Nigeria Tops the List of 100 Most-funded African Startups

What are the most funded companies in Africa? is one of the most often asked topics at Digest Africa.

We need to comprehend the popularity of this query before delving into the most financed startups. To begin with, startups are businesses designed for rapid expansion.

They also seek money from investors who receive shares in return in order to achieve this growth. Instead of bootstrapping, this money enables the entrepreneurs to grow at the rate they desire. A firm might, for instance, be losing money every year, but funding would allow it to grow into new areas, make important hires, and improve its product.

But don’t let the numerous financing announcements that you read on a near-daily basis fool you. Actually, for most businesses, raising capital is the exception rather than the rule. Only 1% of businesses receive funding, according to the Harvard Business Review.

Therefore, at least from a financing viewpoint, the firms that have been able to acquire more funding than others have achieved some level of success. Even while other factors like investor biases play a role in this, as we will discover, knowing which businesses have raised the most money gives us information into the industries and nations that are drawing investors.

Even though some deals reported may predate our existence, we are the best organization to respond to that issue because we have funding data going back to 2015 that we have gathered. We have therefore created a comprehensive list to address this subject for the first time ever. Please see our methodology here to see how we came up with this list, how we manage our data, and what an African startup is.

Deals that companies publicly disclose to the media or some that investors or founders privately disclose are ones that we have listed. We authenticate the latter deals through due diligence. We log all transactions and do not have a limit (for instance, just transactions over $100,000).

On our list of agreements, we also include transactions that are documented in young startup ecosystems and are as little as $25,000.

What then did we learn?

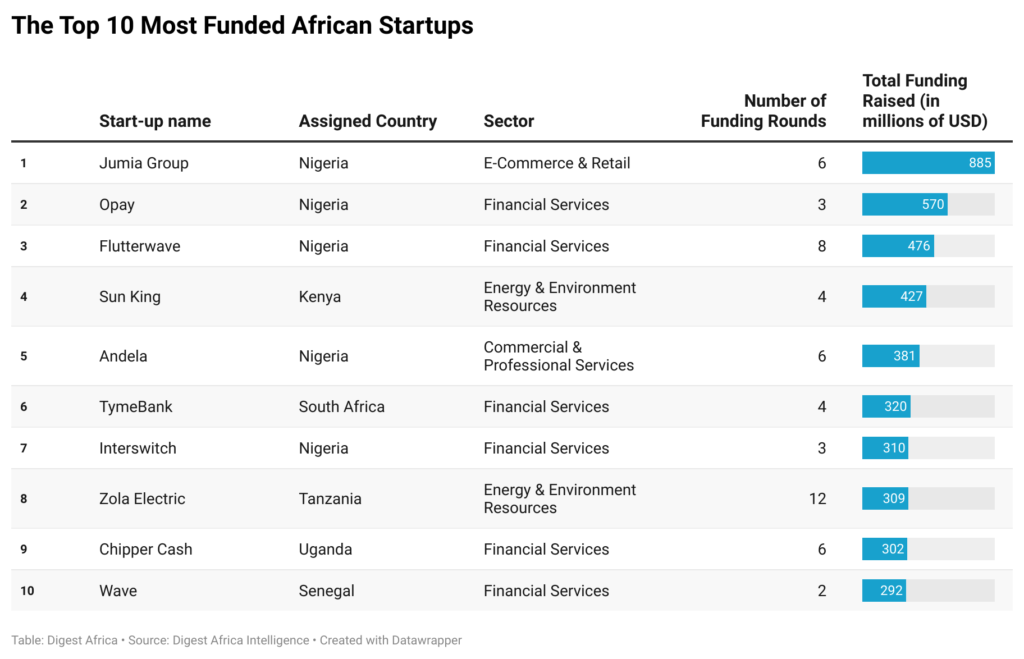

The top 100 African startups in terms of funding have secured $10 billion across 436 transactions, or $23 million on average. This is ridiculous when compared to the USA, where JUUL Labs, a California-based e-cigarette company, has raised $15 billion in disclosed funding, making it the most funded startup there.

