Metaverse: Nestcoin’s new product, Metaverse Magna will help Africans earn by playing games

Many people are still perplexed by what the metaverse is or could be. Millions of dollars, however, are being invested in this virtual universe.

BusinessToday.in reported on November 29, 2021, that Tokens.com, a Canadian investment firm, spent $2.5 million on a virtual land in the metaverse.

The property was purchased on Decentraland, a blockchain-based virtual world.

Surprisingly, the land has a street address. It is situated in Decentraland’s fashion street district. A location in the metaverse where fashion shows and possibly concerts will take place.

While the concept remains speculative, the amount of money invested is very real.

Decentraland raised $26 million in Initial Coin Offerings in 2017. (ICO).

In fact, Facebook, one of the world’s most valuable companies, has changed its name to Meta and spent $50 million on metaverse research.

Although the metaverse appears to be the future that everyone should be a part of, there are still significant barriers to entry, including money and education.

The most affordable piece of Decentraland land costs 3ETH, or about $12,000. Aside from being prohibitively expensive, how does one locate land in a virtual world?

However, lands aren’t the only type of investment available in the metaverse; gaming is as well.

Nestcoin’s new product, Metaverse Magna (MVM), is paving the way for Africans to enter the metaverse through games.

What exactly is metaverse gaming all about?

Gaming is the same whether it’s in the metaverse, on a PlayStation, or on a mobile device.

But gaming is done a little differently in the metaverse.

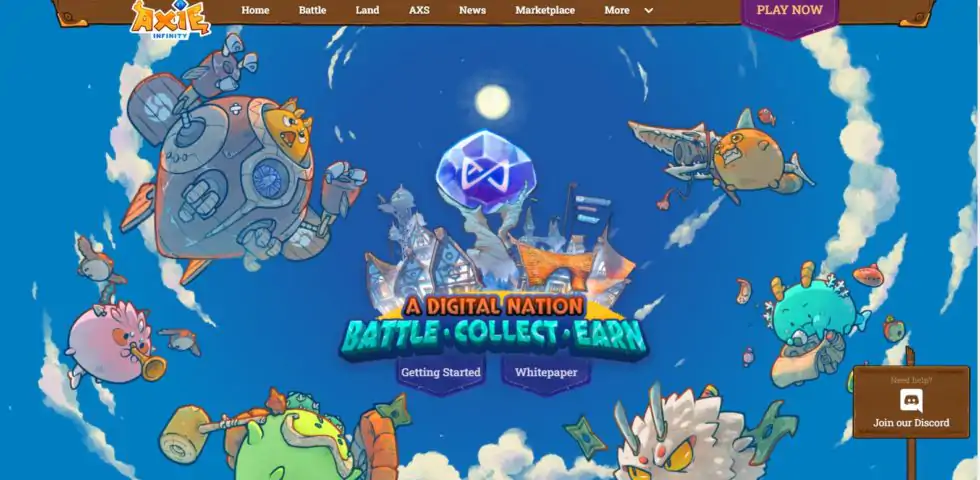

Axie Infinity is the most established metaverse gaming platform to date. Axie Infinity, unlike other games, is built on a blockchain, which means you can use cryptocurrencies to buy and sell characters, upgrades, and power-ups.

Sky Mavis, a Vietnamese company, founded the platform in 2018. It is currently valued at $3 billion.

It is known simply as Axie and allows players to earn up to $2,000 per month.

The number of gamers on the platform increased to 1.8 million in August of this year, with the Philippines accounting for roughly 40% of the total.

What role does Nestcoin’s Metaverse Magna play?

To enter the brightly colored metaverse populated by strange-looking game characters on Axie Infinity, you must own gaming creatures or a variety of other items known as assets.

These creatures, no matter how strange they appear, are not cheap. According to Rest Of World, game assets can cost up to $1,500. That is more than 2000% higher than Nigeria’s minimum wage.

According to KLA, a market research and data specialist firm, only 3% of cryptocurrency owners in South Africa own up to $3,000 in cryptocurrencies.

While expensive Axie assets are a deterrent, the metaverse is still in its infancy, and few people know how to enter.

Nestcoin’s MVM wants to assist players in obtaining these creatures in exchange for a percentage of their earnings. For gaming, something akin to AltSchool.

“We are sponsoring anyone out there with access to the Internet, and just the commitment to improving their quality of life with an opportunity to earn a good living playing crypto games,” Onyinye Umeaka, MVM General Manager, said in an interview with Techpoint Africa.

She stated that MVM would buy the assets and create gaming accounts, then lend the accounts to players eager to learn, play, and earn.

“As the players play, they earn cryptocurrency, and we split the earnings between ourselves and the players, with the players keeping 70% based on performance and us keeping 30%.”

In the Philippines, gaming scholarships were established

While the rest of the world was dealing with the pandemic and lockdowns, the Philippines was also dealing with typhoons and floods. When it became nearly impossible to find work, some people turned to gaming.

“Workers in the Global South are making a living playing the blockchain game, Axie Infinity,” according to Rest Of Worlds.

There are platforms in the Philippines, such as MVM, that provide scholarships to gamers. Yield Guild Games (YGG), for example, can manage up to 4,7000 players, or scholars as they are known.

Even venture capitalists are investing

In August of this year, YGG raised $4.6 million to accelerate play-to-earn gaming. It claims to have earned up to $8.6 million with Axie Infinity and intends to purchase more gaming assets and hire more scholars.

Despite being nowhere near YGG, MVM is already making inroads into the crypto gaming industry.

“We’ve been running the experiment for a few months now. “We already have over 130 players participating in the games as part of our scholarship program,” Umeaka said.

MVM, on the other hand, is a decentralized autonomous organization, as opposed to YGG (DAO). This means that MVM is made up of players, community managers, and development managers.

Players are coached and trained on strategies for winning games.

Although MVM appears to be more centralised than decentralized, Umeaka stated that it would be a DAO with its own tokens, with gamers and investors as stakeholders.

MVM was founded in collaboration with Old Fashion Research (OFR), a blockchain investment fund with a multi-strategy approach.

Yele Bademosi, CEO and Co-Founder of Nestcoin, believes that the play-to-earn metaverse has the potential to lift many Africans out of poverty.

However, Internet penetration rates in the Middle East, Eastern Africa, and Western Africa remain low, at 26%, 24%, and 42%, respectively. This is less than the global average of 59.5 percent.

With the amount of volatility associated with all things crypto-related, it’s only a matter of time before we can say with certainty that crypto gaming will remain valuable.