Flutterwave, Other African Fintech Startups Discontinue Virtual Card Service Indefinitely

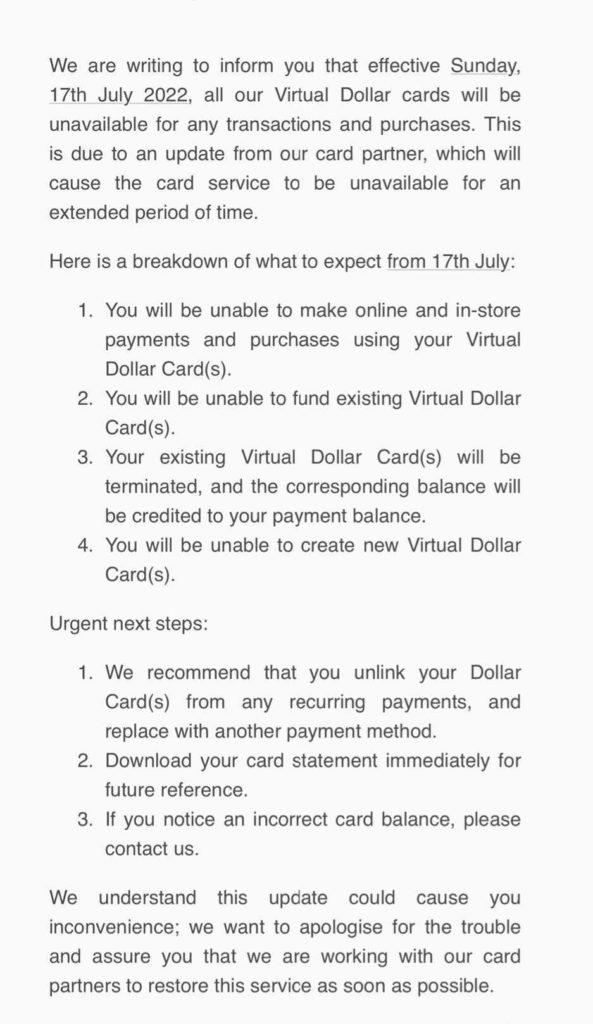

In an email received earlier today, the fintech startup Flutterwave announced that starting on Sunday, July 17, 2022, customers of Barter Card, a virtual dollar card service, will no longer be able to use it.

According to the message, the service was terminated “due to an update from our card partner, which will result in the card service being unavailable for a prolonged period of time.”

This implies that Nigerians utilizing the program won’t be able to use the Barter virtual currency card to make payments or purchases online. Additionally, they won’t be able to fund currently active virtual cards because those cards will be canceled and the associated balance credited to customers’ payment balances.

Users have, therefore, been advised to unlink their dollar cards from any recurring payments plan they have attached and replace them with another payment method.

Insiders in the industry think that this is taking place since Union 54 is leaving Nigeria, which will have an impact on its services and service suppliers.

What Barter Is

In order to help consumers send money to and from Africa for free, Flutterwave developed Barter by Flutterwave as a lifestyle payment solution in November 2018. The program also made it simple and frictionless to receive money from abroad, create virtual cards for online shopping, pay bills, and make rapid payments online.

This result follows an order from a Kenyan court to close 56 bank accounts held by seven different companies after the country’s Asset Recovery Agency informed the court that the accounts were being used as conduits for money laundering while posing as merchant services.

Since then, Flutterwave has refuted the accusations, claiming that it has documentation to support its assertions.

However, according to the ARA, “Investigations found that the bank account operations had suspicious actions where funds may be received from certain foreign companies which generated suspicion. Instead of paying out to merchants, the money was then moved to associated accounts.

In response, Flutterwave said that it had “a responsibility to protect the integrity of the ecosystem, and we vow our commitment to continue working with all stakeholders to uphold this.” We are striving to clear up the data and determine the reason for the fraudulent claims.