Ernest Nnamdi On How Blockchain Can Help Leapfrog Financial Literacy In Africa

Africa is now the world’s second fastest-growing region after Asia, with annual GDP growth rates over 5% over the last decade. Despite this growth, this good economic growth in the continent had not translated into shared prosperity and better livelihoods for the majority. Growth has to be inclusive to be socially and politically sustainable. One key component of inclusive development is financial inclusion, an area in which Africa has been lagging behind other continents.

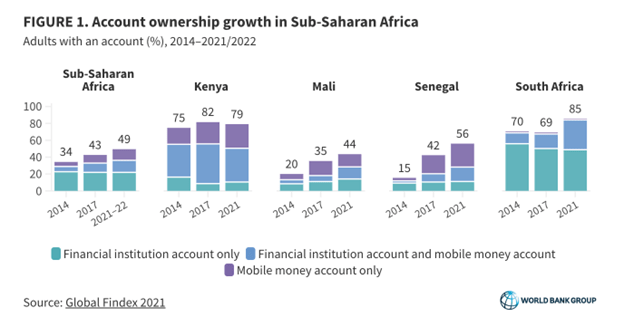

Financial literacy remains a significant challenge across Africa, with large segments of the population lacking access to basic financial services and education. This gap hinders economic growth, perpetuates poverty, and limits opportunities for many Africans. According to the World Bank, only 49 per cent of adults own a bank account in Sub-Saharan Africa. Broadening access to financial services will mobilise greater household savings, expand the class of entrepreneurs, and enable more people to invest in themselves and their families.

Can blockchain technology live up to the hype?

Financial inclusion is therefore necessary to ensure that economic growth performance is sustained. Financial inclusion refers to all initiatives that make formal financial services available, accessible and affordable to all segments of the population. But how can this be achieved? Achieving financial inclusion requires innovative solutions that can reach the unbanked and underserved populations.

This is where blockchain technology comes into play. Blockchain, the decentralised and distributed ledger technology, has the potential to revolutionise financial inclusion by providing secure, transparent, and low-cost financial services. By leveraging blockchain, individuals can access financial services without the need for traditional intermediaries like banks. This is especially significant in Africa, where many people lack access to traditional banking infrastructure.

With blockchain, individuals can store and manage their financial data securely, making it possible to access financial services like loans, savings, and payments. Moreover, financial inclusion initiatives built on Blockchain can be integrated with existing financial systems, making it possible to reach a wider audience. Blockchain can provide secure, decentralised, and low-cost financial services, making them ideal for the African market. Cryptocurrencies like Bitcoin and Ethereum have successfully facilitated cross-border transactions and micro-payments.

Blockchain showing early success

Success stories and initiatives are already emerging across the continent. Platforms like BitPesa have emerged as a cost-effective alternative to traditional money transfer services in East Africa, offering significant savings for businesses and reducing remittance fees for individuals. In fact, Between June 2020 and June 2021, US$105.6 billion was sent to Africa in cryptocurrency payments.

According to Chainalysis, this was a 1200% growth rate compared to the previous year. This demonstrates the potential of blockchain technology to leapfrog traditional barriers to financial literacy in Africa. The benefits of blockchain technology in financial literacy are numerous. It provides transparency, security, and accessibility, empowering individuals to track their financial activities, ensure the integrity of financial data and transactions, and access financial services through mobile devices.

African developers are not left out.

African developers like Ernest Nnamdi, a web3 expert with a wealth of experience in the industry, are helping to change the narrative. Currently, supporting global companies like Morph, and, previously, at Celo Foundation as a developer advocate to help developers and companies leverage blockchain technology to build applications that the populace in Africa and emerging economies can relate to. He believes that financial inclusion initiatives facilitated by Blockchain can hold immense potential by providing digital identities for the unbanked, thus granting them access to financial services.

These initiatives also offer decentralised and secure payment systems, reducing transaction costs and increasing efficiency. In addition, blockchain can create transparent and tamper-proof credit scoring systems, enabling underserved populations to access credit. “It can also help facilitate cross-border transactions and remittances, reducing costs and increasing speed, ultimately promoting financial inclusion on a global scale”, he added.

The future ahead

The future holds immense promise, and the prospects are exhilarating. The vision is to get to a point where entrepreneurs can access capital and resources effortlessly, cross-border trade is seamless, and financial exclusion is a thing of the past. Imagine a future where blockchain-enabled innovations like decentralised finance (DeFi) and central bank digital currencies (CBDCs) create new opportunities.

With blockchain, Africa can emerge as a leader in global innovation and technological advancement. The future is blockchain. It is an opportunity to embrace emerging technology and unlock the vast potential of the African continent. Together, it could create a brighter future for generations to come, a more inclusive, prosperous, and empowered future.