The comparison might not be fair, though, as the startup ecosystem in the USA is one of the most developed. However, Gojek, its primary competitor from Indonesia, has raised $4.7 billion, while Grab, the super app from Singapore, has raised $9 billion.

The top 100 most-funded African businesses have raised less money ($13.7bn) than the two Asian behemoths. One could argue that entrepreneurs in Africa aren’t getting enough money, but as the ecosystem develops, this could change.

Clickatell received a $6 million Series A fundraising round from venerable California venture capital firm Sequoia Capital on October 1, 2006, making it the first funding round received by any startup in the top 100. The most recent transaction was the Egyptian fintech Telda, which raised $20 million in Series A fundraising on October 12, 2022, bringing its total funding to $25 million, just enough to enter the top 100 at position 96.

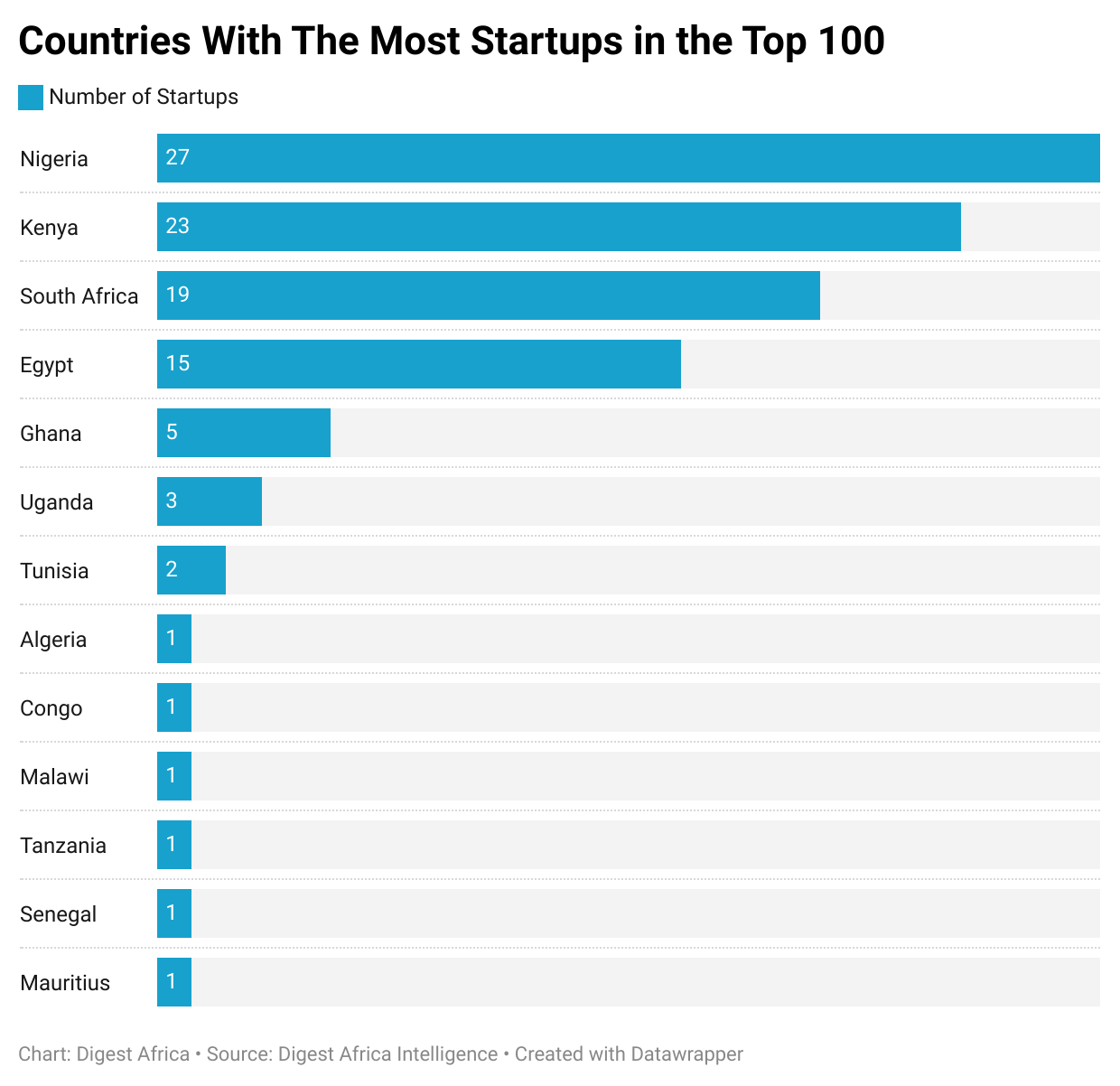

