3 trends that will transform African mobile apps in 2022

In 2021, the mobile sector in Sub-Saharan Africa showed extraordinary resilience against the effects of Covid-19 and sustained rapid expansion.

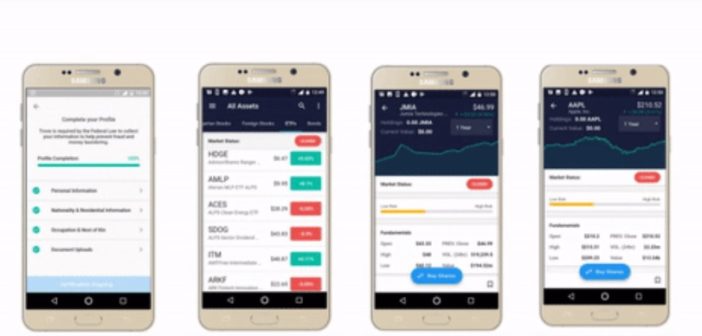

Digital solutions have been essential in assisting communities and organizations in transitioning to a mobile-first strategy to address the majority of the continent’s daily concerns, with fintech applications leading this increase.

According to the Mobile Economy Report, by 2025, 615 million individuals in Sub-Saharan Africa will have subscribed to mobile services, accounting for half of the region’s population. As we begin a new year, Daniel Junowicz, RVP EMEA & Strategic Projects at AppsFlyer, a leading mobile marketing analytics platform, examines three major trends for mobile apps in Africa this year.

The amount of money invested in mobile applications will rise.

A previous AppsFlyer and Google analysis highlighted a thriving African mobile app business, powered by a rising fintech space, an increase in ‘super applications,’ and the COVID-19 epidemic, among other causes.

The analysis concluded that the African mobile app market showed tremendous growth, with overall installs increasing by 41% between Q1 2020 and Q1 2021, after analyzing over 6,000 apps and 2 billion installs across South Africa, Nigeria, and Kenya. Nigeria had the highest growth rate, at 43 percent, followed by South Africa at 37 percent and Kenya at 29 percent.

The global pandemic’s digitization needs have boosted Africa’s opportunity to convert itself into a digitally focused continent.

As we approach 2022, the momentum that many firms have carried on their digital transformation journeys, particularly in the retail and banking industries, shows no signs of fading. With Africa’s recovery from the pandemic delayed by low immunization rates, firms will increasingly attempt to capitalize on a growing digitally informed consumer.

According to Briter Bridges, African entrepreneurs raised $4.65 billion in disclosed funding last year, with fintech companies receiving 62% of the total. Increasing web and in-person traffic to mobile experiences will be a main emphasis for traditional organizations as they increase their investment in mobile apps and mobile app marketing, which is expected to account for more than half of the overall marketing spend.

Customer experience and brand loyalty will improve as mobile commerce expands.

In Africa, industries such as mobile commerce will continue to grow at an exponential rate through 2022 as more consumers, particularly formerly non-tech-aware shoppers, become more accustomed to purchasing online via mobile applications. Because social commerce is expected to take up more room in the total mobile marketing landscape, creating an engaging user experience to increase brand loyalty is critical.

The growth of e-commerce apps in Africa last year shows no signs of slowing down. According to AppsFlyer’s State of eCommerce app marketing research, the African mobile app market is thriving, with more individuals accessing products and services online than ever before, with a surge of 55% on Android and 32% on iOS in 2021, with consumer spending increasing by 55% overall.

The more consumers grow acquainted with mobile applications, the more they will respond to innovation and improvements in the UX, resulting in good brand engagement.

Enhancing the user experience (UX) will be a key priority for app developers and marketers as they focus on more impactful copy, minimizing distractions, and optimising creative design within the limited space of a mobile screen.

Intense rivalry for attention should drive the market toward creative mobile applications that will undoubtedly appeal to consumers and maintain a higher level of brand loyalty.

Fintech and social super applications will become increasingly prevalent.

Super applications developed from China, a country with a large population, strong consumer purchasing power, and underserved industries, not unlike Africa. We Chat, a messaging service, swiftly extended into additional activities including shopping, gaming, and video sharing.

This is a strategy that several Western social media companies, like Meta, are attempting to mimic by incorporating more and more functionality into their single apps.

Africa has the potential to be a major market for Super applications, particularly Fintech. By the end of 2021, there were 548 million registered accounts in Sub-Saharan Africa, with over 150 million of them active monthly, accounting for 43 percent of all active mobile money accounts worldwide. These apps provide users with ease by providing the fundamental infrastructure required by the unbanked population as well as simple access to a wide range of services.

Kenya’s M-Pesa and Nigeria’s Opay have been good examples in East and West Africa, with at least a few more coming from last year, as have Uber and Bolt’s expansions from auto hailing applications into food delivery. So, as we approach 2022, the competition to dominate the digital retail and consumer market for super applications has begun! Expect to see businesses expand and extend their app’s capabilities by embedding their suite of features into people’s daily lives.