How Founders Should Pitch Their Startup: A Guide to Winning Over Investors

The difference between securing funding and walking away empty-handed often comes down to a single conversation. In Africa’s competitive startup ecosystem, where venture capital remains scarce and investors receive hundreds of pitches annually, founders must master the art of the pitch to stand out.

Nigerian startups raised over $1.2 billion in 2023, but this capital was distributed among just a fraction of the companies seeking investment. The challenge isn’t simply a lack of available funds. It is that most founders fail to communicate their value proposition effectively to those holding the purse strings.

Start With the Problem, Not Your Solution

Investors hear about revolutionary products daily. What they rarely encounter are founders who can articulate a genuine market problem with precision. The pitch should open by establishing that a real, measurable problem exists—one that affects a significant number of people or businesses.

Flutterwave didn’t begin its pitch by discussing payment infrastructure technology. The company started by highlighting the fragmented nature of African digital payments and the barriers preventing businesses from accepting transactions across borders. Only after establishing this context did they introduce their solution.

The problem statement must be specific enough to be credible. Vague claims about “revolutionizing” an industry or addressing a “major pain point” signal inexperience. Investors want data: how many people face this problem, what does it currently cost them, and why haven’t existing solutions resolved it?

Demonstrate Market Understanding Beyond Surface-Level Research

African tech investors have grown skeptical of founders who present market size calculations based purely on continental population figures. Claiming a total addressable market of “200 million potential users across Africa” without acknowledging infrastructure constraints, income levels, or competitive dynamics raises immediate red flags.

Credible market analysis requires founders to segment their audience and explain their path to capturing specific user groups. Paystack’s early pitch focused on the Nigerian e-commerce market—a defined, accessible segment—rather than making broad claims about digital payments across the continent. This specificity demonstrated operational awareness that later justified their $200 million acquisition by Stripe.

Investors also evaluate whether founders understand their competitors. Dismissing competition or claiming none exists damages credibility. Every market has alternatives, even if those alternatives are informal or offline solutions.

Present Traction as Evidence, Not Aspiration

Growth projections matter far less than demonstrated progress. Investors back founders who have proven they can execute, not those with compelling spreadsheets showing hockey-stick growth curves.

Traction takes different forms depending on the startup’s stage. For pre-revenue companies, relevant metrics might include user sign-ups, engagement rates, or pilot program outcomes. Revenue-generating businesses should present customer acquisition costs, lifetime value calculations, and retention data.

The key is honest reporting. Inflated metrics or creative accounting erode trust faster than modest, but legitimate numbers build it. When Andela pitched investors in its early days, the company emphasized the rigorous selection process for its developer training program and the placement rates of graduates—concrete evidence that their model worked before scaling.

Build a Narrative Around Founder-Market Fit

Investors increasingly prioritize founder-market fit. That is, the alignment between a founder’s background and the problem they’re solving. This doesn’t mean only former bankers can build fintech companies, but founders must explain why they’re positioned to succeed in their chosen market.

Personal experience with the problem often provides this credibility. When pitching Cowrywise, founder Razaq Ahmed drew on his own challenges with savings discipline in Nigeria’s banking environment. His firsthand understanding of user behaviour informed product decisions in ways that resonated with investors.

For founders without direct experience in their target market, demonstrating deep research, advisory relationships, or team composition can substitute. The critical element is showing that the founding team understands cultural, regulatory, and practical realities that affect product adoption.

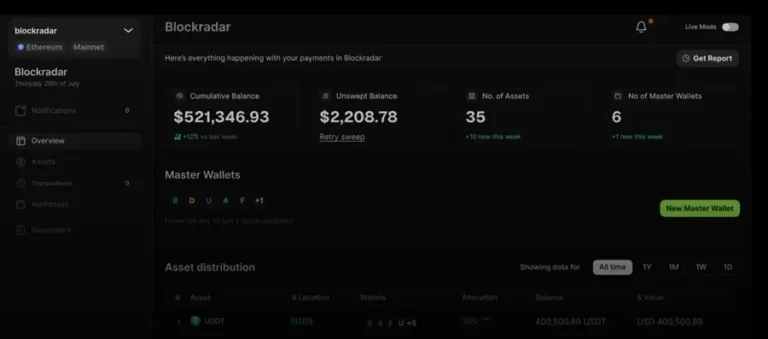

Address Business Model Viability Directly

African startups have historically struggled with business model clarity—a pattern that sophisticated investors now scrutinize carefully. The pitch must outline how the company will generate revenue and why customers will pay.

Freemium models, advertising-based revenue, and transaction fees all have precedent, but founders must explain the unit economics. At what scale does the business become profitable? What are the primary cost drivers, and how do they change as the company grows?

Kobo360’s pitch succeeded partly because the company clearly articulated how it would capture value from Nigeria’s fragmented trucking industry, taking a percentage of each load facilitated through its platform while reducing empty return trips that hurt carriers’ margins.

Close With a Specific Ask and Use of Funds

The pitch should conclude by stating precisely what the founder needs and how they’ll deploy the capital. Generic statements about “expanding the team” or “growing the user base” lack strategic clarity.

Investors want to see that founders have thought through their next twelve to eighteen months. Breaking down the funding ask into specific allocations—product development, marketing spend, regulatory compliance, key hires—demonstrates planning discipline.

Equally important is articulating what milestones the funding will help achieve. These milestones should be measurable and directly tied to increasing company value, whether through user acquisition targets, revenue thresholds, or product launches that unlock new markets.

In Summary

Pitching remains as much about building investor confidence as presenting business fundamentals. The most successful African founders treat each pitch as an opportunity to demonstrate not just their startup’s potential, but their own capacity to navigate the complexities of building a company in challenging markets. For investors deciding where to place limited capital, that distinction often determines which startups receive backing.