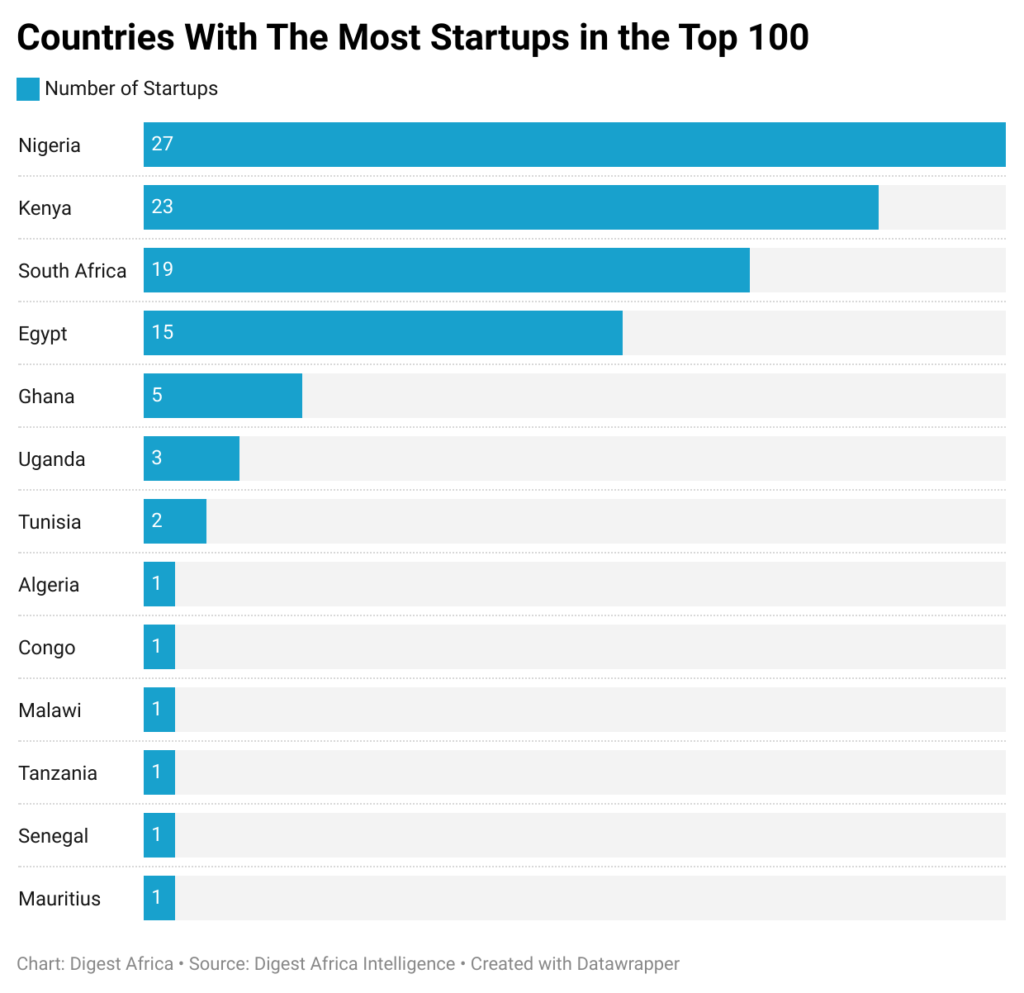

13 different African nations are all represented, with Kenya (23 startups) and Nigeria (27) making up half of them. 34 firms each from South Africa and Egypt represent the other two major 4 members, making up 84% of the 100 startups.

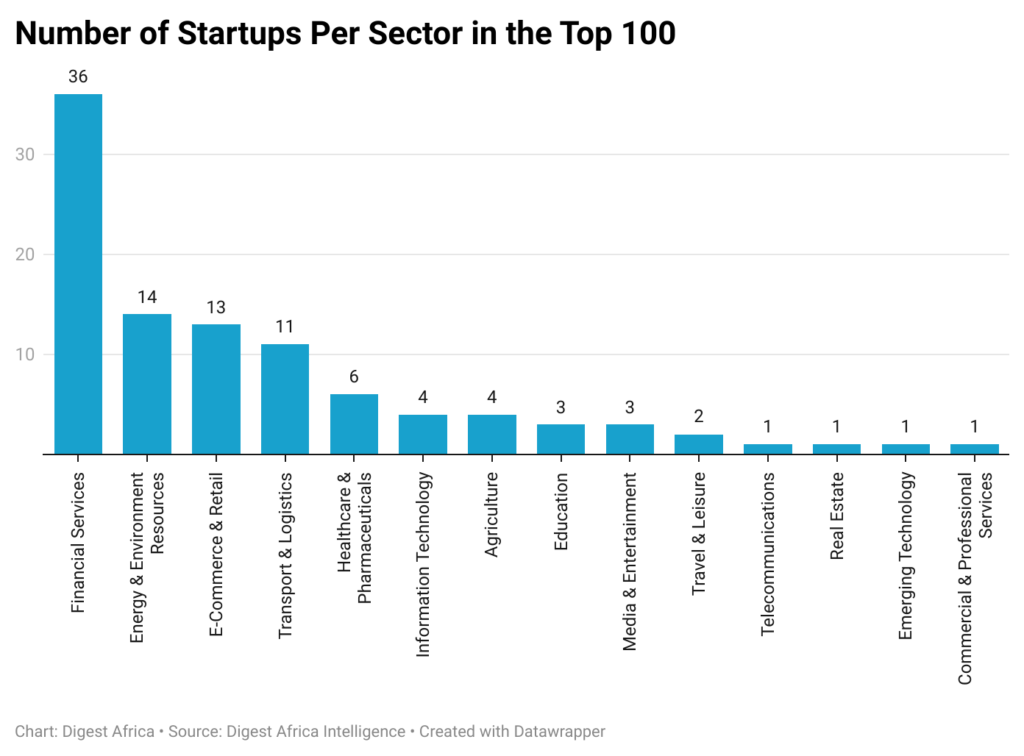

Fintech startups made up 36 startups overall, more than twice as many as the following area, Energy and Environment Resources. The top 100 featured representation from 14 different industries.

