LinkedIn, fintech organisations can target quality audiences in the professional space. The platforms enable businesses to efficiently market to decision-makers, C-level executives, investors, and professionals who act on new opportunities.

- Optimise Product Offerings

Developing the right product ensures that it stays relevant to market needs. Data trends and customer feedback can inform product development. Using data analytics to identify service gaps, fintech companies can introduce and develop features – such as a budgeting tool within a banking app – that target certain user pain points. For instance, improving customer service, mobile app usability, and payment processing could all be achieved by analysing transaction failure rates and customer complaints.

Key Strategies for Fintech in Data-Driven Marketing

- Behavioural Analytics – Behavioural analytics is the process of gathering and examining user behaviour on a website or app. Fintech companies can discover customer preferences, trends, and even pain spots by monitoring user engagement. For example, the onboarding process might be streamlined in such a way as to increase conversions if a large number of users abandon the process at the account verification stage.

- AI-Powered Personalisation – The fintech sector works with a lot of data, and analysing it using the conventional method would take a longer process. Using AI to analyse such data can help in understanding consumers’ behaviour and needs faster. AI can provide advice in real time to meet customers’ financial goals. For example, AI can be used to alert customers to keep an eye on the way they spend their money if they notice that they do overspend.

- Segmented Marketing Campaigns – Segmenting audiences according to their location, financial habits, and demographics is another strategy to employ. A fintech business may develop distinct marketing efforts for urban and rural customers, tailoring its language to target unique pain points. While rural consumers would require more information about mobile money services, urban users might be interested in investing applications.

- Social Media and Influencer Marketing – Outside of traditional marketing strategies, social media is a great platform for identifying the right time to make a post and the most successful content that would attract customers. Leveraging data insights can be used to optimise networking sites like Facebook, Twitter, and LinkedIn to increase engagement and credibility.

- Data Content Marketing and Education – A lack of financial literacy can often hinder fintech adoption in Africa. This can be addressed by using data to create relevant content that addresses pain points and fosters trust.

Despite the benefits, the use of data in marketing to scale up fintech adoption in Africa has its challenges. First are the fragmented regulations. Africa has over 50 countries, each with its own legal framework. For instance, there are the regulations like Nigeria’s NDPR and South Africa’s POPIA. These regulations have their peculiarities, and navigating them would be a complex quest for fintech companies.

Another challenge is the absence of infrastructure. Inconsistent internet connectivity makes fintech adoption hard, specifically for people in rural areas. So, the industry must consider developing services – such as lightweight apps and SMS SMS-based services – that can reach users with limited internet access.

Digital literacy gaps also hinder the widespread adoption of mobile financial services in Africa. Many people are afraid of fraud or data breaches and lack knowledge of online financial services. This makes it necessary to educate customers about fintech solutions and data protection by offering gamified learning experiences, step-by-step instructions, and customer assistance in several languages to boost trust in fintech services.

In conclusion, data-driven marketing is an effective strategy that can accelerate Africa’s adoption of fintech. The days of depending just on intuition or guesswork are over; data is now the most important resource for developing tailored marketing tactics that increase consumer engagement and build trust. For fintech businesses to close the financial inclusion gap on the continent, they must be prepared to delve deeply into analytics, examine trends, and put the findings into practice. Through the smart use of social media marketing, AI, and behavioural insight, the fintech ecosystem can flourish and benefit both consumers and companies. One cannot exaggerate enough the importance of data-driven marketing; it involves more than simply gathering data; it means using it wisely to transform the financial landscape of Africa.

___________________________

Kelechi Anyikude is a Digital Marketing Strategist and a regular tech and business contributor at various other publications.

Connect with Kelechi about tech marketing and opportunities in scaling startups on LinkedIn (Kelechi Anyikude)