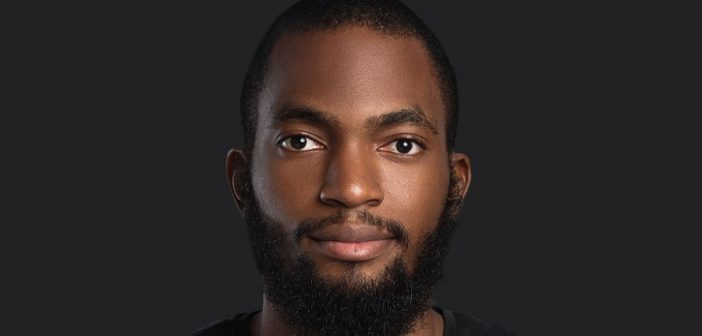

Meet the Investor: Dayo Koleowo, of Microtraction

Dayo Koleowo’s career path has taken him from construction to food delivery to venture capital, but he believes the lessons he has learned will serve him well as he backs innovative African tech startups with early-stage VC firm Microtraction.

Koleowo studied Quantity Surveying at university and went to work in the public sector preparing bills of quantities and supervising construction work for projects before moving into the private sector as a project analyst with a construction consultancy firm.

The decision to enter the tech space and then invest in tech startups was not planned.

“It was a case of opportunity colliding with preparation and, of course, capitalizing on that opportunity.” “I had always been interested in technology since I was a child, and even after graduating, I made it a point to stay up to date on what was going on in other parts of the world in terms of the technology industry,” Koleowo told Disrupt Africa.

“After nearly three years in construction, I resigned and co-founded an online food delivery startup with two of my close friends.”

ChowHub, which Disrupt Africa profiled in 2016, was that startup. Though ultimately a failure, it aided Koleowo in his current position.

“We were naive about running a startup as first-time founders, but we were fearless and determined to do everything we could to solve the problem.” “The entrepreneurship journey had its ups and downs, but most importantly, it prepared me for a future on the other side of the table,” he explained.

“As our startup began to wind down, I went down a rabbit hole learning what it takes to build a startup, how to raise money, what investors look for… Among other things, Paul Graham’s essays, Mark Suster’s blog, and Justin Khan’s Snapchat videos became my tech bibles. So, when an opportunity arose by chance via Twitter, I seized it and joined Yele three weeks after its launch to help build Microtraction from the ground up.”

Yele Bademosi is a founding partner of Microtraction (read his profile as part of this series here). He founded Microtraction in 2017 with the goal of bridging the continent’s pre-seed funding gap. The first fund was raised by a mix of founders and operators, local and international HNIs, family offices, and institutions, including Y Combinator’s Michael Seibel and Google’s Andy Volk, while the second will be a mix of founders and operators, local and international HNIs, family offices, and institutions.

“Across two funds in three African countries, we have backed 30 companies in sectors such as fintech, ed-tech, e-health, and SaaS,” Koleowo said.

The majority of these investments have been in Nigeria, with companies such as Accounteer, Riby, Thank U Cash, CowryWise, Wallet.ng, Schoolable, 54gene, Termii, and Festival Coins, but Microtraction has also backed Ghana’s Bit Sika and Kenya’s Raise. Koleowo stated that there are many things to be proud of.

Microtraction typically invests at the pre-seed stage, but it has plans to expand its horizons.

“As we grow as a fund, we intend to invest in the seed stage as well.” “As long as it is a tech or tech-enabled company, we are sector agnostic,” Koleowo said.

“Our goal is to be pan-African and to invest in as many African countries as possible.”

Aside from money, Koleowo claims that the firm adds a lot of value to the companies in which it invests.

“In addition to financial capital, we offer what we call business capital – everything other than money.” “We roll up our sleeves and work with our companies from the beginning, covering topics such as customer identification, product development, fundraising, customer acquisition, and team building,” he said.

“The Microtraction team is comprised of ex-founders with diverse backgrounds and experience, which adds tremendous value to the entrepreneurs and teams that we support.” We also recognize the significance of assisting our founders with the network that we have built individually and collectively.”

The Network Partners Initiative, an exclusive and elite network of individuals and companies with specialized skill sets with which Microtraction has partnered to support its founders, is one such service.

“You have access to that network once you become a Microtraction company,” Koleowo explained.

He’s been in the tech industry for a few years and says everything is very exciting right now.

“We are seeing more capital, more companies founded, more practical experience, more talent produced, and more success stories told than we have ever seen on the continent.” “It’s a good time to be on the continent right now,” he said.

However, African founders frequently lack business support while building their businesses, which Microtraction seeks to address.

“This is why investors must provide more than just cash. There are numerous areas in which a startup requires assistance, including legal, hiring, fundraising, navigating regulation, distribution, and growth. Startups are similar but distinct depending on stage and sector, but one thing they all have in common is the need for assistance as they build out their venture,” Koleowo explained.

Policymakers should also provide support, according to Koleowo, but governments are not doing enough to boost local startup ecosystems.

“There is a lot of room for improvement in terms of policies that affect startups in various countries.” Entrepreneurs, in my opinion, must design with policymakers in mind and bring them along to ensure that incentives are aligned. In short, we need more policymakers’ help to create an enabling environment for startups,” he said.

Nonetheless, investor interest in the space is high right now, thanks to significant progress over the last five years.

“We speak to a lot of people all over the world, and global investors like Sequoia and Tiger Global are very interested, as evidenced by their investments in Africa.” “We are playing a critical role for ourselves, coming in very early and acting as a feeder to later-stage global investors looking to come in and invest in Africa,” Koleowo explained.

That isn’t going to change anytime soon.

“Our plans are to continue doing exactly what we know how to do best – finding remarkable founders early on, backing them up, and supporting them indefinitely.” We also intend to invest in more African countries and broaden our geographic reach.”