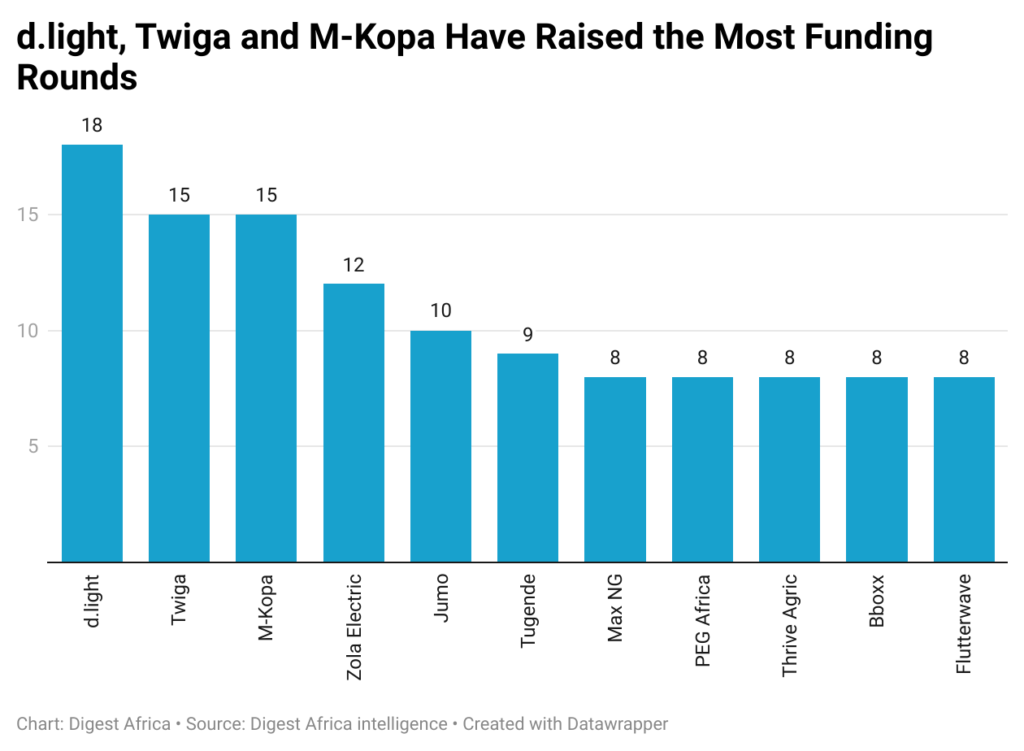

The top 100 startups raised their entire capital in an average of 4 funding rounds. With 18, the solar company d.light raised the most money. Twiga, M-Kopa, and Zola Electric were next.

Twelve startups in total only required one fundraising round to be among our top 100. The top-ranked startup among these is Gro Intelligence from Kenya (ranked 31st), which raised $85 million for its Series B round.

