South Africa 6DOT50 startup enables crypto-holders to pay for goods and services at 40k merchants

Written by TOM JACKSON

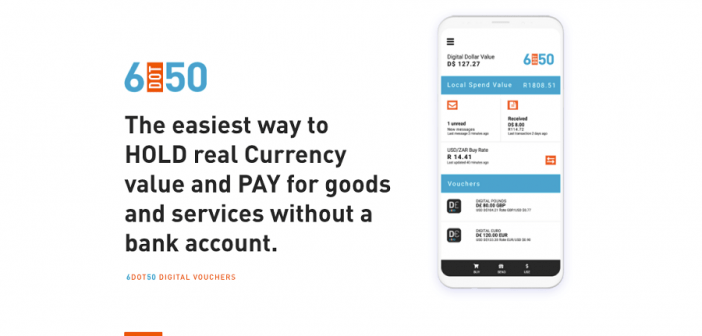

South African startup 6DOT50 is enabling crypto-holders to pay for goods and services at over 40,000 merchants across the country, including at Shoprite Holdings stores and all Zapper merchants.

Until now cryptocurrencies have mostly failed to fulfil the primary purpose of money, namely its ability to be exchanged for goods and services. 6DOT50 claims to have solved this problem by positioning its Digital Rands Money Vouchers as the bridge between the crypto and fiat worlds, providing an offramp for crypto value that offers merchants a common, stable and reliable measure of value to accept as payment.

The business was formed in 2019, and its first product offering was launched in May 2020, as the level five lockdown in South Africa resulted in domestic employers not having a way to pay their cash-based employees. This accelerated the development of the business and the introduction of its Digital Rand Money Vouchers.

Basically, 6DOT50 offers a free transactional account to all users, accepting Bitcoin, Litecoin, Ethereum, Bitcoin Cash and Dash as payment for its Digital Rands. The purchase of Digital Rands takes less than five minutes and the funds are immediately available to be used as a way to pay for goods and services at more than 40,000 stores and online retailers across South Africa.

“6DOT50 operates a digital money voucher-based, banking grade, transactional platform designed as an alternative way for people to store money, instantly send and receive money and pay for goods and services without the need to own a bank account,” said Warren Venter, the startup’s chief executive officer (CEO).

“We provide cash-based customers with an easy onramp to hold a digital store of value and enjoy safe and convenient digital payments. We also offer cryptocurrency enthusiasts an easy offramp, making crypto as acceptable as bank card payments across our merchant network. This means a user can go from Bitcoin to paying for a coffee in a matter of minutes.”

Merchants include Shoprite, Checkers, any Zapper-enabled merchant, and many more.

“The crucial upshot of our model is that we are not regulated by any banking or finance legislation as we are not a deposit-taking institution, meaning that no KYC is required. All a user needs to open a free 6DOT50 transactional account is a South African mobile phone number,” Venter said.

The traditional banking system has failed billions of individuals worldwide by imposing high fees and challenging documentation requirements, leaving them excluded from the digital economy, he said. Crypto solves this problem, but it needs to be more accessible. Venter believes that 6DOT50 has the key.

“There is a gap between the cash and cryptocurrency world and the world of real production industries. We believe that cryptocurrencies and fiat will simultaneously coexist so we provide a bridge between the different money worlds by providing a service of converting physical cash and cryptocurrencies to a digital representation of fiat that makes cash and crypto payments as acceptable as bank cards across our merchant network,” said Venter.

“6DOT50, unlike traditional fintech solutions, is not a regulated business focussing on making it easier for people to access and use a traditional bank account. Our unique value proposition is the use of Digital Money Vouchers as an alternative way to store money, send and receive money and pay for goods and services without the need to own a bank account.”

Funded through a combination of equity and debt funding, 6DOT50 has a free-to-user model and monetises through settlement fees negotiated with its merchant network.

Whenever one of its members uses their account value to access a product or services, 6DOT50 pays the merchant the amount less the fee negotiated with the merchant. Venter describes the company as “post-revenue but still pre-profit”.

“Given the risks associated with cash transactions, both from a security and COVID-19 transmission risk perspective, the majority of our user base are using the platform as a safer way to pay their unbanked and underbanked employees. Their employees are in turn able to instantly receive their money, buy airtime or data and access thousands of merchants including Shoprite, Checkers, Usave, Dischem and Wimpy,” he said.

“Our recent crypto release, enabling cryptocurrency holders to access products and services from our merchant network using their crypto value, has started to pick up momentum. More than 93 per cent of cryptocurrency enthusiasts have indicated that they would use their cryptocurrency to make payments. We are excited to make this a reality in South Africa.”

The company also has plans beyond South Africa.

“The introduction of our Digital Dollar Vouchers later this year will open the door to our international expansion agenda,” Venter said.