Topship, freight startup secures $2.5m seed fund from Flexport, others

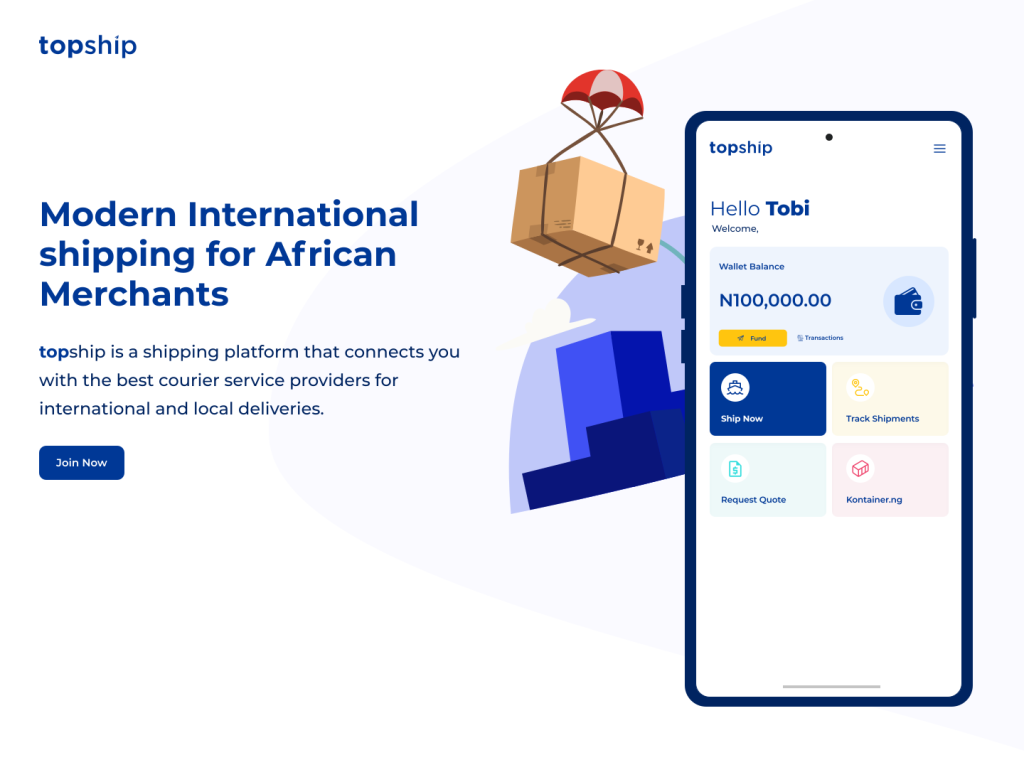

Topship, a Nigerian digital freight company, has raised $2.5 million in seed capital. Flexport led the investment round, which included Y Combinator, Olive Tree Capital, Capital X, and True Capital as well as additional investors.

According to the startup’s release, fresh funding would be critical in its expansion efforts. This comes just months after the firm graduated from the YC winter cohort.

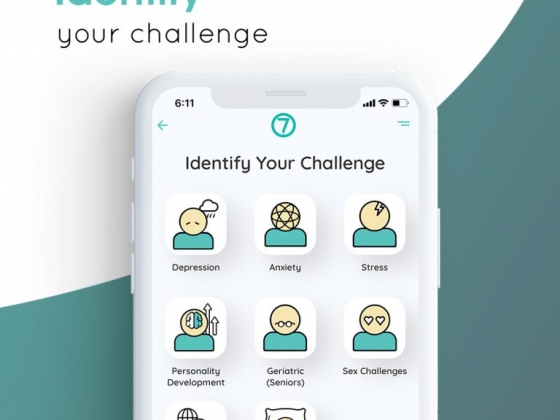

Topship enables businesses to transfer a huge quantity of items while also assisting customers with their shipping requirements. It may be as basic as a student sending paperwork and doing some online shopping.

According to Moses Enenwali, the firm’s CEO and Co-Founder, the firm has assisted over 1500 Nigerian merchants in distributing their products in 150 countries. Nigerian merchants can only accept parcels and cargo deliveries from the US, the UK, and China through it.

Topship was created in 2020 after the CEO noted a spike in demand for international shipping by Nigerian merchants, especially during the COVID-19 pandemic. Enenwali became interested in the need of a proper shipping procedure after working with ACE Logistics and Sendbox, two different shipping companies. The company was founded in March 2021 as a result of this.

According to TechCrunch. Air cargo, according to Enenwali, is a better option for launching a freighting company than ocean cargo since it is easier and faster to transfer more things, which benefits merchants.

This isn’t a knock on the largest freight firm, Flexport, which concentrates exclusively on ocean cargo transportation, since CEO Enenwali claims that African startups aren’t ready for that model, forcing the need to alter the system because airports are inevitably present in every country and continent.

… in Nigeria, we have one function port, and for ocean freight to work, we need ports, railways, and roads for trucking. But we don’t have the roads, and we don’t have the railways.

Topship CEO tells TechCrunch in a report.

The company makes money by selling shipping insurance and taking a cut of each transaction. The company is currently looking for additional revenue streams, such as trade financing and customs processing fees, according to Moses.