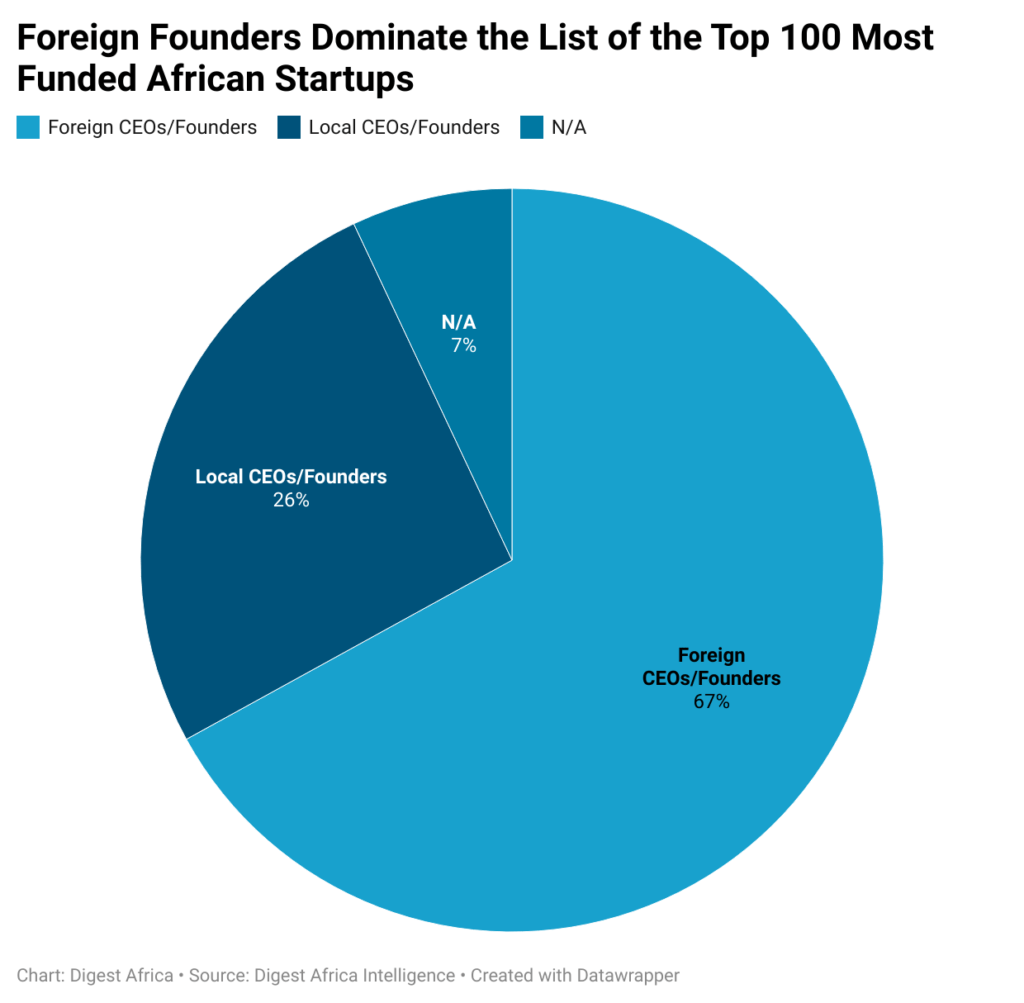

67 of the 100 startups were started by foreign entrepreneurs. A foreign founder in this context does not just refer to expatriates but also to entrepreneurs who received at least their undergraduate education in the West. Only 26 firms were started by local founders, and they were all educated in African nations. This study does not include the seven startup founders.

Although this could seem to be discrimination towards regional founders, other factors are at work. On this list, the average amount of funding raised by startups is $100m. Since the African ecosystems are still developing and because VC is a relatively unheard-of asset class, it does not attract as much investment in Africa as it does in other regions, such as North America and Europe, this is out of reach for the majority of local founders. This puts local founders at a disadvantage, as we will discover later, because anyone looking to attract significant capital rounds will have to look at VC firms in the USA and Europe.

Investors create biases to maximize returns because of the hazardous nature of startups, where Forbes estimates that 90% of businesses fail. Similarity bias is one of these biases, when investor judgments are influenced by a founder’s educational background and professional experience. Investors who worked at Goldman Sachs and attended Stanford will be biased to invest in founders with similar backgrounds. For instance, an investor with an office in New York will find investing in a founder who attended New York University more appealing than one who attended Makerere University in Uganda. Founders who have attended similar schools and have similar background experiences benefit from these biases.

