Flutterwave Obtains a Switching License from the Central Bank of Nigeria

Flutterwave, a major payments technology firm in Africa and in Nigeria, has announced that the Central Bank of Nigeria has granted it a Switching and Processing License (CBN).

Flutterwave will be able to issue payment cards to customers directly thanks to the Switching and Processing license, as well as process financial transactions for other fintech businesses and other financial institutions.

The authorization is regarded as the most valuable authorization granted by CBN to a fintech company in the market. Prior to this, Flutterwave had the International Money Transfer Operator (IMTO) and Payment Solution Service Provider (PSSP) licenses.

Commenting on the latest development, CEO and Founder, Olugbenga GB Agboola, said:

“This is big news for our customers, partners, investors, and other stakeholders. It is an important milestone in our growth story. Building a thriving payments ecosystem in Nigeria, Africa’s largest economy, is in line with our goal of developing a world-class and secure payment infrastructure for global merchants and payment service providers across the continent.”

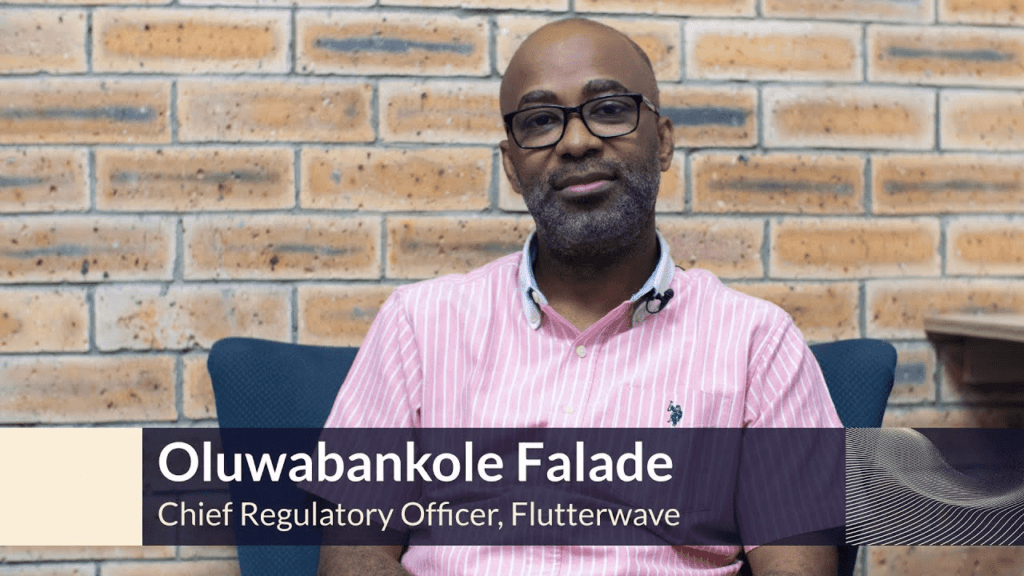

Oluwabankole Falade, the Chief Regulatory and Government Affairs Officer for Flutterwave, expressed his excitement on behalf of the company at finally being able to receive the license after completing a difficult procedure that included fulfilling several regulatory demands made by the CBN.

He said:

“We’re thrilled to have been issued this license after fulfilling all of the regulatory requirements. The application process was very rigorous and included a detailed review of our operations as a business. As a switch, we have more responsibilities and will continue to work with Regulators to ensure we meet and exceed their expectations.”

He stated that the CBN’s application and assessment process was stringent and thorough, requiring an analysis of every facet of Flutterwave’s operations, including its financial standing.

Similarly, Onyedikachim Nwankwo, Head of Product Marketing said:

“The license will allow us to offer more services and explore more payment use cases for our ecosystem. With this license, we can offer more value to our customers while taking more control of our value chain to enable an improved payments experience for our enterprise, medium scale, and retail customers.”

Licenses are required for Flutterwave

For Flutterwave, this most recent development is a relief. Unfavorable reports about the troubled fintech startup have been making the press.

Remember that all financial institutions that are partners with Flutterwave and ChipperCash were handed a circular by the Central Bank of Kenya (CBK) ordering them to stop doing so last month.

This, according to CBK Governor Patrick Njoroge, is the result of the business not having a license to operate in Kenya, he explained during a meeting of the Monetary Policy Committee (MPC).

Later, the business informed via letter that consumers will no longer be able to use the Barter card, a virtual dollar card, as of Sunday, July 17, 2022. According to the email, the service was shut down “due to an update from their card partner, which had caused the card service to be unavailable for a lengthy period of time.”

Similar to this, the Kenyan High Court froze Flutterwave’s fund of up to Sh400.6 million ($3.3 million) in three different bank accounts as well as around 19 Safaricom M-Pesa pay bill numbers in July after it had already frozen Sh6.2 billion ($59.2 million) of the company’s assets. Some market observers believe that the company’s problems may be related to its lack of a license.

The corporation is actively trying to shift its position, as seen by its recent high-level hires and license acquisitions.