Tanzania’s NALA secures $10m seed funding for expansion

NALA, a Tanzanian cross-border payments firm, has raised $10 million in seed funding. Amplo, Accel $ Bessemer Partners, and DFS Lab led the round.

Angel investors included the Head of Google Payments, Peeyush Ranjan, and the Co-Founder and CTO of Monzo, Jonas Templestein, among others.

This round follows an undisclosed amount of pre-seed funding raised by the startup.

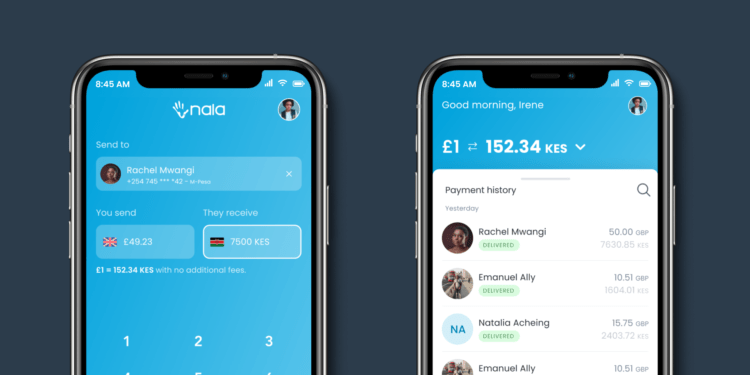

NALA, founded by Benjamin Fernandes, a former national television host of youth talk shows and sports shows in Tanzania, is a fintech startup that enables cross-border payments from the United Kingdom (and the United States and the European Union) to Africa.

Money sent by people living outside their countries of origin accounts for the majority of foreign exchange inflows into many countries, demonstrating the enormous importance remittances have assumed as a factor of economic development. Sub-Saharan Africa had the highest remittance costs, averaging 8.17 percent in the fourth quarter of 2020.

Due to unstable internet and high service fees, mobile money services in Tanzania can be difficult to use. Furthermore, sending money requires a user to enter between 39 and 46 digits, but NALA has greatly simplified this process. International money transfers began on the platform in 2020, and NALA’s user base has grown from 100,000 in 2019 to more than 250,000 today.

The first East African company from Y Combinator in 2019, most of NALA’s users are in diaspora. And in the last six months, more than 8,000 customers have moved over $10 million in transaction volume to Africa.

“Our core customer base is the diaspora right now who live in the U.K. This is the customer we’re currently serving today as we speak,”

Benjamin Fernandes, CEO

Expansion, increased product offerings and talent acquisition

The investment will allow NALA to hire more employees and support growth efforts in the United Kingdom, the United States, and Europe. The startup has obtained license approvals in this regard. It will also construct payment rails in Africa and expand into new markets. Tanzania, Kenya, Uganda, Rwanda, Ghana, and South Africa are among the countries where NALA is active. The startup’s goal is to be present in 12 African countries, including Nigeria, by the end of the year.

The fintech firm also intends to officially launch multi-currency accounts, allowing the African diaspora to store local African currencies while traveling abroad. This is a process that is still in its early stages.

It is also currently testing NALA for Businesses, which allows people in the diaspora to make payments to Africa.

NALA users will also be able to send money from Africa to the United States and the United Kingdom. All of these plans are part of an effort to distinguish itself as more than just a remittance company.

“We don’t want to be compared to a regular remittance company, and people will do that naturally. But we think remittance is just the starting point for what we’re going to build. My take is that payments across the continent is 1% built, and there’s a lot of infrastructure and software that needs to be built deeply. That’s where we want to sit and this $10 million round is going to do a lot of that.”

Benjamin Fernandes, CEO NALA