Favour Ori’s new fintech startup, Payday raises $1m pre-seed to build Africa’s paypal

Payday, a Pan-African financial technology company has announced a $1m pre-seed fund raise. According to the startup, the raise will help it to build an online payments system that is equivalent to Paypal.

According to the announcement, the raise was supported by several investors including LofyInc, Microtraction, Magic Fund, Ventures Platform, Voltron Capital, CcHub Syndicate, Helicarrier Inc, Greencap Equity, Midlothian Angel Network and Emergence Capital.

Other individual investors participated in the round. These include Olugbenga Agboola (GB), Charles Odita, Eke Eleanya, Adegoke Olubusi, Edmund Olotu (Bloc), Prosper Otemuyiwa (Eden), Dimeji Sofowora and a host of others also contributed to the round.

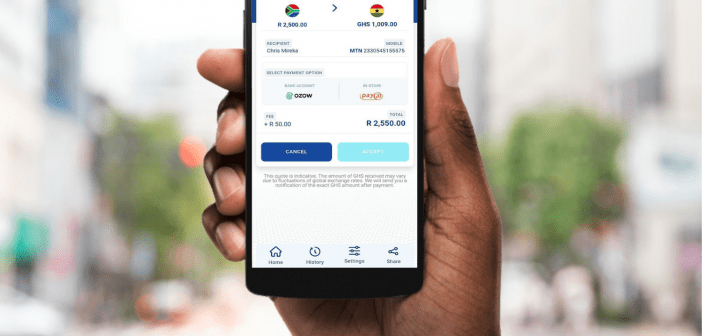

Payday is a platform created to provide fast payments for Africans across the globe. The company’s goal is to become the wants to be the ultimate shop for cross-border payments in Africa and beyond.

The startup was founded by Favour Ori in May 2021, just a few months after he resigned as CEO of Wejapa. Favour was found guilty of extortion and high-handedness according to reports of the independent investigator hired by the company.

Payday’s beta test was kicked off a month later and then a cold launch in July. According to the startup, over $1.4 million was processed in transactions just 3 weeks after the launch.

Africa offers significant potential for many organisations, specifically those requiring online payments.

Speaking on the investment, Bosun Tijani, co-founder and CEO, Co-Creation Hub mentioned the timeliness of the startup’s services.

“Payday’s solution is extremely timely and it backs up Africa’s agenda of a single market. Making it seamless and easy to pay people in their local currency; and through multiple checkout options it’s a strong boost for AfCFTA.”

Bosun Tijani, co-founder and CEO, Co-Creation Hub

Services rendered by Payday includes sending and receiving money globally, getting paid by foreign employers and clients, issuing Virtual Mastercards, and paying tuition and other fees in the United States, Canada, and the United Kingdom.

Also, Payroll, taxes and compliance can also be carried out by foreign companies with African employees using Payday. The platform is available for download on the Play & App stores. On Playstore, it has over 1,000 downloads already with an average rating of 4.5.

Payday is looking to establish its headquarters in Rwanda, a country that is fast becoming the hotspot for technological hubs due to her business–friendly environment, market accessibility, and geographic centrality.

Ntoudi Mouyelo-K, the Chief Investment Officer (CIO) of Rwanda Finance Limited, the agency in charge of the promotion and development of Kigali International Financial Center (KIFC) welcomed the establishment of Payday in Rwanda.

“Payday’s continental ambition will benefit from KIFC premier Pan-African financial network. The number of African and international investors supporting Payday is a recognition of Mr Ori’s innovative solution developed from Rwanda and it illustrates the attractiveness of Kigali International Financial Center as a new home for fintech in Africa.”

Ntoudi Mouyelo-K, the Chief Investment Officer (CIO) of Rwanda Finance Limited.