Nigeria buy now pay later startup, Klump secures $780k pre-seed funding

Klump, a Lagos-based buy now pay later (BNPL) startup, has raised a pre-seed funding round of $780,000 to help it launch its flagship “Pay with Klump” product with select partners, offering BNPL solutions to customers and businesses.

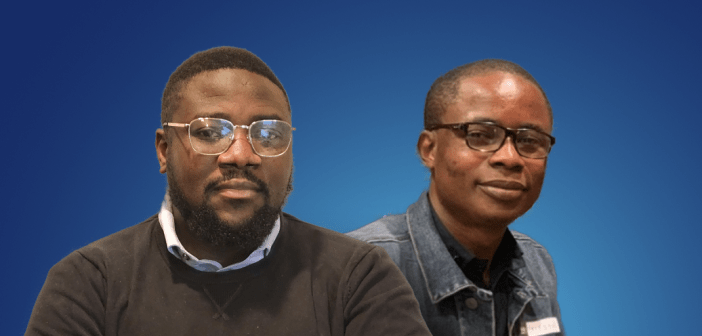

Klump, founded in 2021 by Celestine Omin and Olufunbi Falayi, who have combined experience building products with Konga, DealDay, Paystack, Andela, Amazon, and H-E-B, offers customers the option to buy and receive their purchases immediately, or spread the payments over four equal installments.

Klump’s proprietary credit eligibility and fraud detection engine allows it to make an informed credit decision on a customer in less than three minutes, with the goal of reducing the decision time to less than a minute in the future.

Seedcamp led the $780,000 pre-seed funding round, with participation from MAGIC Fund, Voltron Capital, Yellowwood, Kickoff Africa, Hoaq Capital, Kesho VC, Assembly Investors, and several angel investors and founders, including Olugbenga “GB” Agboola, CEO of Flutterwave; Will Neale, founder of Grabyo; Michael Pennington, founder of Gumtree; Richmond Bassey, CEO of Bamboo; Babs Ogundeyi, CEO

The funds will be used to further develop Klump’s credit decision and checkout engine, as well as to build the team, develop merchant partnerships, and provide affordable financing to its customers.

“Our BNPL offering is a natural next step in the development of the African e-commerce sector, and we intend to be at the forefront by developing the capability to make real-time credit decisions on customers and offer flexible payments to help reduce the economic pressure of one-time payments, which has grown astronomically since the emergence of COVID-19.” At the same time, we want to help merchants achieve commercial success by giving them the tools they need to offer their customers the option of paying in small installments,” Omin explained.

Klump, according to Falayi, can make sound credit eligibility decisions quickly, facilitate transactions to approved customers, make disbursements to merchants, and effectively drive customer collections with a flexible and efficient collections system.

“We’re keeping mechanisms in place to promote responsible lending and reduce the risk of customers taking out loans they can’t afford,” he said.

Felix Martinez, an investor at Seedcamp, said he was thrilled to be supporting Klump because it has laid the groundwork for democratizing new payment methods in a vastly underserved African market.

“It was clear to us from our first meeting that their respective experiences scaling some of Africa’s largest startup successes and implementing best-in-class payment solutions for large e-commerce merchants make them the ideal team to become the continent’s responsible BNPL category leader,” he said.

Klump has also collaborated with AltSchool, an alternative technology academic institution, to provide laptop financing to its students, as well as Betastore, a B2B retail platform, to provide inventory financing to its retail customers. Klump plans to launch additional large-scale collaborations in the coming weeks, with an initial focus on marketplaces with higher-margin, discretionary-spend categories like apparel and footwear, fitness, accessories, and beauty. Klump will also concentrate on the education, travel, and healthcare industries.