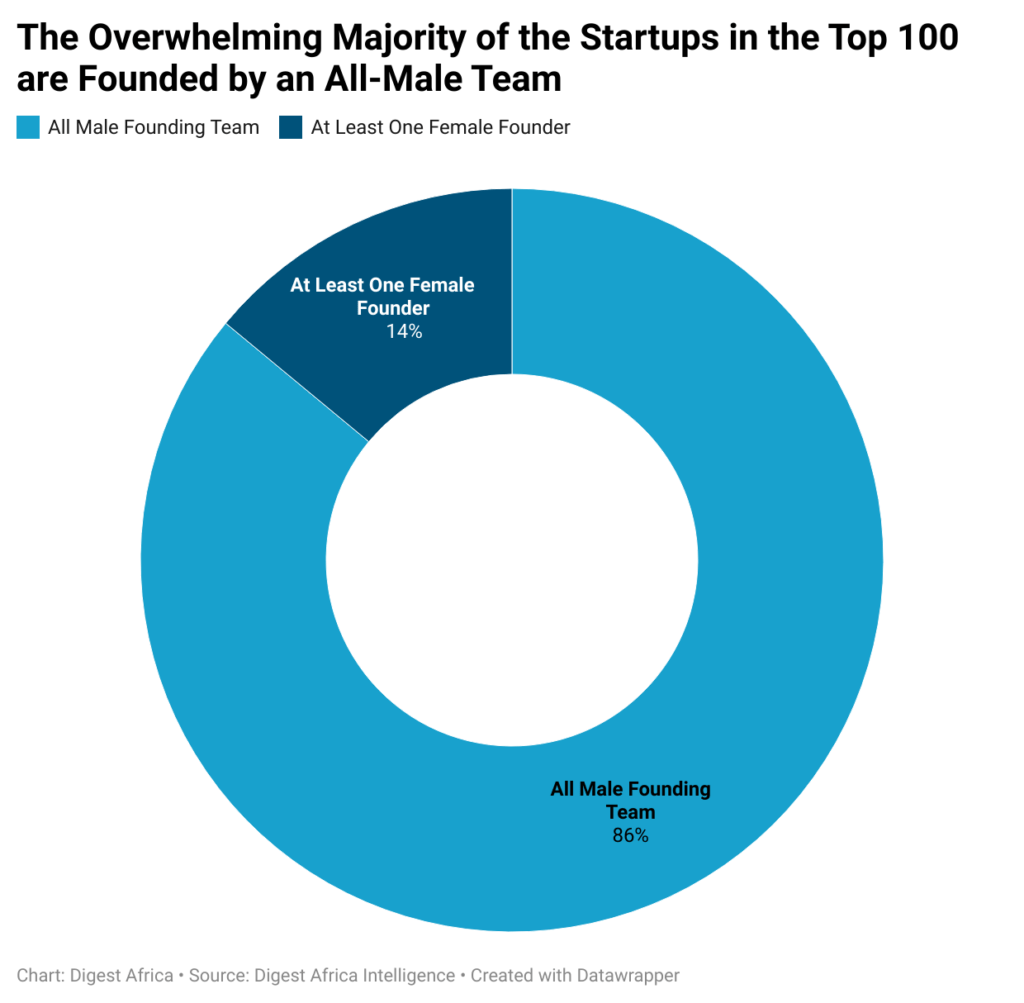

Similarly, despite studies from the Boston Consulting Group demonstrating that firms with at least one female founder generate more than twice as much revenue per dollar invested as those started by an all-male team, they performed even worse than the local founders. In an interview with TechCrunch, professor Sarah Thebaud of the University of California, Santa Barbara (UCSB) revealed that her research on gender bias in entrepreneurship found that “people are likely to systematically discount the competence of female entrepreneurs and the investment-worthiness of their enterprises and the women are rated less-skilled and less competent than the male participants.”

Africa is where we can see this. Only 14 percent of the top 100 most funded firms have at least one female founder, with Andela (5th) having Christina Sass, its current president, listed as one of its founders.

What Are The Top African Startups In Funding?

Jumia is at the top of the list. In six investment rounds between January 2012 and April 2019, Africa’s largest e-commerce company raised $885 million before going public on the New York Stock Exchange (NYSE). A $400 million Series C fundraising round from Rocket Internet, MTN Group, Orange, Goldman Sachs, CDC Group, and AXA Group in March 2016 was one of the noteworthy funding rounds.

The top 10 comprises five firms from Nigeria (Jumia, Opay, Flutterwave, Andela and Interswitch). The other five firms are based in Uganda, Tanzania, South Africa, Senegal, and Kenya. There are no Egyptian startups in the top 10 despite the country having 15 in the top 100. MNT Halan ($127m in total investment) is the highest-ranked Egyptian startup and is placed 19th overall.

Click here to access the full list