Nigeria aside fintech . Article by Victor Obioma

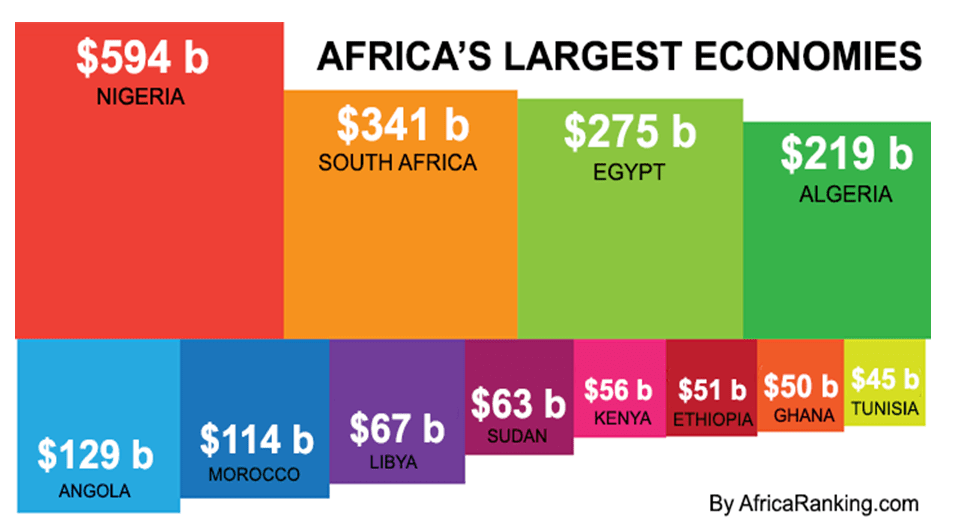

Nigeria is Africa’s largest economy and eighth largest population in the world with a booming 200+ million people, 53.2% of whom fall into the active population of 15 to 65 years- indicating abundant vast human capital.

She parades some of the World’s most ingeniously innovative minds, industry champions and technology leaders scattered within her population.

Overview

Nigeria is fast becoming one of Africa’s top economies to watch. Geographically, Nigeria is one of eight countries located in the Gulf of Guinea, the maritime area located in the Western part of the African continent, bordering the Atlantic Ocean.

The Gulf of Guinea offers direct freight access to North America, South America, Europe, and Asia with a combined GDP of over $43 trillion USD. It is estimated Nigeria’s Population will grow to 480 million by 2050.

Her agricultural industry accounts for approx. 70 percent of the country’s employment, petroleum products are the primary export– accounting for more than 90 percent of Nigeria’s exports.

In March 2021 Flutterwave raised $170 million USD in series C round five months after PayStack also a Fintech Company was acquired by Stripe Inc. USA in October 2020 for $200 million USD to expand her operations in Africa.

Nigeria aside FINTECH explores other sectors in Nigeria with huge Investment potentials, promising return on Investment- ROI for local and foreign Investors.

The decision to invest is a difficult one and takes time. The environment has to be right and attractive, to pull in Foreign Investors.

There are core factors investors consider before investing in an economy, chief amongst them include:

(a) Enabling environment and sound Government policies that protect Investors and their Investments

(b) Infrastructural development to support sector driven growth of the particular sector local and foreign investors are considering to Invest in

(c) Local participation of nationals of the country and proof of their growth capacity within a given period- usually three to five years

(d) Availability of home grown human capital to provide expertise, knowledge, input and support system for foreign companies or Investors to leverage on;

(e) Scalability of the products, services and solutions of the specific sector been considered

(f) Multi product, service options and alternatives that can be derived from the sector in question

(g) Level of competition currently ongoing in the sector been considered for Investment

(h) Amount of investment required, impact of such investment and the profitability ratio- Return on Investment (i) Accessibility of raw materials and other factors of production

(j) How quick to conclude set up formalities like business registration, timeframe to obtain registration certificate, licenses, company and allied matters statutory requirements for foreigners to own company, tax payments, FOREX remittance etc.

Nigeria is a destination with the third highest Foreign Direct Investment (FDI) in Africa and holds a special attraction for savvy investors from across the globe keen to capitalize on a GDP estimated to grow to over $750 billion USD by 2022.

Nigeria’s population, cultural diversity, ingenuity of her citizens, grit, resilience, strong mental energy and creative mindset plays an important role in putting Nigeria on the World Map as a country with the capacity to lead trade, commerce and investment narrative in Africa.

Mineral resources, agriculture, livestock production etc. are some examples of Nigeria’s vast under-tapped opportunities with huge market growth potential in West and sub-Saharan Africa.

The Government of Nigeria has invested in creating an enabling environment for business, investors and industrial ventures by ensuring the streamlining, modernization of administrative, bureaucratic procedures, implementation of policies and programs that guarantee a free market economy plus low corporate tax to encourage Foreign Investors to not only make contacts but also take steps further to engage and set up operations in Nigeria.

The Objective is to explore other sectors aside FINTECH with very high yielding Returns on Investment- ROI and are accessible to local and International investors for consideration to foster collaboration, inter trade business relations that are critical for transnational sustainable growth and economic development.

Nigeria is a ready investment hub with massive opportunities in several other promising sectors ripe for investment and available human capital for investors to employ at nearly half the cost; to deliver International standard superior quality product and services. I will examine in details; some of these investor ready sectors and the huge potentials they carry.

“Companies that incorporate local value creation will be both more sustainable and more profitable in Africa in the long-term”

– Tony O. Elumelu- Africapitalist, entrepreneur, founder: HEIRS Holdings and Tony Elumelu Foundation – TEF

Opportunities in Nigeria Aside Fintech

1. Abundant Mineral Resources:

Nigeria has deposits of abundant, untapped Mineral resources like Gold, Coal, Columbite, Tin, Iron Ore, Uranium, Limestone, Marble, Bitumen, Koalin etc. scattered across the country. For instance, Plateau State has about 22 various mineral deposits, Nasarawa has 21; Kaduna, 19; Sokoto, 12; Ondo, 12; Bauchi, 11; Edo, 11; Oyo, 11; Benue, 10; Kogi, 9; Anambra, 9; Kwara, 8; Borno, 8; Delta, 8; Bayelsa, 8; Cross River, 8; Imo, 8; Kano, 7; Akwa Ibom, 7; Abuja, 7; Ogun, 7; Abia, 6; Rivers, 6; Osun, 6; Ekiti, 5; Adamawa, 4; Ebonyi, 3; Enugu, 3; Katsina, 3; Lagos, 3; Niger, 3; Gombe, 2; Yobe, 2; Zamfara, 2; Jigawa, Kebbi, and Taraba states all have one Mineral resource. These present huge Investment Opportunities and revenue potentials for these States.

State Governments in Nigeria have been over dependent on the Federal Government for allocations to handle all projects without looking inwards for abundant natural resources to be tapped in their respective states.

It has been reported that Nigeria loses about N50 trillion naira annually from her untapped resources.

From gold alone, an estimate of N8 trillion naira was discovered to have been lost annually in Nigeria from royalties, taxes, charges and other fees that the Government at all tiers would have earned from firms and individuals operating in the solid minerals Industry.

Recently Nigeria Sovereign Investment Authority- NSIA signed $1.4bn USD deal with Moroccan investors on Ammonia and Diammonium Phosphate

This support the resolve of the Administration of President Muhammadu Buhari to implement policies on economic diversification to shore up Investment in high potential sectors like Mineral reserves which are FOREX game changers; as crude oil which accounts for Nigeria’s major revenue source is depleted in the global market; leaving the mineral resource space as an interesting sector aside FINTECH to invest in Nigeria.

To be continued…

About the Author:

Victor Obioma is Chairman, VICFAUS INTEGRATED SOLUTIONS LIMITED (Division of VIEWS GROUP Co.), He is International Partner for Nigeria; World Business Angels Investment Forum-WBAF and Member; Global Start Ups Committee. He is Member, Global Chamber of Business Leaders-GCBL; Global Entrepreneurs Network (GEN) Startup Founders Mentor at Tony Elumelu Foundation (TEF), TAKWEEN Accelerator & Advisor at Prosper Advisors Network, Kenya.